City of Pittsburgh Income Tax Forms

What is the City of Pittsburgh Income Tax Forms

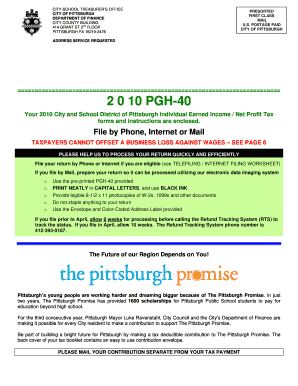

The City of Pittsburgh income tax forms are official documents required for residents and businesses to report their income and calculate their local tax obligations. These forms, including the commonly used PGH-40, are essential for ensuring compliance with local tax laws. The forms capture various income sources and deductions applicable to individuals and entities operating within the city limits.

How to use the City of Pittsburgh Income Tax Forms

Using the City of Pittsburgh income tax forms involves several steps to ensure accurate reporting. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, download the appropriate form, such as the PGH-40, from the City of Pittsburgh finance department's website. Carefully fill out the form, ensuring all income and deductions are accurately reported. Finally, submit the completed form according to the specified submission methods.

Steps to complete the City of Pittsburgh Income Tax Forms

Completing the City of Pittsburgh income tax forms requires attention to detail. Follow these steps:

- Collect all relevant income documentation.

- Download the correct form from the City of Pittsburgh finance department.

- Fill in personal information, including your name, address, and Social Security number.

- Report all sources of income, including wages and self-employment income.

- Apply any eligible deductions or credits.

- Review the completed form for accuracy.

- Submit the form by the deadline.

Legal use of the City of Pittsburgh Income Tax Forms

The legal use of the City of Pittsburgh income tax forms is crucial for compliance with local tax regulations. These forms must be filled out accurately and submitted by the designated deadlines to avoid penalties. Electronic submissions are legally recognized, provided they meet the necessary requirements for eSignatures and data integrity. Utilizing a reliable eSignature platform can help ensure that your submissions are legally binding.

Filing Deadlines / Important Dates

Filing deadlines for the City of Pittsburgh income tax forms are typically aligned with federal tax deadlines. For the 2021 tax year, the deadline for submitting the PGH-40 is usually April 15 of the following year. It is essential to stay updated on any changes to these dates, as local regulations may adjust deadlines or extend them under specific circumstances.

Form Submission Methods (Online / Mail / In-Person)

The City of Pittsburgh offers multiple submission methods for income tax forms. Residents can submit their completed forms online through the City of Pittsburgh finance department's website, ensuring a quick and efficient process. Alternatively, forms can be mailed to the designated tax office or submitted in person at local tax offices. Each method has its advantages, so choose the one that best suits your needs.

Quick guide on how to complete city of pittsburgh income tax forms

Effortlessly prepare City Of Pittsburgh Income Tax Forms on any device

The management of documents online has become a favored choice among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage City Of Pittsburgh Income Tax Forms on any device using the airSlate SignNow apps for Android or iOS and streamline any document-oriented process today.

How to modify and electronically sign City Of Pittsburgh Income Tax Forms with ease

- Obtain City Of Pittsburgh Income Tax Forms and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious document searches, or errors necessitating the printing of new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and electronically sign City Of Pittsburgh Income Tax Forms and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of pittsburgh income tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Pittsburgh City Tax Form?

The Pittsburgh City Tax Form is a document required for residents and businesses in Pittsburgh to report and pay city taxes. It is crucial for ensuring compliance with local tax regulations. Understanding how to complete and submit the Pittsburgh City Tax Form can save you from potential fines and help you manage your tax obligations better.

-

How can airSlate SignNow help me with the Pittsburgh City Tax Form?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending documents, including the Pittsburgh City Tax Form. With its user-friendly interface, you can streamline the process, ensuring that your tax forms are filled out correctly and submitted on time. Plus, you can track the status of your documents to ensure everything is in order.

-

What are the costs associated with using airSlate SignNow for the Pittsburgh City Tax Form?

Our pricing plans for airSlate SignNow are designed to be cost-effective, catering to various needs. You can choose between different subscription tiers based on your frequency of use and required features. Utilizing airSlate SignNow for the Pittsburgh City Tax Form can help you avoid costly mistakes and ensure compliance with tax laws.

-

Is airSlate SignNow secure for sending the Pittsburgh City Tax Form?

Yes, airSlate SignNow places a high priority on security, implementing industry-standard encryption. When you send the Pittsburgh City Tax Form through our platform, you can trust that your sensitive information is protected. This ensures your tax documents remain confidential and secure throughout the signing process.

-

Can I integrate airSlate SignNow with other software for managing the Pittsburgh City Tax Form?

Absolutely! airSlate SignNow offers seamless integrations with various software solutions, enhancing your ability to manage the Pittsburgh City Tax Form efficiently. Whether you're using accounting software or document management systems, our platform can work alongside your current tools for a smoother workflow.

-

What features does airSlate SignNow offer for managing the Pittsburgh City Tax Form?

airSlate SignNow comes equipped with a variety of features tailored for easy document management, including templates, in-document fields, and customizable workflows for the Pittsburgh City Tax Form. These tools help you streamline the completion and signing processes, reducing the time you spend on tax documentation. It's designed to ensure your forms are accurately filled and properly submitted.

-

How can I ensure my Pittsburgh City Tax Form is submitted correctly?

To ensure your Pittsburgh City Tax Form is submitted correctly, utilize airSlate SignNow's built-in validation features that guide you through the completion process. You can also access templates and expert tips within our platform to avoid common mistakes. Taking advantage of these tools will help maintain the integrity of your submitted tax forms.

Get more for City Of Pittsburgh Income Tax Forms

Find out other City Of Pittsburgh Income Tax Forms

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now