American Express Charge Card Fee Annual Rs Form

Understanding the American Express Charge Card Fee Annual Rs

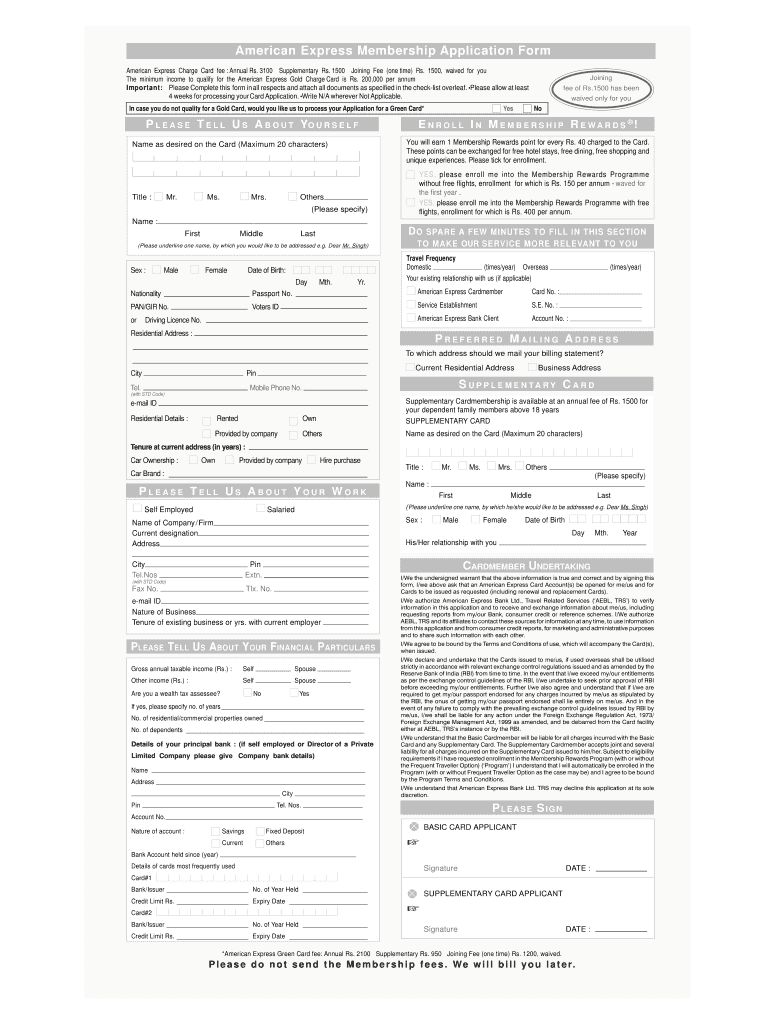

The American Express annual fee is a charge associated with holding certain American Express cards, including the premium Centurion Card. This fee can vary significantly depending on the card type and the benefits it offers. For instance, the Centurion Card is known for its high annual fee, which reflects its exclusive perks and services. Understanding this fee is crucial for cardholders to evaluate the overall value of their card in relation to its benefits.

Steps to Complete the American Express Charge Card Fee Annual Rs

Completing the American Express Charge Card Fee Annual Rs form involves several steps to ensure that all necessary information is accurately provided. Begin by gathering personal and financial details, including your Social Security number, income information, and any relevant identification. Next, carefully fill out the form, ensuring that all sections are completed. Pay special attention to the fee structure and any associated terms. After reviewing the form for accuracy, submit it as directed, either online or via mail, depending on your preference and the specific requirements of American Express.

Legal Use of the American Express Charge Card Fee Annual Rs

When utilizing the American Express Charge Card Fee Annual Rs, it is essential to adhere to legal guidelines to ensure compliance. This includes understanding the terms and conditions associated with the card, including the implications of the annual fee. The form must be filled out truthfully and accurately, as misrepresentation can lead to penalties or denial of card services. Additionally, maintaining compliance with federal and state regulations regarding credit and financial disclosures is crucial for all cardholders.

Key Elements of the American Express Charge Card Fee Annual Rs

Several key elements define the American Express Charge Card Fee Annual Rs. These include the cardholder's personal information, the specific card type, and the annual fee amount. The form also requires acknowledgment of the card's terms, including payment obligations and the benefits associated with the card. Understanding these elements helps cardholders make informed decisions about their financial commitments and the value derived from their American Express card.

Eligibility Criteria for the American Express Charge Card Fee Annual Rs

Eligibility for the American Express Charge Card Fee Annual Rs is determined by several factors. Applicants typically need to demonstrate a strong credit history and sufficient income to cover the annual fee and any associated charges. Additionally, American Express may consider the applicant's overall financial profile, including any existing relationships with the company. Meeting these criteria is essential for a successful application and to ensure that the cardholder can fully utilize the benefits offered.

Examples of Using the American Express Charge Card Fee Annual Rs

Cardholders may encounter various scenarios when using the American Express Charge Card Fee Annual Rs. For instance, a frequent traveler might leverage the card's travel rewards and benefits, justifying the annual fee through savings on flights and hotel stays. Alternatively, a business owner may find value in the card's expense management tools and cashback options, which can outweigh the cost of the annual fee. Understanding these examples can help potential cardholders assess whether the American Express card aligns with their financial goals.

Quick guide on how to complete american express charge card fee annual rs

Effortlessly set up American Express Charge Card Fee Annual Rs on any device

Digital document management has gained popularity among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the features necessary to create, edit, and electronically sign your documents quickly without delays. Manage American Express Charge Card Fee Annual Rs on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and electronically sign American Express Charge Card Fee Annual Rs with ease

- Locate American Express Charge Card Fee Annual Rs and then click Get Form to begin.

- Utilize the tools provided to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign American Express Charge Card Fee Annual Rs and ensure excellent communication at every stage of your form creation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What is the best way to offset American Express platinum card annual fee?

Wow, I see some pretty salty replies to this question...First off, the Platinum isn’t as prestigious as people make it out to be. I’m a college student and I have one, that’s saying something (granted I also have excellent credit and a job). I am very price sensitive - I once spent 3 days thinking about if I wanted to buy a $60 jacket… I did and it’s my favorite jacket. But being price sensitive doesn’t mean you can’t have nice things. Here the rundown of how you can MAKE THE MOST of your platinum card.$200 Airline Credit: buy 2 American Airline gift cards at $100 each. Boom, $200 reclaimed.$200 Uber credit: use Uber or Uber Eats. Pretty self-explanatory.Sign-up bonus: Depending on which offer you sign-up for (let's say 60,000 MR points), equals to $600 in travel. Aye, you just recovered a whole year.Centurion Lounge/ Priority Pass: Every hungry or thirst at an airport? Of course you are, you’re at an airport! Instead of spending money, go to the lounge for some refreshments. Those hamburgers and bottles of water add up!AMEX Offers: I love those, gotten back like $200 this year!TSA Precheck/ Global Entry Credit: Every time I use the precheck and global entry line, I look at the other pleb… I mean other fine travelers in the regular lines with pitty. Oh, the horror of having to take off your shoes, liquids, laptops, and pacemakers. This benefit will spoil you rotten.Hilon and SPG Gold: which aren’t very valuable in themselves, but status match to Wyndham and Total Rewards (Caesar’s Entertainment) Diamond Status and you’ve got yourself some great Las Vegas Perks! ($100 dining credit, 2 free show tickets, late checkout, no resort fees, etc.)Platinum Concierge: Every needed show tickets or event tickets but Ticketmaster is gouging you with feels like Spirit Airlines? Call up your concierge and they can help you find great seats for a great price! I’ve done it a few times and I’m very satisfied.So you see, there is a lot of benefits if you travel around. But if you don’t, it’s going to be harder to maximize the benefits you get for the $550 annual fee.

-

How can I get American Express to waive the annual fee?

Simply ask for it. If your payment history is good ( on time) and your usage is reasonable ( 25–45% of your limit each month) typically they will without having to do anything else. Annual fees are free money to credit card companies. They are there for two reasons:1) because the corporations realized that people are desensitized to paying fees under a certain amount. Also a large majority of people never actually look a their bill as long as it is in the ballpark of what they think is accurate. Therefore many people simply pay the fee without even registering that it is there.2) because if you have outstanding debt that rolls form one year to the next that annual fee is technically “new” debt and allows me to keep your account open as bad debt longer. Since the only way I have to collect on that debt as an unsecured debt is financial pressure on your credit report, I want that bad debt to continue as long as possible so it can’t “fall off”.If you are a good customer, the loss of the annual fee is NOTHING compared to the interest on rolling balances and transaction fees from merchants they receive so they have zero issue dropping it with nothing more than a simple, polite phone call. The only thing to remember is that you may have call each year as the system will automatically apply it.

-

How does American Express overcome its seemingly disadvantageous network effect: fewer cardholders, fewer merchants, higher merchant fees, and consumer annual fees (for most cards)?

American Express (company) sells its network to merchants by playing up their relatively wealthy customer base. The average Amex customer spends 2-4 times as much as customers using competing cards. Despite the higher discount rates, merchants want to be able to take payments from Amex's higher end customers and sacrifice a few additional points to do so.On the consumer end, the reality is that in certain cases, there are NOT competing cards that offer the same benefits and level of service--this is what lures consumers to the brand. The Starwood Preferred Guest (loyalty program) (SPG) card is a good example. No other card allows you to accumulate SPG points at a rate of one per dollar spent. Even in Amex's on point network, these SPG points go for ~3 Amex points to 1 SPG point, so it's a great deal at 1 per dollar of spend.With Amex's higher level cards (Platinum and Centurian), they often have special early access to certain blocks of premium seats at major events and concerts like the tennis' U.S. Open (tennis) tournament. Regarding fees at competitive cards, I think you'll find that for cards that do offer comparable benefits, say the Visa Signature American Airlines (airline) card, you'll find that they charge a fee as well.Because Amex it targeting a higher end customer and part of that strategy includes higher discount rates, typically you'll find that the Amex card is not accepted at smaller merchants. While there are a lot more of these types of businesses, in terms of credit card payments, we probably see something like an 80/20 effect where 20% of the merchants are doing 80% (if not a signNow portion) of the volume. There's a good chance that the bigger merchants in the 20% accept Amex, which offers plenty of volume from which Amex can profit despite a small network.

-

How much I have to spend to waive off annual fee 2000 Rs for SBI platinum credit card?

If you are spending more than 3 Lacs then annual charges will be waived off.Source: https://www.sbicard.com/sbi-card...

-

Why is it some stores want to charge $2 fee for using an American Express credit card, but not Visa or Mastercard?

American Express probably charge the retailer that much more than Visa/MC charge the retailer. They always did in the past.Q: Why is it some stores want to charge $2 fee for using an American Express credit card, but not Visa or Mastercard?

Create this form in 5 minutes!

How to create an eSignature for the american express charge card fee annual rs

How to create an eSignature for the American Express Charge Card Fee Annual Rs in the online mode

How to generate an electronic signature for the American Express Charge Card Fee Annual Rs in Chrome

How to create an eSignature for signing the American Express Charge Card Fee Annual Rs in Gmail

How to generate an eSignature for the American Express Charge Card Fee Annual Rs right from your smartphone

How to create an eSignature for the American Express Charge Card Fee Annual Rs on iOS

How to make an eSignature for the American Express Charge Card Fee Annual Rs on Android OS

People also ask

-

What is the American Express annual fee for different credit cards?

The American Express annual fee varies depending on the card you choose. Premium cards often carry higher fees due to additional benefits and rewards. To find the best fit for your spending habits, compare the American Express annual fee of multiple cards and consider the perks they offer.

-

Are there any cards with no American Express annual fee?

Yes, there are American Express cards that do not charge an annual fee. These cards typically have fewer benefits compared to premium options but can still provide rewards and cashback opportunities. Always check the card's details to ensure it meets your financial needs while avoiding the American Express annual fee.

-

How can I avoid paying the American Express annual fee?

To avoid the American Express annual fee, you can opt for a no-annual-fee card offered by American Express. Alternatively, some premium cards may waive the fee for the first year, so you can try them without commitment. Always read the terms and conditions to understand how to avoid the fee untimely.

-

What benefits come with cards that have an American Express annual fee?

Cards with an American Express annual fee often come with enhanced benefits, including rewards programs, travel insurance, and concierge services. The fee typically reflects the value provided, so assess whether these perks align with your lifestyle and spending habits. Understanding the benefits can help you justify the American Express annual fee.

-

Can the American Express annual fee be waived or reduced?

In some cases, American Express may offer promotions or incentives to waive or reduce the annual fee for existing customers. Additionally, negotiating with customer service may result in a temporary or permanent fee reduction, depending on your loyalty and spending history. It’s worth inquiring if you believe you qualify for such offers.

-

How does the American Express annual fee compare to other credit card fees?

The American Express annual fee is generally competitive when compared to credit cards from other issuers. While some cards may have lower or no fees, those often lack the robust rewards and perks found in Amex cards. It’s important to weigh the cost of the American Express annual fee against the benefits provided to determine overall value.

-

What should I consider before applying for a credit card with an American Express annual fee?

Before applying for a credit card with an American Express annual fee, evaluate your spending habits and financial goals. Look into the rewards structure, benefits, and any introductory offers that may offset the fee in the first year. Consider whether the perks justify the expense to make a well-informed decision.

Get more for American Express Charge Card Fee Annual Rs

Find out other American Express Charge Card Fee Annual Rs

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free