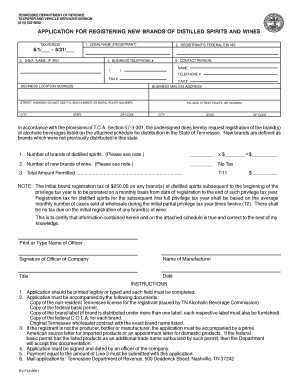

Tennessee Distilled Spirits Tax Form

What is the Tennessee Distilled Spirits Tax Form

The Tennessee Distilled Spirits Tax Form is a specific document required for reporting and paying taxes on distilled spirits within the state of Tennessee. This form is essential for businesses and individuals involved in the production, distribution, or sale of distilled spirits. It helps ensure compliance with state tax laws and regulations, allowing the government to collect the appropriate taxes on these products.

How to use the Tennessee Distilled Spirits Tax Form

Using the Tennessee Distilled Spirits Tax Form involves several key steps. First, you need to gather all necessary information related to your distilled spirits activities, including sales data and production details. Once you have this information, fill out the form accurately, ensuring that all required fields are completed. After completing the form, review it for any errors or omissions before submitting it to the appropriate state agency.

Steps to complete the Tennessee Distilled Spirits Tax Form

Completing the Tennessee Distilled Spirits Tax Form can be broken down into a few straightforward steps:

- Gather all relevant data about your distilled spirits sales and production.

- Obtain the latest version of the Tennessee Distilled Spirits Tax Form from the official state website.

- Fill out the form carefully, ensuring all required fields are completed.

- Double-check the form for accuracy and completeness.

- Submit the form according to the instructions provided, whether online, by mail, or in person.

Key elements of the Tennessee Distilled Spirits Tax Form

The Tennessee Distilled Spirits Tax Form includes several key elements that must be accurately reported. These elements typically include:

- Business name and address

- Tax identification number

- Details of distilled spirits produced or sold

- Tax calculation based on sales or production volume

- Signature of the responsible party

Legal use of the Tennessee Distilled Spirits Tax Form

The legal use of the Tennessee Distilled Spirits Tax Form is crucial for compliance with state tax regulations. Properly completing and submitting this form ensures that businesses meet their tax obligations, avoiding potential penalties. The form serves as a legal document that can be referenced in case of audits or disputes regarding tax payments.

Form Submission Methods (Online / Mail / In-Person)

The Tennessee Distilled Spirits Tax Form can be submitted through various methods, providing flexibility for users. Options typically include:

- Online submission through the state’s tax portal, which may offer immediate confirmation of receipt.

- Mailing the completed form to the designated state tax office, ensuring it is postmarked by the due date.

- In-person submission at local tax offices, allowing for direct interaction with tax officials if assistance is needed.

Quick guide on how to complete tennessee distilled spirits tax form

Manage [SKS] effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to access the correct forms and securely store them online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign [SKS] seamlessly

- Find [SKS] and click Get Form to begin.

- Utilize the resources we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Edit and eSign [SKS] and maintain excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Tennessee Distilled Spirits Tax Form

Create this form in 5 minutes!

How to create an eSignature for the tennessee distilled spirits tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tennessee Distilled Spirits Tax Form?

The Tennessee Distilled Spirits Tax Form is a document required for businesses involved in the production or sale of distilled spirits in Tennessee. This form helps ensure compliance with state tax regulations and is essential for reporting sales and inventory accurately. Using airSlate SignNow simplifies the process of completing and submitting this form electronically.

-

How can I complete the Tennessee Distilled Spirits Tax Form using airSlate SignNow?

To complete the Tennessee Distilled Spirits Tax Form with airSlate SignNow, simply upload the form to our platform, fill in the required fields, and eSign it. Our easy-to-use interface makes it seamless for users to input their information accurately. With features like templates and pre-filled data, completing the form has never been easier.

-

Is there a cost associated with using airSlate SignNow for the Tennessee Distilled Spirits Tax Form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, allowing you to manage the Tennessee Distilled Spirits Tax Form effectively. Our pricing is designed to be cost-effective, empowering businesses to save on paper costs while ensuring compliance. You can choose a plan that suits your frequent usage of tax forms.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for the Tennessee Distilled Spirits Tax Form offers numerous advantages, including increased efficiency and secure document storage. Our platform allows you to streamline the signing process, reduce turnaround times, and maintain compliance effortlessly. With built-in tracking features, you can easily monitor the status of your forms.

-

Can I integrate airSlate SignNow with other software for tax purposes?

Yes, airSlate SignNow integrates seamlessly with various software, enhancing your ability to manage the Tennessee Distilled Spirits Tax Form more effectively. You can connect it with accounting and tax software to ensure that all your data is synchronized and up-to-date. This integration simplifies your workflow, making tax season less stressful.

-

What security measures does airSlate SignNow use for tax documents?

airSlate SignNow prioritizes the security of your documents, including the Tennessee Distilled Spirits Tax Form. We utilize industry-standard encryption and secure storage to protect sensitive information from unauthorized access. Additionally, our platform complies with regulatory requirements, ensuring peace of mind for businesses.

-

How long does it take to get the Tennessee Distilled Spirits Tax Form processed?

Processing times for the Tennessee Distilled Spirits Tax Form can vary depending on the submission method and any additional requirements from the state. However, using airSlate SignNow signNowly speeds up the process due to our digital solutions. Generally, electronic submissions through our platform receive faster acknowledgment and processing.

Get more for Tennessee Distilled Spirits Tax Form

- Form 944 x rev february 2022 adjusted employers annual federal tax return or claim for refund

- Instructions for form 941 ss internal revenue service

- Wwwirsgovpubirs pdfinstrucciones para el anexo b formulario 941 pr rev marzo

- Instrucciones para irs tax forms

- Before completing students should review the minor policy as printed on the back of this form andor in the undergraduate catalog

- Wwwpdffillercom513143999 re entry application 2020 2022 form cuny baruch college re entry application fill

- Contract intake form rf research foundation cuny

- Enrollment form for uc medicare ppo or po box ucnet

Find out other Tennessee Distilled Spirits Tax Form

- Sign Maryland Banking Quitclaim Deed Mobile

- Sign Massachusetts Banking Purchase Order Template Myself

- Sign Maine Banking Operating Agreement Computer

- Sign Banking PPT Minnesota Computer

- How To Sign Michigan Banking Living Will

- Sign Michigan Banking Moving Checklist Mobile

- Sign Maine Banking Limited Power Of Attorney Simple

- Sign Michigan Banking Moving Checklist Free

- Sign Montana Banking RFP Easy

- Sign Missouri Banking Last Will And Testament Online

- Sign Montana Banking Quitclaim Deed Secure

- Sign Montana Banking Quitclaim Deed Safe

- Sign Missouri Banking Rental Lease Agreement Now

- Sign Nebraska Banking Last Will And Testament Online

- Sign Nebraska Banking LLC Operating Agreement Easy

- Sign Missouri Banking Lease Agreement Form Simple

- Sign Nebraska Banking Lease Termination Letter Myself

- Sign Nevada Banking Promissory Note Template Easy

- Sign Nevada Banking Limited Power Of Attorney Secure

- Sign New Jersey Banking Business Plan Template Free