Uitr 6c Form

What is the Uitr 6c

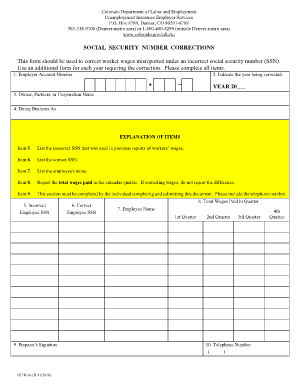

The Uitr 6c form is a specific document used in Colorado for reporting certain tax-related information. It is primarily utilized by businesses and individuals to ensure compliance with state tax regulations. This form serves as a declaration of income, deductions, and credits, which are essential for accurate tax filing. Understanding the purpose and requirements of the Uitr 6c is crucial for anyone involved in the financial or business sectors in Colorado.

How to use the Uitr 6c

Using the Uitr 6c form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and previous tax returns. Next, fill out the form with the required information, ensuring that all figures are accurate and reflect your financial situation. After completing the form, review it for any errors before submission. The Uitr 6c can be submitted online, by mail, or in person, depending on your preference and the specific requirements set by the Colorado Department of Revenue.

Steps to complete the Uitr 6c

Completing the Uitr 6c form requires careful attention to detail. Follow these steps for a successful submission:

- Gather all relevant financial documents, such as W-2s, 1099s, and receipts for deductions.

- Access the Uitr 6c form through the Colorado Department of Revenue website or obtain a physical copy.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income and any applicable deductions or credits.

- Double-check all entries for accuracy and completeness.

- Submit the form electronically or send it via mail to the appropriate state office.

Legal use of the Uitr 6c

The Uitr 6c form must be completed in compliance with Colorado state laws to be considered legally valid. This includes ensuring that all information provided is truthful and accurate. Failure to comply with the legal requirements can result in penalties, including fines or additional taxes owed. It is essential to keep records of all submitted forms and related documents for future reference and potential audits.

Key elements of the Uitr 6c

Several key elements are essential when filling out the Uitr 6c form. These include:

- Personal Information: Accurate identification details, including name and Social Security number.

- Income Reporting: Total income from all sources must be clearly stated.

- Deductions and Credits: Any applicable deductions or credits should be itemized to reduce taxable income.

- Signature: A signature is required to validate the form, confirming that the information provided is correct.

Form Submission Methods

The Uitr 6c form can be submitted through various methods, providing flexibility for users. The available submission methods include:

- Online Submission: Complete and submit the form electronically through the Colorado Department of Revenue's website.

- Mail: Print the completed form and send it to the appropriate address as specified by the state.

- In-Person: Deliver the form directly to a local Colorado Department of Revenue office.

Quick guide on how to complete uitr 6c

Easily Prepare Uitr 6c on Any Device

Digital document management has surged in popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, allowing you to access the correct format and securely store it online. airSlate SignNow provides all the functionality required to create, edit, and eSign your documents promptly without delays. Manage Uitr 6c on any device with airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The Easiest Way to Edit and eSign Uitr 6c with Ease

- Find Uitr 6c and then click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet signature.

- Review the details and then click the Done button to finalize your changes.

- Select how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious searches for forms, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements with just a few clicks from any device you prefer. Edit and eSign Uitr 6c and maintain excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the uitr 6c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Uitr 6c and how does it relate to airSlate SignNow?

Uitr 6c is a specific regulatory requirement that organizations must adhere to when handling electronic signatures. airSlate SignNow complies with Uitr 6c, ensuring that your e-signatures are legally binding and secure, which can help businesses streamline their document workflows while meeting regulatory standards.

-

How does airSlate SignNow help with Uitr 6c compliance?

airSlate SignNow provides features that are designed to meet Uitr 6c compliance. This includes secure storage, tamper-proof signatures, and detailed audit trails, which help ensure that your electronic signing process aligns with Uitr 6c requirements and maintains the integrity of your documents.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers various pricing plans to cater to different business needs, allowing you to choose the best option for your budget. Each plan provides access to essential features that support Uitr 6c compliance along with additional functionality tailored for larger teams or enterprises.

-

What features does airSlate SignNow provide to support Uitr 6c?

AirSlate SignNow includes a robust set of features such as document templates, bulk sending, and integration with popular applications. These tools not only enhance productivity but also ensure compliance with Uitr 6c, enabling your business to effectively manage e-signatures in a legally compliant manner.

-

Can airSlate SignNow integrate with other software systems?

Yes, airSlate SignNow seamlessly integrates with a variety of software systems, including CRMs and productivity tools. These integrations allow businesses to automate workflows while adhering to Uitr 6c compliance, making it easier to manage documents and e-signatures within existing platforms.

-

What benefits does using airSlate SignNow provide for businesses?

Using airSlate SignNow enhances business efficiency by streamlining the e-signature process and reducing paperwork. Additionally, with Uitr 6c compliance features embedded, businesses can ensure that their signing processes are secure and meet industry regulations, instilling trust with clients and partners.

-

Is airSlate SignNow user-friendly for new users?

Absolutely! AirSlate SignNow is designed with an intuitive interface that allows new users to easily navigate and utilize its features. The straightforward design ensures that even those unfamiliar with e-signatures can quickly adapt while still maintaining compliance with Uitr 6c requirements.

Get more for Uitr 6c

Find out other Uitr 6c

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document