Form G 7 2019

What is the Form G 7

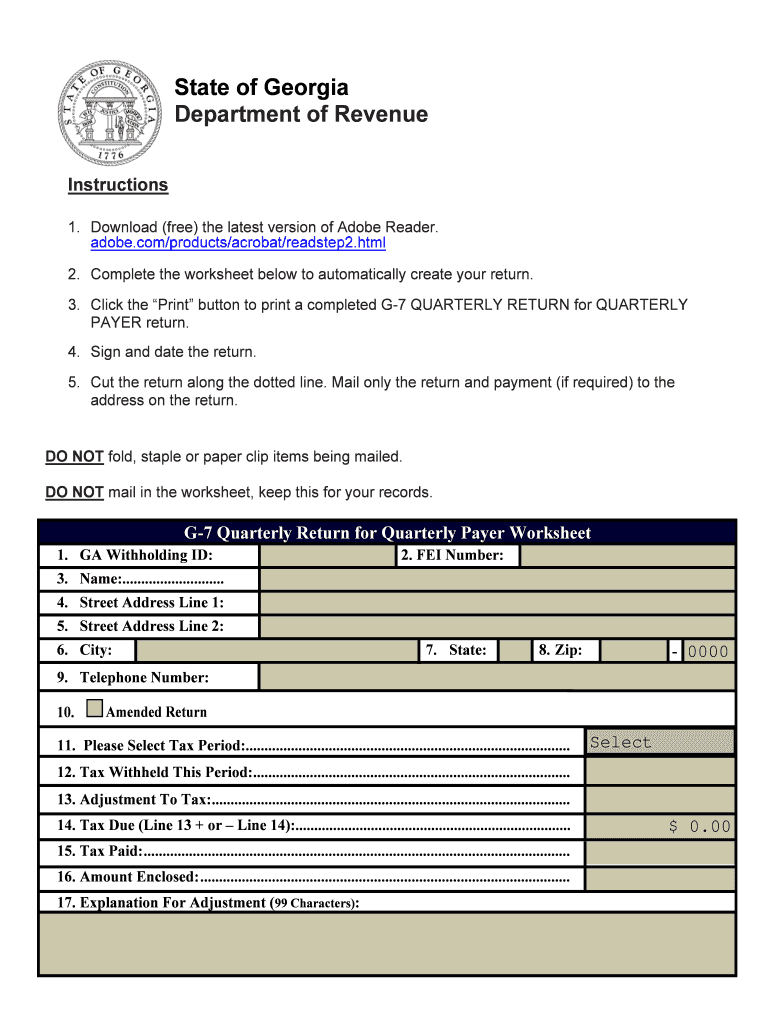

The Georgia Form G 7 is a quarterly return used by businesses to report and remit sales and use tax to the Georgia Department of Revenue. This form is essential for ensuring compliance with state tax regulations. It is specifically designed for businesses that collect sales tax from customers and need to report this information periodically. The G 7 form captures various details, including total sales, taxable sales, and the amount of tax collected during the reporting period.

Steps to complete the Form G 7

Completing the Georgia Form G 7 requires careful attention to detail. Here are the steps to follow:

- Gather all sales records for the reporting period, including invoices and receipts.

- Calculate the total sales made during the quarter.

- Determine the amount of taxable sales from the total sales.

- Calculate the total sales tax collected based on the applicable tax rate.

- Fill out the form with the calculated figures, ensuring accuracy.

- Review the completed form for any errors or omissions.

- Submit the form by the due date, along with the payment for any taxes owed.

How to obtain the Form G 7

The Georgia Form G 7 can be obtained from the Georgia Department of Revenue's official website. It is available as a downloadable PDF, which can be printed and filled out manually. Additionally, businesses may be able to access the form through various tax preparation software that supports Georgia tax filings. Ensuring you have the latest version of the form is crucial, as tax regulations may change.

Legal use of the Form G 7

The legal use of the Georgia Form G 7 is governed by state tax laws. To be considered valid, the form must be completed accurately and submitted on time. Electronic submissions are permitted, provided they comply with the Georgia Department of Revenue's guidelines. It is important to retain copies of the submitted forms and any supporting documentation for record-keeping and potential audits.

Filing Deadlines / Important Dates

Timely filing of the Georgia Form G 7 is crucial to avoid penalties. The form is due on the 20th day of the month following the end of each quarter. The specific deadlines are as follows:

- First Quarter (January - March): Due April 20

- Second Quarter (April - June): Due July 20

- Third Quarter (July - September): Due October 20

- Fourth Quarter (October - December): Due January 20

Businesses should mark these dates on their calendars to ensure compliance.

Form Submission Methods (Online / Mail / In-Person)

The Georgia Form G 7 can be submitted through various methods to accommodate different business needs. These methods include:

- Online Submission: Businesses can file electronically through the Georgia Department of Revenue's online portal, which offers a convenient and efficient way to submit the form.

- Mail Submission: The completed form can be printed and mailed to the appropriate address provided by the Georgia Department of Revenue.

- In-Person Submission: Businesses may also choose to deliver the form in person at their local Department of Revenue office.

Choosing the right submission method can help streamline the filing process and ensure timely compliance.

Quick guide on how to complete form g 7

Complete Form G 7 effortlessly on any device

Web-based document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Form G 7 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign Form G 7 with ease

- Find Form G 7 and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools offered by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal standing as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method for submitting your form, via email, SMS, invite link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Form G 7 and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form g 7

Create this form in 5 minutes!

How to create an eSignature for the form g 7

How to make an eSignature for the Form G 7 online

How to make an electronic signature for your Form G 7 in Google Chrome

How to make an eSignature for signing the Form G 7 in Gmail

How to generate an electronic signature for the Form G 7 from your mobile device

How to create an eSignature for the Form G 7 on iOS

How to create an electronic signature for the Form G 7 on Android

People also ask

-

What is Form G 7 and how is it used?

Form G 7 is a document used for various administrative purposes, often in legal or business contexts. With airSlate SignNow, you can easily create, send, and eSign Form G 7, streamlining your workflow and ensuring compliance with necessary regulations.

-

How does airSlate SignNow simplify the process of handling Form G 7?

airSlate SignNow simplifies handling Form G 7 by providing an intuitive platform that allows users to create, send, and sign documents electronically. This reduces the time spent on paperwork and enhances collaboration, ensuring that your Form G 7 is processed efficiently.

-

What features does airSlate SignNow offer for managing Form G 7?

airSlate SignNow offers a variety of features for managing Form G 7, including customizable templates, advanced eSignature options, and automated workflows. These features help to ensure that your documents are not only signed but also tracked and stored securely.

-

Is there a mobile app for signing Form G 7 with airSlate SignNow?

Yes, airSlate SignNow has a mobile app that allows users to sign Form G 7 on-the-go. This mobile accessibility ensures that you can manage important documents anytime, anywhere, making your eSignature process even more convenient.

-

What are the pricing options for using airSlate SignNow for Form G 7?

airSlate SignNow offers flexible pricing plans that cater to different business needs, starting with a free trial. Depending on your requirements for handling Form G 7, you can choose from various subscription levels that provide additional features and integrations.

-

Can I integrate airSlate SignNow with other software to manage Form G 7?

Absolutely! airSlate SignNow integrates seamlessly with numerous other software applications, enhancing your ability to manage Form G 7. Whether you're using CRM systems or project management tools, these integrations help streamline your processes.

-

What are the benefits of using airSlate SignNow for Form G 7?

Using airSlate SignNow for Form G 7 comes with numerous benefits, such as improved efficiency, reduced paperwork, and quicker turnaround times for document signing. Additionally, the platform ensures compliance and security for all your eSigned documents.

Get more for Form G 7

- Ri 012 2015 2019 form

- Budget request form

- Lee county notice of hearing form 20th judicial circuit florida

- Surgery scheduling sheet form

- Iraq visa from form

- Miscellaneous statement in lieu of receipts marine corps base form

- Fit2work application st john of god health care form

- Application to proceed without prepayment of fees ohsd uscourts form

Find out other Form G 7

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later