Ky Tangible Property Tax Return 2021

What is the Ky Tangible Property Tax Return

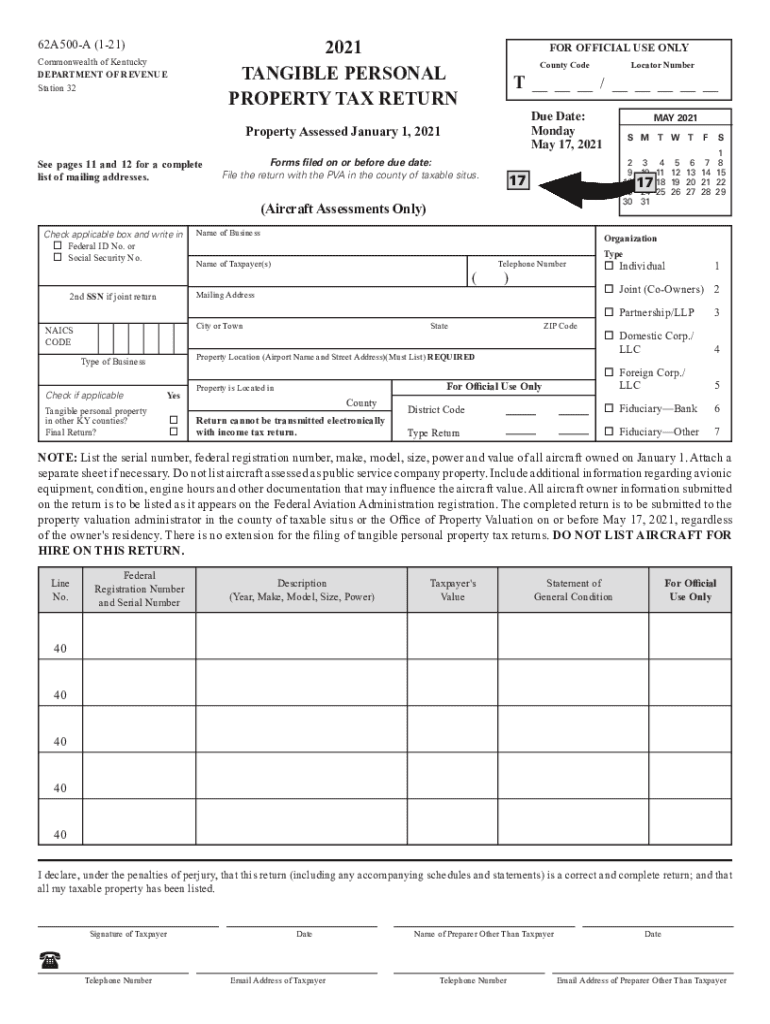

The Kentucky Tangible Property Tax Return is a form used by individuals and businesses to report tangible personal property to the state for tax assessment purposes. Tangible personal property includes items such as machinery, equipment, furniture, and other physical assets that are not classified as real estate. Completing this return is essential for ensuring accurate taxation and compliance with state regulations.

Steps to Complete the Ky Tangible Property Tax Return

Completing the Kentucky Tangible Property Tax Return involves several key steps:

- Gather necessary information about all tangible personal property owned as of January first of the tax year.

- Obtain the appropriate form, which can be found through the Kentucky Department of Revenue website or local county offices.

- Fill out the form accurately, providing details such as the type of property, its location, and its estimated value.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline, either electronically or via mail.

Legal Use of the Ky Tangible Property Tax Return

The Kentucky Tangible Property Tax Return serves as a legal document that establishes the taxpayer's obligations regarding tangible personal property. It is crucial to ensure that the information provided is accurate and submitted on time to avoid penalties. The return must comply with state laws and regulations, which govern the valuation and taxation of personal property.

Filing Deadlines / Important Dates

Filing deadlines for the Kentucky Tangible Property Tax Return are typically set for May 15 of each year. It is important to be aware of this date to avoid late fees or penalties. Additionally, if May 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Keeping track of important dates ensures compliance and helps in effective tax planning.

Required Documents

To complete the Kentucky Tangible Property Tax Return, taxpayers should prepare the following documents:

- Documentation of all tangible personal property owned, including purchase receipts and valuation records.

- Prior year tax returns, if applicable, to provide context for current valuations.

- Any relevant correspondence from the Kentucky Department of Revenue regarding property assessments.

Form Submission Methods (Online / Mail / In-Person)

The Kentucky Tangible Property Tax Return can be submitted through various methods:

- Online submission through the Kentucky Department of Revenue's e-filing system.

- Mailing a completed paper form to the appropriate county property valuation administrator.

- In-person submission at local county offices, where assistance may be available for completing the form.

Penalties for Non-Compliance

Failing to file the Kentucky Tangible Property Tax Return by the deadline can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential to understand the implications of non-compliance and to take proactive steps to ensure timely and accurate filing.

Quick guide on how to complete ky tangible property tax return

Effortlessly prepare Ky Tangible Property Tax Return on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Ky Tangible Property Tax Return on any platform using the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign Ky Tangible Property Tax Return with ease

- Obtain Ky Tangible Property Tax Return and click on Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize necessary sections of the documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements within a few clicks from any device of your choice. Modify and eSign Ky Tangible Property Tax Return to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ky tangible property tax return

Create this form in 5 minutes!

How to create an eSignature for the ky tangible property tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ky tangible property tax return 2021, and why is it important?

The ky tangible property tax return 2021 is a declaration form used by businesses in Kentucky to report their tangible personal property to be assessed for taxation. It is critical because failure to file can result in penalties and missed opportunities for tax deductions.

-

How can airSlate SignNow help with filing a ky tangible property tax return 2021?

airSlate SignNow can simplify the process of filing your ky tangible property tax return 2021 by providing a secure platform for eSigning and sending your documents. This streamlines your workflow, ensuring you minimize delays and maintain compliance with filing deadlines.

-

What are the pricing options for using airSlate SignNow for the ky tangible property tax return 2021?

AirSlate SignNow offers various pricing plans tailored to businesses of all sizes, providing cost-effective solutions for handling ky tangible property tax return 2021 documents. You can choose from monthly, yearly, or pay-as-you-go options to fit your budget and needs.

-

Are there any features specifically designed for managing the ky tangible property tax return 2021?

Yes, airSlate SignNow includes features like document templates and secure eSignature options that make managing the ky tangible property tax return 2021 efficient and user-friendly. These tools are designed to help you ensure accuracy and compliance while saving time.

-

Can I integrate airSlate SignNow with other software for my ky tangible property tax return 2021?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions, allowing you to connect your workflow for the ky tangible property tax return 2021 with your existing tools. This integration helps enhance overall productivity by centralizing your document management.

-

What benefits can businesses expect when using airSlate SignNow for their ky tangible property tax return 2021?

Using airSlate SignNow for your ky tangible property tax return 2021 offers numerous benefits, including enhanced efficiency and reduced paper usage. Additionally, you can ensure legal compliance with easy access to signed documents and automated reminders for important deadlines.

-

Is there a mobile option for managing the ky tangible property tax return 2021 with airSlate SignNow?

Yes, airSlate SignNow provides a mobile application that allows you to manage your ky tangible property tax return 2021 documents on the go. This means you can review, sign, and send important documents from your smartphone or tablet, ensuring flexibility and convenience.

Get more for Ky Tangible Property Tax Return

Find out other Ky Tangible Property Tax Return

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document