Wta Form Dfas

What is the Wta Form Dfas

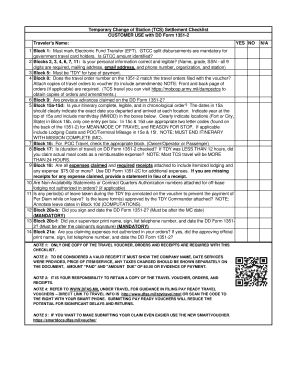

The Wta Form Dfas is a specific document used within the Department of Defense and other federal agencies for various administrative purposes. It serves as a formal request or notification related to personnel actions, financial transactions, or other official matters. Understanding the purpose and requirements of this form is essential for compliance and proper processing within the relevant departments.

How to use the Wta Form Dfas

Using the Wta Form Dfas involves several key steps. First, ensure you have the most current version of the form, which can typically be obtained from official government websites. After downloading the form, carefully read the instructions provided. Fill out the form accurately, providing all necessary information as specified. Once completed, the form can be submitted electronically or via traditional mail, depending on the submission guidelines outlined by the issuing agency.

Steps to complete the Wta Form Dfas

Completing the Wta Form Dfas requires attention to detail. Follow these steps for successful completion:

- Download the latest version of the Wta Form Dfas from an official source.

- Read the instructions carefully to understand the requirements.

- Fill in your personal information, ensuring accuracy.

- Provide any additional details required for your specific request or notification.

- Review the form for completeness and correctness before submission.

Legal use of the Wta Form Dfas

The Wta Form Dfas must be used in accordance with federal regulations and guidelines to ensure its legal validity. This includes adhering to the requirements set forth by the Department of Defense and any other relevant agencies. Proper completion and submission of the form are crucial for it to be recognized as a legitimate document in administrative processes.

Key elements of the Wta Form Dfas

Several key elements are essential for the Wta Form Dfas to be considered complete and valid:

- Personal Information: Accurate details about the individual submitting the form.

- Purpose of Submission: A clear indication of the reason for filing the form.

- Signatures: Required signatures to validate the form, which may include electronic signatures if submitted online.

- Date of Submission: The date the form is completed and submitted.

Form Submission Methods

The Wta Form Dfas can be submitted through various methods, depending on the requirements of the issuing agency. Common submission methods include:

- Online Submission: Many agencies allow electronic submission through secure portals.

- Mail: The form can be printed and sent via traditional postal services.

- In-Person: Some situations may require the form to be submitted directly to an office.

Quick guide on how to complete wta form dfas

Effortlessly Prepare Wta Form Dfas on Any Device

The management of online documents has increasingly gained traction among both businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage Wta Form Dfas across any platform using airSlate SignNow's Android or iOS applications, and enhance your document-related processes today.

The Easiest Method to Modify and Electronically Sign Wta Form Dfas Effortlessly

- Locate Wta Form Dfas and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize signNow sections of your documents or redact sensitive information using the tools specifically offered by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your preference. Alter and electronically sign Wta Form Dfas and ensure excellent communication throughout the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wta form dfas

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Wta Form Dfas and how can it help my business?

The Wta Form Dfas is a crucial document used for various financial transactions and record-keeping. By utilizing the airSlate SignNow platform, businesses can easily manage, send, and eSign this form. This streamlined process enhances efficiency and ensures compliance with regulatory standards.

-

How much does it cost to use airSlate SignNow for Wta Form Dfas?

airSlate SignNow offers flexible pricing plans that cater to different business needs. The cost of sending and eSigning the Wta Form Dfas depends on the specific plan you choose, ensuring that you only pay for the features your business requires. Additionally, our platform offers a free trial for you to explore its capabilities without any commitment.

-

Can I integrate airSlate SignNow with other tools for managing Wta Form Dfas?

Yes, airSlate SignNow provides seamless integrations with various tools and applications, making it easy to manage your Wta Form Dfas. Whether you use CRMs, project management software, or cloud storage services, our platform can connect with them to streamline your workflow. This integration capability enhances overall efficiency in handling documents.

-

What features does airSlate SignNow offer for Wta Form Dfas?

airSlate SignNow includes features such as customizable templates, automated workflows, and advanced eSignature capabilities tailored for the Wta Form Dfas. You can easily create and customize the form, track its status, and ensure that your documents are signed securely and promptly. These features simplify the signing process and improve document management.

-

How secure is airSlate SignNow when handling Wta Form Dfas?

Security is a top priority at airSlate SignNow. When dealing with the Wta Form Dfas, our platform employs advanced encryption methods and follows compliance standards to safeguard your data. This ensures that all transactions and signed documents are secure, protecting sensitive information from unauthorized access.

-

Can I track the status of my Wta Form Dfas using airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your Wta Form Dfas in real-time. You can monitor who has opened, signed, or completed the document, giving you full visibility into the signing process. This feature helps you stay organized and ensures timely completions.

-

Is it easy to use airSlate SignNow for the Wta Form Dfas without technical skills?

Yes, airSlate SignNow is designed to be user-friendly, allowing users without technical skills to easily send and eSign Wta Form Dfas. The intuitive interface guides you through the process, and you can quickly upload your document, add signers, and send it out for signatures with just a few clicks.

Get more for Wta Form Dfas

- Michigan guardianship form

- Summon and complain and blank form 2008

- Petition regarding real estatedwelling michigan courts state of courts mi form

- You have a pending case for divorce separate maintenance paternity or family support form

- Nam102 form

- Restraining order mn form

- Voluntary income assignment missouri courts mo form

- Aoc e 850 2012 form

Find out other Wta Form Dfas

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement