Missfiga Returns Form

What is the Missfiga Returns

The Missfiga Returns form is a specific tax document used primarily for reporting income and calculating tax liabilities. It is essential for individuals and businesses to ensure compliance with federal tax regulations. This form is typically filed annually and plays a crucial role in determining the amount of taxes owed or any potential refunds. Understanding its purpose is vital for accurate tax reporting and financial planning.

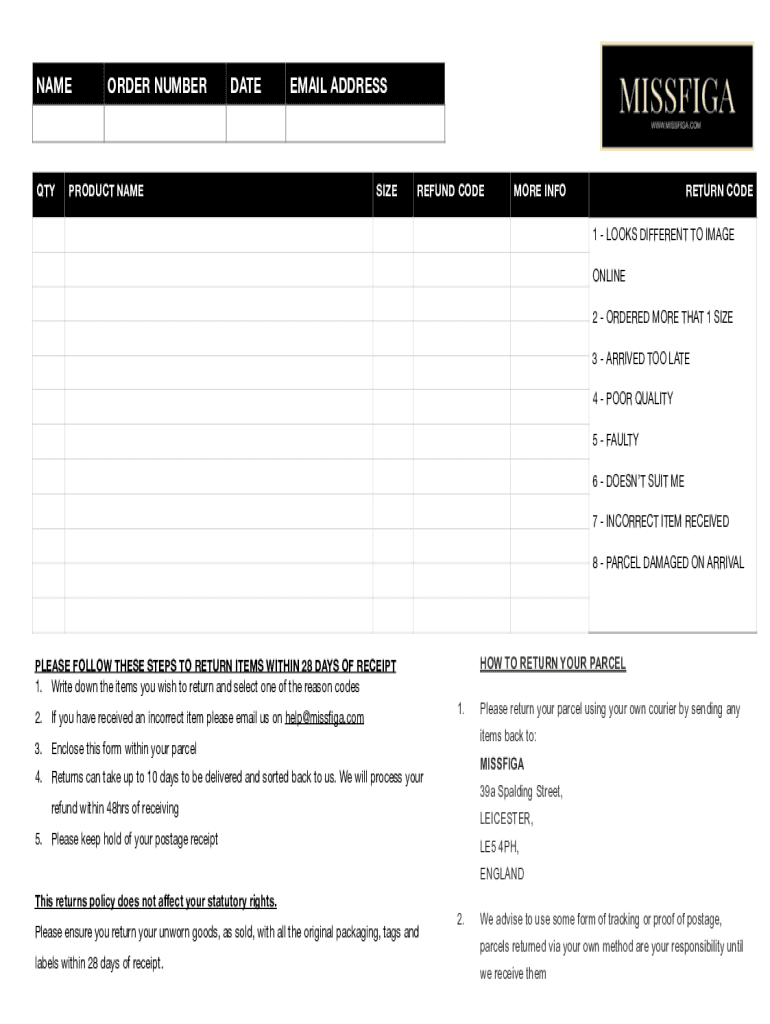

Steps to complete the Missfiga Returns

Completing the Missfiga Returns involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, accurately fill out the form, ensuring that all information is correct and complete. After completing the form, review it for any errors or omissions. Finally, submit the form by the designated deadline, either electronically or via mail, depending on your preference.

Legal use of the Missfiga Returns

The legal use of the Missfiga Returns is governed by federal tax laws, ensuring that the information provided is truthful and accurate. Filing this form is mandatory for individuals and businesses that meet specific income thresholds. Failure to file or inaccuracies can result in penalties, making it crucial to adhere to the legal requirements set forth by the IRS. Additionally, using a reliable platform for eSigning the form can enhance its legal standing.

Filing Deadlines / Important Dates

Filing deadlines for the Missfiga Returns are critical to avoid penalties. Generally, the form is due on April fifteenth of each year, though extensions may be available under certain circumstances. It is important to keep track of these dates to ensure timely submission. Additionally, any changes in tax laws may affect deadlines, so staying informed is essential for compliance.

Required Documents

To successfully complete the Missfiga Returns, several documents are required. These typically include W-2 forms from employers, 1099 forms for freelance or contract work, and any relevant receipts for deductions or credits. Having these documents organized and readily accessible will streamline the process and help ensure that all income and expenses are accurately reported.

Form Submission Methods (Online / Mail / In-Person)

The Missfiga Returns can be submitted through various methods, providing flexibility for filers. Online submission is often the most efficient, allowing for quicker processing and confirmation. Alternatively, forms can be mailed to the appropriate IRS address, though this method may take longer. In-person submission options may also be available at designated IRS offices, offering assistance for those who prefer face-to-face interactions.

Examples of using the Missfiga Returns

Examples of using the Missfiga Returns can vary based on individual circumstances. For instance, a self-employed individual may use the form to report income from freelance work, while a small business owner might utilize it to declare profits and losses from their operations. Understanding these examples can help filers recognize their obligations and ensure they are reporting accurately based on their unique financial situations.

Quick guide on how to complete missfiga returns

Easily Prepare Missfiga Returns on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a perfect environmentally friendly substitute for traditional printed and signed papers, as you can easily find the necessary form and securely archive it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly and efficiently. Manage Missfiga Returns on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

Edit and eSign Missfiga Returns Effortlessly

- Obtain Missfiga Returns and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to secure your changes.

- Select your preferred method to send your form, via email, SMS, or an invite link, or download it to your computer.

Say goodbye to lost or misplaced papers, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your device of choice. Edit and eSign Missfiga Returns to ensure excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the missfiga returns

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are missfiga returns and how do they work?

Missfiga returns refer to the return processes managed through airSlate SignNow, allowing users to easily send and eSign documents. This streamlined system simplifies the complexities of returns, enhancing efficiency and accountability for businesses. With missfiga returns, organizations can ensure that their documentation is organized and easily retrievable.

-

How much does airSlate SignNow cost for managing missfiga returns?

airSlate SignNow offers flexible pricing plans tailored to various business needs, making managing missfiga returns cost-effective. Depending on the chosen plan, customers can benefit from features specifically designed to streamline the returns process. Choosing SignNow for missfiga returns can lead to signNow savings compared to traditional methods.

-

What features does airSlate SignNow provide for missfiga returns?

airSlate SignNow includes several features that enhance missfiga returns, such as customizable templates, automated workflows, and secure eSigning capabilities. These tools help businesses manage their return processes more efficiently while ensuring compliance with legal standards. The user-friendly interface makes it easy for anyone to navigate and utilize these features effectively.

-

Can airSlate SignNow integrate with other platforms for missfiga returns?

Yes, airSlate SignNow can easily integrate with a plethora of platforms and applications to facilitate missfiga returns. This includes popular CRM systems, payment processors, and cloud storage services. These integrations help create a seamless workflow, ensuring that all aspects of the returns process are interconnected and efficient.

-

What benefits do I get from using airSlate SignNow for missfiga returns?

Using airSlate SignNow for missfiga returns provides multiple benefits such as improved efficiency, reduced turnaround times, and enhanced document security. By digitizing the return process, businesses can save valuable time and resources while ensuring that all transactions are tracked effectively. Additionally, the ease of use encourages faster adoption among team members.

-

How secure is the information when processing missfiga returns with airSlate SignNow?

Security is a top priority for airSlate SignNow, especially when handling sensitive information related to missfiga returns. The platform employs robust encryption protocols and compliance with industry standards to protect your documents and data. Customers can confidently use SignNow for their returns, knowing that their information is secure.

-

Are there any limitations when using airSlate SignNow for missfiga returns?

While airSlate SignNow is generally comprehensive, users should be aware of certain limitations regarding specific integrations and advanced features that may carry additional costs. It's essential to evaluate your business's needs thoroughly to ensure that the necessary tools for managing missfiga returns are included in your chosen package. Overall, the benefits often outweigh these limitations.

Get more for Missfiga Returns

Find out other Missfiga Returns

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment