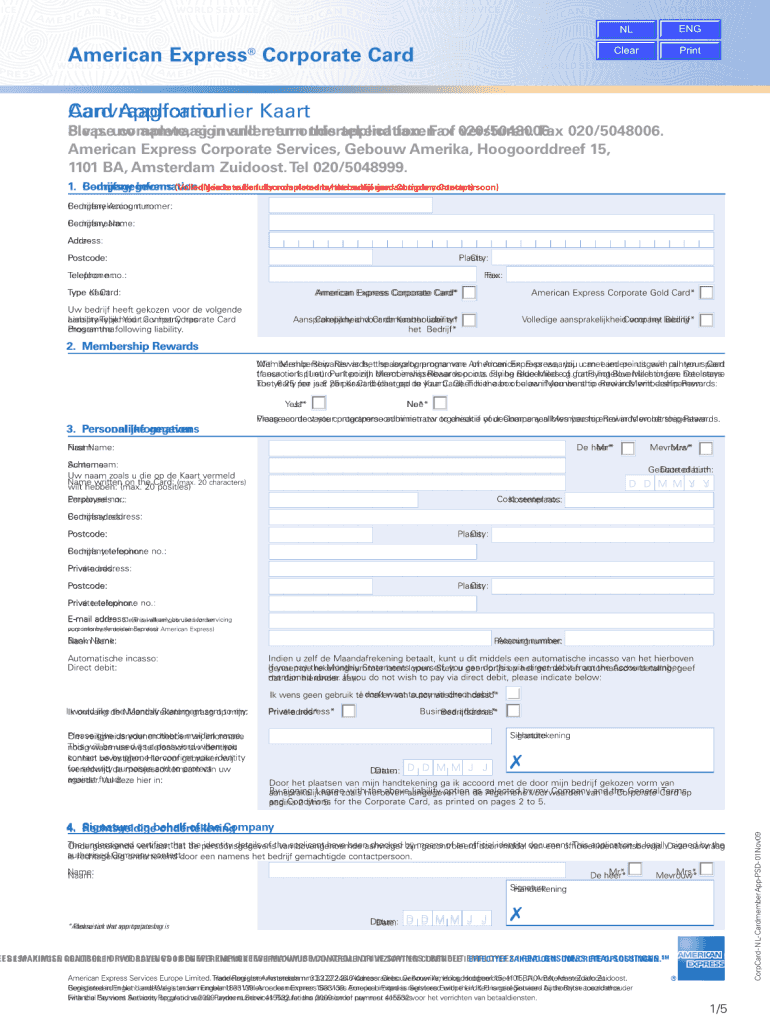

Card Application American Express Corporate Card Form

What is the American Express Corporate Card?

The American Express Corporate Card is a financial tool designed for businesses to manage expenses efficiently. It provides companies with a streamlined way to handle travel and purchasing expenses, offering various benefits such as expense tracking, reporting, and rewards. The card is tailored for organizations looking to enhance their financial management while providing employees with a convenient means to make business-related purchases.

Steps to Complete the American Express Corporate Card Application

Completing the American Express corporate card application involves several key steps to ensure a smooth process. First, gather all necessary information, including business details, financial information, and employee data. Next, visit the American Express website or contact their customer service for the specific application form. Fill out the form accurately, ensuring that all required fields are completed. After submitting the application, monitor the status through the American Express application status page or by contacting customer service for updates.

Eligibility Criteria for the American Express Corporate Card

To qualify for the American Express Corporate Card, businesses typically need to meet certain eligibility criteria. This may include having a minimum annual revenue, a valid business license, and a good credit history. Additionally, companies should demonstrate a need for corporate spending and provide details about their business structure, such as whether they are a corporation, LLC, or partnership. Meeting these criteria helps ensure that the application process is efficient and successful.

Required Documents for the American Express Corporate Card Application

When applying for the American Express corporate card, certain documents are essential for verification purposes. These may include:

- Business registration documents

- Tax identification number (EIN)

- Financial statements or bank statements

- Personal identification of the authorized signers

- Proof of business address

Having these documents ready can expedite the application process and increase the chances of approval.

Legal Use of the American Express Corporate Card

The American Express Corporate Card is legally binding when used according to the terms outlined in the cardholder agreement. Businesses must adhere to the guidelines set forth by American Express, including responsible spending and timely payment of balances. Compliance with federal and state regulations regarding business expenses is also crucial. Understanding these legal aspects ensures that the card is used appropriately and that the business remains in good standing with financial institutions.

Form Submission Methods for the American Express Corporate Card Application

Businesses can submit the American Express corporate card application through various methods. The most common method is online submission via the American Express website, which allows for quick processing. Alternatively, businesses may choose to submit the application by mail, ensuring that all required documents are included. In some cases, in-person applications can be made at American Express locations or through authorized representatives. Each method has its own processing times and requirements, so it is advisable to choose the one that best fits the business's needs.

Quick guide on how to complete card application american express corporate card

Prepare Card Application American Express Corporate Card effortlessly on any device

Web-based document management has gained traction among companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the right form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any hold-ups. Manage Card Application American Express Corporate Card on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

The easiest way to modify and eSign Card Application American Express Corporate Card with ease

- Find Card Application American Express Corporate Card and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes just a few seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the information and then click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

No more losing or misplacing documents, searching for forms, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign Card Application American Express Corporate Card and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How did credit cards become plastic cards with embossing?

How A Tenacious Entrepreneur Made An Imprint On Your Credit Card It was a cold winter in 1954 and it was clearly the low point of Stanley Dashew’s (http://en.wikipedia.org/wiki/Sta...) life. Dashew Business Machines, the company he started after arriving in Los Angeles in 1950, faced financial collapse, even though they just received the largest order ever in its four-year history from the U.S. Air Force. There was a severe cash-flow problem that threatened to bring the company to bankruptcy before it could fulfill the order for a new metal plate identification system based on Stanley’s invention, the Databosser. The machine embossed unique metal identification plates, which we called Dashaplates. But they only had thirteen hundred dollars. Stanley was left with no other choice but to sell his most prized worldly object Constellation a wooden crafted seventy-six-foot sailboat. He found a buyer and used the $45,000 to fund all the suppliers and workers at his company. Radical Late 1950s Technology Stanley’s Databosser was radical expansion to embossing technology that was used up until his invention. The Addressograph-Graphotype from the Addressograph-Multigraph Company most advanced machine was a keyboard based embossing machine that used a set of dies and punches to emboss or to deboss plates or tags for a given ID application. It was strictly a manual process where the operator used the keyboard to select individual characters at speeds from fifty to one hundred plates per hour. With the Databosser production was up to one thousand embossed plates per hour directly from punch cards or punch tape and later computers.In 1949, Frank X. McNamara, head of the Hamilton Credit Corporation (later, Diners Club) was eating with friends at "Major's Cabin Grill" in New York and when the check came he noticed he had forgotten his wallet. This sparked a Payment Card revolution. By 1950, Diner's Club released the first multiuse Charge card. Thees very first Payment Cards used a very simple "technology", a person's unique Signature and later a unique account number sequence printed on the cardboard card. This process held for most of the 1950s as American Express also released its own Charge Card.The Cardboard Diner’s Club Card Goes PlasticBy 1961, it became clear to Diner’s Club that a more robust material was needed to produce its card products. They also need a more automated system for the merchant to process the transaction. The company thought the only option was to use Plastic cards and turned to the Addressograph-Multigraph Company for the embossing machines to personalize the cards. These manual machines would have required rooms filled of typists creating metal dies or reusing existing dies to emboss a card, the process have had a great expense and up to a $15 cost per card however they had little choice, or so they thought.Addressograph Graphotype Embossing MachineDisruption 1960s StyleIn this era Stanley’s company still considered a “start-up” company and he was poised ready to change the entire Payment Card Industry. By 1961 there were over 1.2 million Diner’s Clubs members and Stanley demonstrated how the Databosser could mass produce charge cards. It was not an easy task to get attention to his rather new company even though he had far better technology. Stanley had to think creatively to get the Databosser in the hands of the production people at Diner’s Club to actually see how they worked. He devised a plan to pose as a delivery person and roll the machine and sample cards right into the production area of Diner’s Club. The unorthodox demonstration was a resounding success and by mid 1961 shiny new plastic cards were sent to all members using the Databosser. Needless to say the Addressograph-Multigraph Company machines were surrounding the Databosser as they were used to create print the letters and address the envelopes that delivered the cards.By 1962 Stanley captured the Carte Blanche account. But the real challenge was landing the American Express account. They were considered the most influential and prestigious company in the world at the time. The Addressograph-Multigraph company was none too happy to lose the other card companies and began production on its own automated embossing system. It would be hard to compete as virtually every company owned on an Addressograph-Multigraph business machine for mass producing form letters and American Express was a very large customer for them.Relentless Salesman Sells American ExpressAmerican Express would be a challenge but Stanley was not going to wait for the other company to copy his technology. After a great deal of letters, phone calls and personal visits Stanley finally was granted one chance to make a presentation. He said, “To have any chance to capture the American Express account we needed to do our homework. We found out exactly which American Express executives would be attending our client presentation. When it came time for the meeting, we presented each of the executives with a prototype American Express card, complete with the artwork still used today (which we borrowed from their traveler’s checks) and each one embossed with the executives’ names, and a faux account number and expiration date. As a final flourish, which underscored Amex’s extraordinary customer loyalty, each card included a reference to “a member since…. I can still see the faces of the American Express executives who were at the meeting. The whole thing was sheer show tell. Ok, call it a gimmick if you like but whatever you call it, it won the account. Here’s the lesson: Don’t just tell potential clients or investors what you can do for then. Show them – in the most dramatic and creative way you can.”The Databosser V100 went on to become a rather huge success. The company was later sold to Howard Hughes. The technology from Stanley and later the Addressograph-Multigraph Company is still in use today. Although there is now a small trend to eliminate the Embossing for a colored hot printing of the acount holder's name and account number on the back of the card. Although this has thus far only used by Chase Bank on some of it’s limited products.Embossing Allowed For The Explosion Of Payment CardsEmbossing allowed for a very rapid system of recording all the important information off the face of the Payment Card by using, at that time carbon slips that were placed over the card and creating a multipart record of the transaction. The three part carbon receipt allowed for a copy for the customer, the merchant and the card company. The merchant would mail the signed copies for payment, usually a check sent to them about 30 days later, keep copy and present the customer copy.In many ways this technology revolutionized the Payment Card just as much as the Magnetic Strip (When was the first credit card with a magnetic stripe issued?). We still live with the vestige of this 1960s can-do technology as a memorial to how some good ideas stick around long after the entire world changes. Creating Products At 95 Years OldAs for Stanley, he stuck around too, now 95 years old and still inventing products. His latest is the Dashaway, a rethinking and hot rod version of the Grandparents walker (no tennis balls on the feet of this thing).Although he never got back Constellation, his prized Sail Boat sold in 1954, Stanley can still be seen sailing the Pacific at the helm facing his next challange.

-

How can one fill a PAN card application with initials?

The PAN Card Application has specific guidelines that no initials be included for the First Name, Middle Name, and Last Name fields of the applicant, his/her father and mother.While initials are not permitted in the above mentioned fields, you have the option to choose how your name appears on the PAN Card. There you could have initials listed.For example, lets take the name Virat Kholi.First Name would be Virat.Last Name would be Kholi.Name on Card can be any of the following:Virat KholiViratK ViratVirat KIf you would like to check how the application turns out, you could submit an online PAN Card Application and download the pre-filled PDF form for free at Brokerage Free - New PAN ApplicationHope this information is helpful.Thanks.

-

How can I make the most out of the SPG American Express credit card?

Here are some things to look for to ensure you get the most out of the SPG American Express:Before signing up for an SPG Amex, look to see what kind of welcome bonus you can expect by signing up. Typically, you can expect a welcome bonus of 20,000 Starpoints (value of $446). Look online for any promotions happening which allow you to earn more Starpoints by booking during specific times or destinations. For example, SPG has a promotion right now where you can earn 1,000 bonus Starpoints when at least one night of your eligibile stay of two nights or more at any SPG hotel includes a weekend night (Friday, Saturday or Sunday). When booking hotels, you can earn up to 3 Starpoints per dollar spent if you book a Starwood hotel through the Starwood website, hotel, call center, their travel agent or corporate booking tool with your SPG American Express credit card.If you keep these tips in mind, you’ll be earning enough Starpoints for free hotel nights in no time! Now, once you have your Starpoints, there are many tips to maximize the value you receive for them. According to RateHub.ca, the average value you receive for a Starpoint is $0.0223; this value varies quite dramatically depending on the hotel you book. Here are four tips on how you can maximize your Startpoints:Book hotels in categories 1, 2 & 5Certain hotel categories offer greater value for your Starpoints. For example, on average when you book a category 1 hotel, you receive $0.0348/Starpoint. This is more than double the value you receive when booking a category 4 hotel, $0.0170. Hotels in categories 1 and 2 offer the greatest value for your Starpoints but are often in undesirable locations (near airports). The greatest value you can get for redeeming your Starpoints is by booking a Category 2 hotel in Central & South America. Here is a summary on the average value you can expect per hotel category:· Category 1 = $0.0348· Category 2 = $0.0300· Category 3 = $0.0191· Category 4 = $0.0170· Category 5 = $0.0224· Category 6 = $0.0175· Category 7 = $0.0151 2. Redeem your Starpoints for hotels in the most valuable regionsThe number of Starpoints required to book a hotel varies with each category but not by region. Also, the category levels are tied to the quality of the hotel rather than being directly linked to the price. Since each region requires the same amount of Starpoints, you receive better value for your Starpoints in regions with high hotel prices. Click on the link at the bottom of the page to see an example of our calculations. Here is a summary on the average value you can expect per region:· North America = $0.0253· Central & South America = $0.0199· Europe = $0.0238· Africa = $0.0238· Middle East = $0.0161· Asia Pacific = $0.02143. Compare hotel pricesThe value you receive for your Starpoints is largely tied to the price of the hotel. On average, certain regions offer more value but it’s still important to look within a region since there are still large price discrepancies between hotels. A higher hotel price does not always mean that a hotel is superior but most people do notice a difference between a $175/night hotel and a $350/night hotel. When redeeming Starpoints it’s important to take note of the price differences between hotels in that category. 4. Consider booking hotels with cash and pointsSome hotels will offer the option of booking with Cash and Points. Choosing to book with Cash and Points is a good option if you do not have enough Starpoints because you still receive good value. Usually, you will receive more value for your Starpoints by redeeming only points but in some situations you receive better value by choosing the Cash and Points option. Click the link below to see an example. To see a more detailed explanation on how to maximize the value of your SPG points visit RateHub.ca. Our page The Value of a Starwood Preferred Guest (SPG) Starpoint outlines the seven hotel categories in this program, their value by world region and more tips on how to maximize the value of your Starpoints.

-

How can you check the application status of an American Express credit card?

In India, You can check your Amex Credit Card Application Status on Following link,American Express Card | Application TrackerSimply enter either your mobile number provided at the time of filling application or enter your reference number that you may have received through mail.

-

How will consumers respond to the American Express Prepaid Card?

Functionality of the Amex card may be quite limited according to banktalk.org http://banktalk.org/2011/06/15/a... which may impair adoption. Leading prepaid programs tend to be feature rich; for example: NetSpend, Greendot and RushCards offer text message alerts so that users always know their balance; most programs offer access to coupons and/or discounts; NetSpend offers a savings account that pays 5%; and, most cards facilitate direct deposit (which allows unbanked customers to save potentially hundreds of dollars per year on check cashing fees otherwise incurred to avoid bank hold periods), bill payment, money transfers and have ODP fees that are half of what banks typically charge or prohibit overdrafts and the resultant fees entirely. There is much talk about prepaid card fees however a 2011 study by Bretton Woods [http://bretton-woods.com/media/5... showed how leading prepaid card programs are competitive when considered as an alternative to a traditional FI bank account especially for market segments that don't carry minimum balances or make use of large credit facilities such as LOCs and mortgages; however, this is only true if the prepaid card program offers a suite of services and features that are comparable or superior to a bank account. In summary it appears that American Express may still have some work to do before their prepaid card will appeal to the unbanked, underbanked or mass-market. I think the new Amex prepaid card will be more interesting after they expand the card's functionality and figure out a compelling distribution model.

-

How do I change my address in the Aadhar card?

You can change the following details in Aadhar Card:NameGenderDate of BirthAddressE-mail IDTHINGS TO REMEMBER BEFORE APPLYING FOR AADHAR CARD DETAILS CHANGE:Your Registered Mobile Number is mandatory in the online process.You need to submit Documents for change of – Name, Date of Birth and Address. However, Change in Gender and E-mail ID do not require any document.You have to fill details in both – English and Regional/Local language (Eg. Hindi, Oriya, Bengali etc)Aadhar Card Details are not changed instantly. It is changed after Verification and Validation by the authoritySTEPS TO AADHAR CARD DETAILS CHANGE ONLINE:Click Here for going to the link.Enter your Aadhar Number.Fill Text VerificationClick on Send OTP. OTP is sent on your Registered mobile number.Also Read: Simple Steps to Conduct Aadhar Card Status Enquiry by NameYou will be asked to choose the Aadhar Card Details that you want to change.You can select multiple fields. Select the field and Submit.In next window fill the Correct Detail in both – English and Local language (if asked) and Submit.For Example – Here one has to fill the Email IdNOTE – If you are changing – Name, Date of Birth or Address, you have to upload the scanned documents. Click Here to know the Documents or Check them here.Verify the details that you have filled. If all the details look good then proceed or you can go back and edit once again.You may be asked for BPO Service Provider Selection. Select the provider belonging to your region.At last – You will be given an Update Request Number. Download or Print the document and keep it safe. It is required in checking the status of the complaint in future.So this step completes the process of Aadhar Card details change online.CHECK THE STATUS OF YOUR AADHAR CARD DETAILS CHANGE REQUESTStep 1 – Go the website by Clicking HereStep 2 – Fill the Aadhaar No. and URN – Update Request NumberStep 3 – Click on “Get Status”You are done. The new window on the screen will show the status of your request for change in Aadhar Card Details.

Create this form in 5 minutes!

How to create an eSignature for the card application american express corporate card

How to create an eSignature for the Card Application American Express Corporate Card in the online mode

How to create an electronic signature for the Card Application American Express Corporate Card in Google Chrome

How to create an electronic signature for signing the Card Application American Express Corporate Card in Gmail

How to generate an electronic signature for the Card Application American Express Corporate Card from your smart phone

How to create an eSignature for the Card Application American Express Corporate Card on iOS devices

How to make an electronic signature for the Card Application American Express Corporate Card on Android devices

People also ask

-

What is the American Express Corporate Advantage Program PDF?

The American Express Corporate Advantage Program PDF outlines benefits and features offered to corporate clients using American Express. This program provides various advantages such as discounts, travel benefits, and more, helping businesses manage expenses efficiently.

-

How can airSlate SignNow enhance the use of the American Express Corporate Advantage Program PDF?

airSlate SignNow allows businesses to easily send and eSign the American Express Corporate Advantage Program PDF, streamlining document management. This integration ensures that all documents related to the program are securely signed and accessible, improving overall workflow efficiency.

-

What are the pricing options for the airSlate SignNow solution?

airSlate SignNow offers several pricing tiers to cater to different business needs, ensuring access to essential features while using the American Express Corporate Advantage Program PDF. Flexible pricing plans are available, making it cost-effective for businesses of all sizes to implement electronic signature solutions.

-

What features does airSlate SignNow provide for managing the American Express Corporate Advantage Program PDF?

Key features of airSlate SignNow include templates, collaboration tools, and automated reminders which enhance the management of the American Express Corporate Advantage Program PDF. These features simplify the signing process and keep track of all transactions, enhancing compliance and efficiency.

-

How can businesses benefit from using airSlate SignNow with the American Express Corporate Advantage Program PDF?

Utilizing airSlate SignNow with the American Express Corporate Advantage Program PDF can lead to improved speed and accuracy in document handling. Businesses can save time and reduce paper usage, all while enjoying the numerous perks of the American Express program.

-

Is airSlate SignNow compatible with other software for the American Express Corporate Advantage Program PDF?

Yes, airSlate SignNow seamlessly integrates with various software platforms, enhancing the management of the American Express Corporate Advantage Program PDF. This compatibility helps companies consolidate their workflows and use the program effectively within their existing systems.

-

Can I access the American Express Corporate Advantage Program PDF from mobile devices?

Absolutely! With airSlate SignNow, the American Express Corporate Advantage Program PDF can be easily accessed and signed from mobile devices. This feature allows busy professionals to manage documents on the go, ensuring that important paperwork is completed without delay.

Get more for Card Application American Express Corporate Card

Find out other Card Application American Express Corporate Card

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer