62A500P Personal Property Tax Forms and Instructions Excel 2024-2026

Understanding the 62A500P Personal Property Tax Form

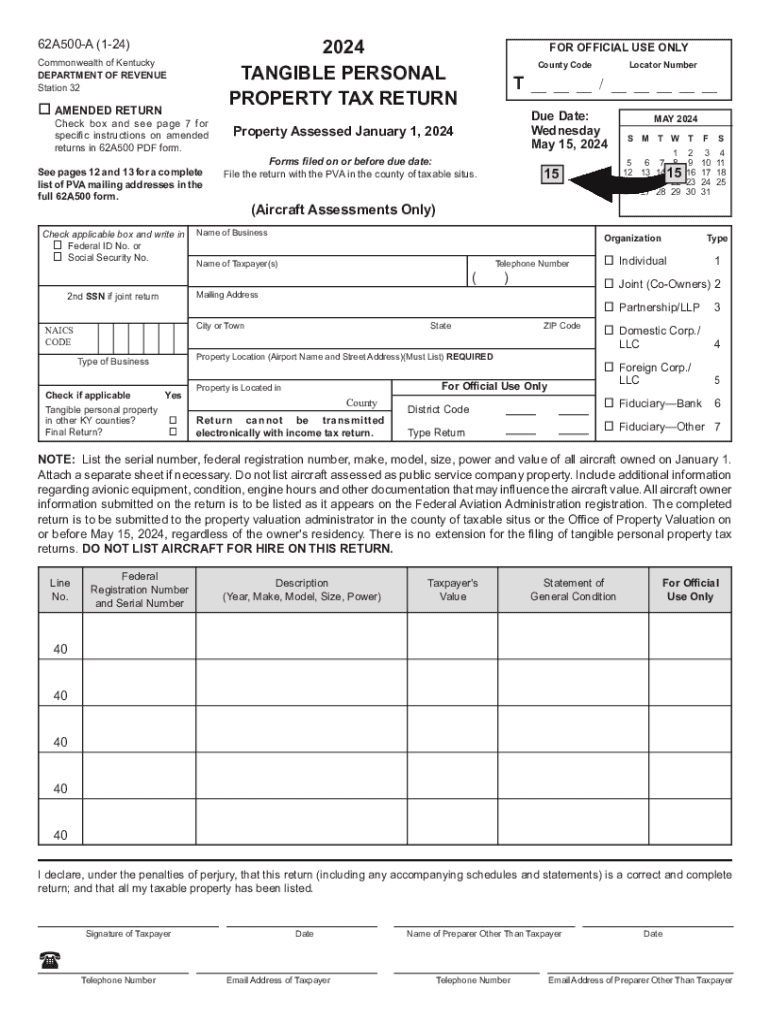

The 62A500P Personal Property Tax Form is a critical document used by businesses and individuals to report personal property to the appropriate tax authorities. This form is essential for ensuring compliance with local tax regulations and accurately assessing property taxes owed. It typically includes details about the type of personal property owned, its value, and any applicable exemptions. Understanding the purpose and requirements of this form can help taxpayers avoid penalties and ensure proper filing.

Steps to Complete the 62A500P Personal Property Tax Form

Completing the 62A500P form involves several key steps:

- Gather Necessary Information: Collect details about all personal property, including equipment, furniture, and vehicles.

- Determine Property Values: Assess the current market value of each item. This may involve appraisals or using industry standards.

- Fill Out the Form: Accurately enter all required information on the form, ensuring clarity and completeness.

- Review for Accuracy: Double-check all entries for errors or omissions before submission.

- Submit the Form: Follow the designated submission method, whether online, by mail, or in person.

Legal Use of the 62A500P Personal Property Tax Form

The 62A500P form is legally binding and must be completed in accordance with state laws. Filing this form accurately is crucial to avoid potential legal issues, including fines or audits. Taxpayers should be aware of their obligations under state tax laws, which may vary significantly. Consulting with a tax professional can provide guidance on compliance and legal use of the form.

Filing Deadlines and Important Dates

Timely submission of the 62A500P form is essential to avoid penalties. Each state has specific deadlines for filing personal property tax forms. Typically, these deadlines fall within the first quarter of the calendar year, but it is important to verify the exact dates for your state. Marking these dates on your calendar can help ensure compliance and timely filing.

Required Documents for Submission

When filing the 62A500P form, certain documents may be required to support the information provided. These documents can include:

- Proof of ownership for each item of personal property.

- Valuation documents, such as appraisals or purchase receipts.

- Any previous tax returns related to personal property.

- Documentation of exemptions, if applicable.

Who Issues the 62A500P Personal Property Tax Form

The 62A500P form is typically issued by the local tax assessor's office or the state department of revenue. It is important for taxpayers to obtain the correct version of the form from the appropriate authority to ensure compliance with local regulations. Checking with the local tax office can provide clarity on the issuing authority and any updates to the form.

Quick guide on how to complete 62a500p personal property tax forms and instructions excel

Complete 62A500P Personal Property Tax Forms And Instructions excel effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and keep it securely online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your paperwork swiftly without delays. Manage 62A500P Personal Property Tax Forms And Instructions excel on any device with the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign 62A500P Personal Property Tax Forms And Instructions excel with ease

- Locate 62A500P Personal Property Tax Forms And Instructions excel and click on Get Form to begin.

- Utilize the tools we provide to submit your form.

- Highlight relevant sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your edits.

- Choose how you want to send your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign 62A500P Personal Property Tax Forms And Instructions excel and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 62a500p personal property tax forms and instructions excel

Create this form in 5 minutes!

How to create an eSignature for the 62a500p personal property tax forms and instructions excel

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 62a500 a and how does it work?

The 62a500 a is a powerful feature within airSlate SignNow that allows users to streamline their document signing process. It enables businesses to send, sign, and manage documents electronically, ensuring a faster turnaround time. With its user-friendly interface, the 62a500 a simplifies the eSigning experience for both senders and recipients.

-

What are the pricing options for the 62a500 a?

airSlate SignNow offers competitive pricing plans for the 62a500 a, catering to businesses of all sizes. You can choose from monthly or annual subscriptions, with discounts available for long-term commitments. Each plan includes access to the 62a500 a features, ensuring you get the best value for your investment.

-

What features are included with the 62a500 a?

The 62a500 a includes a variety of features designed to enhance your document management process. Key features include customizable templates, real-time tracking, and secure cloud storage. These functionalities help businesses save time and improve efficiency when handling important documents.

-

How can the 62a500 a benefit my business?

Implementing the 62a500 a can signNowly benefit your business by reducing the time spent on document processing. It allows for quicker approvals and enhances collaboration among team members. Additionally, the 62a500 a ensures compliance and security, giving you peace of mind when handling sensitive information.

-

Can the 62a500 a integrate with other software?

Yes, the 62a500 a seamlessly integrates with various third-party applications, enhancing its functionality. Popular integrations include CRM systems, cloud storage services, and productivity tools. This flexibility allows businesses to incorporate the 62a500 a into their existing workflows effortlessly.

-

Is the 62a500 a secure for sensitive documents?

Absolutely, the 62a500 a prioritizes security with advanced encryption and authentication measures. It ensures that all documents are protected during transmission and storage. With the 62a500 a, you can confidently manage sensitive information without compromising security.

-

How easy is it to use the 62a500 a for new users?

The 62a500 a is designed with user-friendliness in mind, making it accessible for new users. The intuitive interface and guided setup process help users quickly familiarize themselves with the platform. With minimal training, anyone can start using the 62a500 a effectively.

Get more for 62A500P Personal Property Tax Forms And Instructions excel

Find out other 62A500P Personal Property Tax Forms And Instructions excel

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement