X the PLATINUM CREDIT CARD from AMERICAN EXPRESS Form

What is the e s i g n platinum credit card?

The e s i g n platinum credit card is a premium credit card offered by American Express, designed to provide cardholders with exclusive benefits and rewards. This card typically includes perks such as travel rewards, access to airport lounges, and comprehensive insurance coverage for travel-related incidents. The e s i g n platinum credit card is tailored for individuals who seek both luxury and practicality in their financial transactions.

How to use the e s i g n platinum credit card?

Using the e s i g n platinum credit card is straightforward. Cardholders can make purchases at millions of locations worldwide, both online and in-store. To maximize benefits, users should familiarize themselves with the rewards program, which often includes points for every dollar spent. Additionally, cardholders can access exclusive offers and discounts through the American Express website or app, enhancing their overall experience.

How to obtain the e s i g n platinum credit card?

To obtain the e s i g n platinum credit card, individuals must complete an application process. This typically involves providing personal information, financial details, and consent for a credit check. Applicants should ensure they meet the eligibility criteria, which may include a minimum credit score and income level. Once the application is submitted, American Express will review it and notify the applicant of the decision.

Key elements of the e s i g n platinum credit card

The e s i g n platinum credit card includes several key elements that enhance its value. These elements often consist of:

- Rewards Program: Earn points on purchases that can be redeemed for travel, merchandise, or statement credits.

- Travel Benefits: Access to airport lounges, travel insurance, and concierge services.

- Purchase Protection: Coverage for eligible purchases against theft or damage.

- Customer Support: 24/7 access to customer service for assistance with card-related inquiries.

Legal use of the e s i g n platinum credit card

The legal use of the e s i g n platinum credit card is governed by the terms and conditions set forth by American Express. Cardholders are responsible for ensuring that their use of the card complies with applicable laws and regulations. This includes understanding the implications of credit card debt and the importance of timely payments to avoid penalties and maintain a good credit score.

Eligibility Criteria

Eligibility for the e s i g n platinum credit card typically includes several criteria that potential applicants must meet. Common requirements include:

- A minimum credit score, often in the good to excellent range.

- Proof of stable income or employment.

- Age requirement, usually at least eighteen years old.

- Residency in the United States.

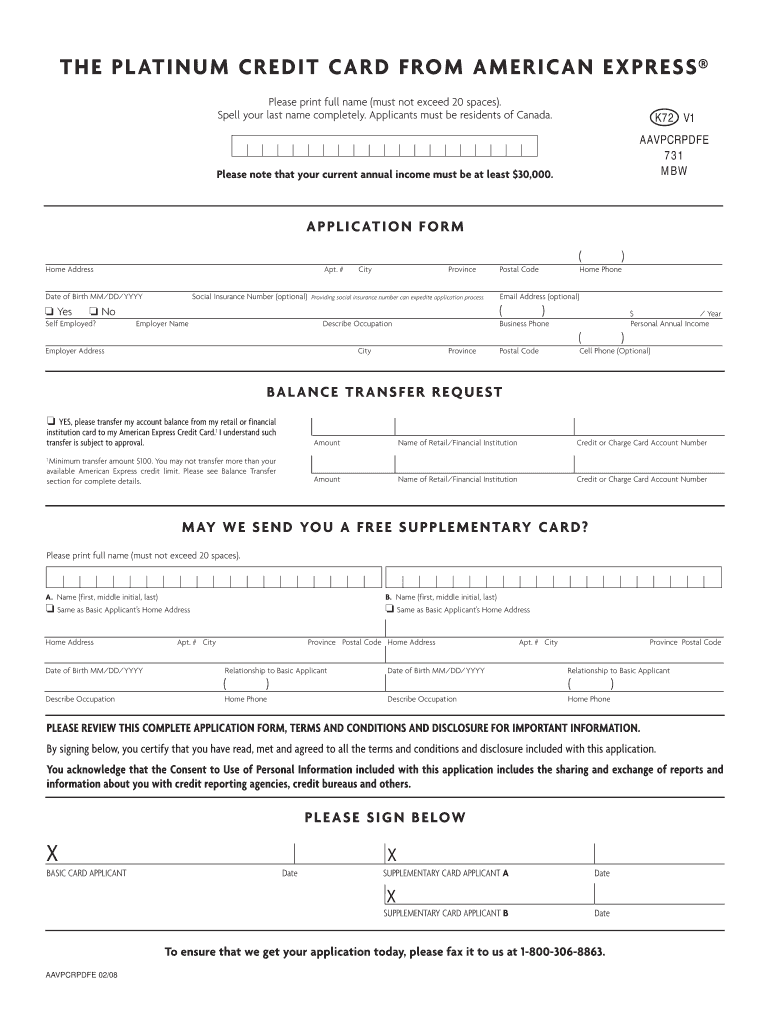

Quick guide on how to complete x the platinum credit card from american express

Effortlessly Prepare X THE PLATINUM CREDIT CARD FROM AMERICAN EXPRESS on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely store it on the web. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly and without delays. Handle X THE PLATINUM CREDIT CARD FROM AMERICAN EXPRESS on any device using the airSlate SignNow apps for Android or iOS and enhance any document-based operation today.

How to Edit and Electronically Sign X THE PLATINUM CREDIT CARD FROM AMERICAN EXPRESS with Ease

- Find X THE PLATINUM CREDIT CARD FROM AMERICAN EXPRESS and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require reprinting. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign X THE PLATINUM CREDIT CARD FROM AMERICAN EXPRESS while ensuring outstanding communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I have a great credit score and banks are offering me a platinum credit card from American Express, is it worth the $550 yearly fee?

I have been an American Express Business Platinum Card member since 1995. In that time the fees have gone up from $250 per year to over $500 per year now, but in that time the benefits have gone up too. I used to carry the Personal Platinum Card also, but I dropped my personal account back to Gold since most of the benefits I was getting were on the Business side and the Business Platinum benefits are MUCH better than the Personal Card benefits. There are dozens of ways to justify the fees, regardless of price. Most of those are little known, rarely documented and rarely used features.Purchase Protection: If you buy something and it is a no return non-refundable item, there is a good chance that AMEX will give you your money back for that item. The annual limit seems to vary, but I have heard that AMEX has gone as high as $3,000 in a year for one customer, likely due to their volume. I have done $1,000 in one year and routinely do $300 on transactions I get jammed up in.Travel Benefits: Access to upscale lounges in airports is enough for me. I will be going to Miami next week and my return trip on Wednesday will be at 9PM. I will get to the airport about 7PM and hang out for 2 hours in pure luxury in the lounge at MIA. I use this feature all the time for FREE food and free drinks and a place to crash away from the common folk. There are also baggage fees and other things you can get back. At $50 per bag additional baggage fees, you can make your money back just on that.Concierge Services: This is why after more than 20 years, I am still a Platinum member. These women (and they are always women for some reason) are AMAZING. Smart, sexy, capable and have bailed my ass out of a jam a number of times. I have been traveling and my hotel reservation was lost and everything is sold out and I am jammed up. Call their 800 number and found a hotel down the street for half the rate I was going to pay saving me $250 and it was for an entire 3 bedroom suite and not just a normal room. I loved it. Thank you American Express. Need concert tickets in Las Vegas to the sold out for month Celine Dion Concert, no problem. Call the 800 number and Rachel apologizes “Mr. Miller, I am sorry, I do have two seats together but unfortunately they are on the 3rd row, would that be Ok?!” Hell yeah! Tickets to a sold out show and apologizes because they aren’t front row. Geez, I am getting all warm and fuzzy just thinking about it.American Express has saved my ass more times that I can count. I don’t care if the fee for Business Platinum was $1,000 per month I would pay it.

-

How can I make the most out of the SPG American Express credit card?

Here are some things to look for to ensure you get the most out of the SPG American Express:Before signing up for an SPG Amex, look to see what kind of welcome bonus you can expect by signing up. Typically, you can expect a welcome bonus of 20,000 Starpoints (value of $446). Look online for any promotions happening which allow you to earn more Starpoints by booking during specific times or destinations. For example, SPG has a promotion right now where you can earn 1,000 bonus Starpoints when at least one night of your eligibile stay of two nights or more at any SPG hotel includes a weekend night (Friday, Saturday or Sunday). When booking hotels, you can earn up to 3 Starpoints per dollar spent if you book a Starwood hotel through the Starwood website, hotel, call center, their travel agent or corporate booking tool with your SPG American Express credit card.If you keep these tips in mind, you’ll be earning enough Starpoints for free hotel nights in no time! Now, once you have your Starpoints, there are many tips to maximize the value you receive for them. According to RateHub.ca, the average value you receive for a Starpoint is $0.0223; this value varies quite dramatically depending on the hotel you book. Here are four tips on how you can maximize your Startpoints:Book hotels in categories 1, 2 & 5Certain hotel categories offer greater value for your Starpoints. For example, on average when you book a category 1 hotel, you receive $0.0348/Starpoint. This is more than double the value you receive when booking a category 4 hotel, $0.0170. Hotels in categories 1 and 2 offer the greatest value for your Starpoints but are often in undesirable locations (near airports). The greatest value you can get for redeeming your Starpoints is by booking a Category 2 hotel in Central & South America. Here is a summary on the average value you can expect per hotel category:· Category 1 = $0.0348· Category 2 = $0.0300· Category 3 = $0.0191· Category 4 = $0.0170· Category 5 = $0.0224· Category 6 = $0.0175· Category 7 = $0.0151 2. Redeem your Starpoints for hotels in the most valuable regionsThe number of Starpoints required to book a hotel varies with each category but not by region. Also, the category levels are tied to the quality of the hotel rather than being directly linked to the price. Since each region requires the same amount of Starpoints, you receive better value for your Starpoints in regions with high hotel prices. Click on the link at the bottom of the page to see an example of our calculations. Here is a summary on the average value you can expect per region:· North America = $0.0253· Central & South America = $0.0199· Europe = $0.0238· Africa = $0.0238· Middle East = $0.0161· Asia Pacific = $0.02143. Compare hotel pricesThe value you receive for your Starpoints is largely tied to the price of the hotel. On average, certain regions offer more value but it’s still important to look within a region since there are still large price discrepancies between hotels. A higher hotel price does not always mean that a hotel is superior but most people do notice a difference between a $175/night hotel and a $350/night hotel. When redeeming Starpoints it’s important to take note of the price differences between hotels in that category. 4. Consider booking hotels with cash and pointsSome hotels will offer the option of booking with Cash and Points. Choosing to book with Cash and Points is a good option if you do not have enough Starpoints because you still receive good value. Usually, you will receive more value for your Starpoints by redeeming only points but in some situations you receive better value by choosing the Cash and Points option. Click the link below to see an example. To see a more detailed explanation on how to maximize the value of your SPG points visit RateHub.ca. Our page The Value of a Starwood Preferred Guest (SPG) Starpoint outlines the seven hotel categories in this program, their value by world region and more tips on how to maximize the value of your Starpoints.

-

What credit card is better to have? The Chase Sapphire Reverve or the American Express Platinum

The Chase Sapphire Reserve and AMEX Platinum are both great cards. If you’re looking for the best bang for your buck, then the Chase Sapphire Reserve is the way to go.However, my vote goes to the AMEX Platinum as the better card to have.Let’s take a quick look at the top benefits of the card!A $100 fee credit for Global Entry or an $85 fee credit for TSA Pre Check. This can be redeemed once every four years. TSA Pre will allow you to be expedited through airport security. If you don’t already have this, then you are missing out!A $200 annual airline fee credit. The credit can be applied towards things such as baggage fees, pet flight fees, and change fees. This credit is given by calendar year so you can redeem this multiple times within 12 months (eg. if you get the card in November of this year the credit will reset in January of next year). The only bad thing about this credit is that it can only be used with one airline (that you select).Access to the American Express Global Lounge Collection. This includes the legendary Centurion Lounges, Priority Pass lounges, and Delta Sky Clubs (only when flying with Delta). With lounge access you’ll actually look forward to arriving at the airport early and relaxing!A $200 Uber credit. This is split into $15 monthly credits plus a $20 bonus in December. We wish the card didn’t limit the credit to $15/month, but it’s still a nice feature.Complimentary Gold status at Hilton and Starwood Hotels. Since Marriott acquired Starwood, the Gold status can be transferred from SPG to Marriott. The Gold status will offer you perks such as free wi-fi and late checkout which can be a lifesaver!Complimentary status in Hertz Gold Plus Rewards, Avis Preferred and National Car Rental Emerald Club Executive. The car rental status upgrades will allow you to skip the line when picking up your car, and provide complimentary vehicle upgrades where available.No foreign transaction fees. This is a key feature for any international traveler. If you’re charging a foreign currency to your standard credit card, it would cost you over 2% extra for the currency conversion. With no FX fees on the AMEX platinum, you only pay what the banks pay to convert your currency.Access to the Global Dining Collection. The dining collection gives you access to exclusive events with famous chefs as well as things like special menus and complimentary beverages at their restaurants. To get access, just contact the Platinum concierge and they can arrange this for you.Access to the Platinum Concierge Service. The American Express Platinum concierge is the best in the business. We have used concierges from all of the premium credit cards, and AMEX has the best one – no contest. Their experience with getting access to special events is unparalleled.Robust travel insurance coverage. This is the best insurance coverage you’re going to find on a credit card. The insurance package covers car rental loss and damage, lost/stolen/damaged baggage, premium roadside assistance, and travel medical/accidents.If I was making a decision purely based on benefits, then I would not choose the AMEX Platinum over the Chase Sapphire Reserve. What really puts AMEX over the top for me is their customer service.Very few companies in the world treat their clients as well as American Express does. As a platinum member, you will have access to their platinum-only contacts as well as the platinum concierge. It’s tough to quantify the value of their customer service in dollar amounts, but if you’ve ever dealt with their team you get the feeling that AMEX employees genuinely care about solving your problem – whether it be a lost card, reversing fraudulent charges, making restaurant reservations, or making an insurance claim.Here’s some more information on the AMEX Platinum: American Express Platinum Review

-

How good does my credit score need to be to qualify for an American Express Platinum card?

How good does my credit score need to be to qualify for an American Express Platinum card?Credit Score of 700–720[1] [2]$550 annual fee[3] [4]Sufficient annual income[5]SOURCE: American Express - /us/credit-cards/*The American Express Platinum card carries one of the highest annual fees for a card in its class and a rewards rate that pales in comparison to similar cards; however, you can’t beat its extensive list of luxury travel perks, including access to exclusive Centurion lounges.[6]RelatedAmerican Express Platinum ReviewPlatinum Card® from American Express ReviewsAmerican Express Platinum Review: Luxury Isn’t CheapSOURCE: americanExpressFootnotes[1] What is the Credit Score Needed for the American Express Platinum? -[2] American Express Platinum Credit Score[3] The Platinum Card from American Express review[4] Is the Amex Platinum Worth the Annual Fee? - The Points Guy[5] American Express Platinum Credit Score[6] The Platinum Card from American Express review

Create this form in 5 minutes!

How to create an eSignature for the x the platinum credit card from american express

How to create an eSignature for your X The Platinum Credit Card From American Express online

How to generate an eSignature for the X The Platinum Credit Card From American Express in Chrome

How to generate an eSignature for putting it on the X The Platinum Credit Card From American Express in Gmail

How to create an electronic signature for the X The Platinum Credit Card From American Express straight from your mobile device

How to generate an eSignature for the X The Platinum Credit Card From American Express on iOS

How to create an electronic signature for the X The Platinum Credit Card From American Express on Android devices

People also ask

-

What is the e s i g n platinum credit card?

The e s i g n platinum credit card is a financial product designed for individuals looking for flexibility and rewards. It offers unique features that simplify your spending while also providing the benefits of digital transactions. With this card, you can efficiently manage your finances and enhance your purchasing power.

-

What are the key features of the e s i g n platinum credit card?

The e s i g n platinum credit card includes various features such as cashback on purchases, low annual fees, and no foreign transaction fees. Additionally, it comes with digital management tools that help you track your spending effectively. These features make it an appealing choice for both casual and frequent users.

-

How can I benefit from the e s i g n platinum credit card?

By using the e s i g n platinum credit card, you gain access to exclusive rewards and cashback opportunities. This card also helps you budget better with its integrated spending tools. Furthermore, its low fees and manageable terms make it a practical choice for anyone looking to optimize their financial strategy.

-

What is the pricing structure for the e s i g n platinum credit card?

The e s i g n platinum credit card features a competitive pricing structure with low annual fees and no hidden charges. Cardholders can benefit from various promotional offers that reduce initial costs. It's essential to review the terms and conditions to find the best option based on your spending habits.

-

Are there any integration options with the e s i g n platinum credit card?

Yes, the e s i g n platinum credit card can easily integrate with various financial management tools and apps. These integrations enhance your ability to track your expenditures and manage your finances seamlessly. Utilizing these tools helps you to fully leverage the benefits of your e s i g n platinum credit card.

-

What should I do if my e s i g n platinum credit card is lost or stolen?

If your e s i g n platinum credit card is lost or stolen, it's crucial to report it immediately to the issuing bank. They can help you freeze your account and issue a new card to prevent unauthorized charges. Always monitor your account for any suspicious activity until the situation is resolved.

-

How do I apply for the e s i g n platinum credit card?

Applying for the e s i g n platinum credit card is a straightforward process. You can complete the application online through the bank's official website or mobile app. Ensure you have the necessary documentation ready for a quicker approval process.

Get more for X THE PLATINUM CREDIT CARD FROM AMERICAN EXPRESS

- Discretionary housing payment hereford form

- Northwood university transcript request form

- Texas department of aging and disability services form 5515 nfa august nursing facility administrator program application for

- Notice of claim onondaga county form

- Texas certified moped list form

- Transcript request form hawkeye community college

- Federation festivals rating sheet jr 3 9 form

- Battery warranty claim form download antigravity batteries

Find out other X THE PLATINUM CREDIT CARD FROM AMERICAN EXPRESS

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure