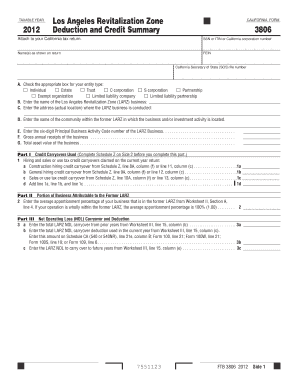

California Form 3806

What is the California Form 3806

The California Form 3806 is a tax form used by individuals and businesses to report specific financial information to the state of California. This form is primarily associated with the calculation of certain tax credits and deductions. It is important for taxpayers to understand the purpose of this form to ensure accurate reporting and compliance with state tax regulations.

How to use the California Form 3806

Using the California Form 3806 involves several steps to ensure proper completion and submission. Taxpayers must first gather all necessary financial documents related to their income and deductions. Once the required information is collected, individuals can fill out the form accurately, ensuring that all sections are completed. After completing the form, it should be reviewed for any errors before submission to the appropriate state tax authority.

Steps to complete the California Form 3806

Completing the California Form 3806 requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial documents, including income statements and previous tax returns.

- Download the California Form 3806 from the official state website or access it through a tax preparation software.

- Fill out the form, ensuring that all required fields are completed accurately.

- Double-check the calculations and information entered to avoid mistakes.

- Sign and date the form, if required, before submission.

Legal use of the California Form 3806

The California Form 3806 is legally binding when completed and submitted according to state regulations. To ensure its legal validity, taxpayers must adhere to specific guidelines set forth by the California Franchise Tax Board. This includes providing accurate information and submitting the form by the designated deadlines. Failure to comply with these legal requirements may result in penalties or issues with tax filings.

Key elements of the California Form 3806

Key elements of the California Form 3806 include personal identification information, income details, and specific deductions or credits being claimed. Taxpayers must provide their Social Security number, filing status, and any relevant financial data. Understanding these key components is essential for ensuring that the form is filled out correctly and that all applicable tax benefits are claimed.

Form Submission Methods

The California Form 3806 can be submitted through various methods, including online, by mail, or in person. Taxpayers may choose to file electronically using tax software that supports California forms, which often provides a more streamlined process. Alternatively, individuals can print the completed form and mail it to the appropriate tax office or deliver it in person if preferred. Each submission method has its own guidelines and deadlines that must be followed.

Filing Deadlines / Important Dates

Filing deadlines for the California Form 3806 are critical for compliance. Typically, the form must be submitted by the state tax deadline, which aligns with federal tax filing dates. It is essential for taxpayers to be aware of these dates to avoid late penalties. Keeping track of any changes to deadlines is also important, as state regulations may vary from year to year.

Quick guide on how to complete california form 3806

Finish California Form 3806 effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed papers, as you can access the required form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Handle California Form 3806 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The simplest way to modify and electronically sign California Form 3806 with ease

- Obtain California Form 3806 and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign California Form 3806 to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california form 3806

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is California Form 3806?

California Form 3806 is a state tax form used for certain tax reporting purposes. It is essential for individuals and businesses to ensure compliance with California tax laws. Utilizing airSlate SignNow can streamline the process of preparing, signing, and submitting this document.

-

How does airSlate SignNow help with California Form 3806?

airSlate SignNow provides an intuitive platform for filling out and eSigning California Form 3806. This reduces errors and enhances efficiency, allowing users to complete their forms quickly and securely. With integrated tools, you can manage all your tax documents in one place.

-

Is airSlate SignNow cost-effective for using California Form 3806?

Yes, airSlate SignNow offers competitive pricing that makes it a cost-effective solution for handling California Form 3806. With various subscription plans, businesses can choose an option that fits their budget while still gaining robust features for document management. Free trials are also available to test the service.

-

What features does airSlate SignNow offer for California Form 3806?

airSlate SignNow offers several features that simplify working with California Form 3806. These include customizable templates, real-time tracking, and secure cloud storage. Users can efficiently collaborate and ensure that all signatures are obtained promptly.

-

Can I integrate airSlate SignNow with other software for California Form 3806?

Absolutely! airSlate SignNow seamlessly integrates with popular applications to enhance the management of California Form 3806. Whether you use CRM systems or cloud storage solutions, you can easily connect them for a more streamlined workflow.

-

What benefits does airSlate SignNow provide for managing California Form 3806?

Using airSlate SignNow for California Form 3806 offers numerous benefits, including faster processing times and enhanced security for sensitive documents. The platform also allows for easy access to forms from any device, ensuring that you can work from anywhere. This flexibility is crucial for busy professionals.

-

How secure is using airSlate SignNow for California Form 3806?

airSlate SignNow prioritizes security for all documents, including California Form 3806. Features such as encryption, secure data storage, and compliance with industry standards ensure that your information is protected. This commitment to security helps build trust with your clients.

Get more for California Form 3806

Find out other California Form 3806

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU

- Help Me With eSign Oregon Mechanic's Lien

- eSign South Carolina Mechanic's Lien Secure

- eSign Tennessee Mechanic's Lien Later

- eSign Iowa Revocation of Power of Attorney Online

- How Do I eSign Maine Revocation of Power of Attorney

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple