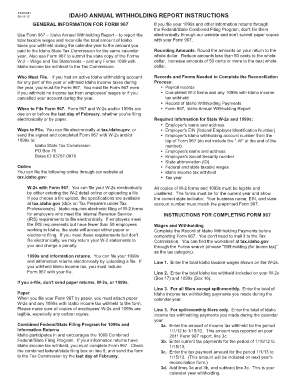

Idaho Form 967

What is the Idaho Form 910?

The Idaho Form 910 is a specific tax form used by individuals and businesses in Idaho for reporting and documenting certain tax-related information. This form is essential for ensuring compliance with state tax regulations and is typically required for various tax filings. Understanding the purpose and requirements of Form 910 is crucial for anyone needing to navigate Idaho's tax system effectively.

How to Obtain the Idaho Form 910

Obtaining the Idaho Form 910 is straightforward. Individuals and businesses can access the form through the official Idaho State Tax Commission website. It is available as a downloadable PDF, which can be printed and filled out manually. Additionally, some tax preparation software may include the form, allowing for easier completion and submission. Ensuring that you are using the most current version of the form is important for compliance.

Steps to Complete the Idaho Form 910

Completing the Idaho Form 910 involves several key steps:

- Gather necessary documentation, such as income statements and previous tax returns.

- Fill out personal information, including your name, address, and Social Security number.

- Provide details about your income, deductions, and any credits you are claiming.

- Double-check all entries for accuracy to avoid errors that could delay processing.

- Sign and date the form before submission.

Following these steps carefully will help ensure that your form is completed correctly and submitted on time.

Legal Use of the Idaho Form 910

The Idaho Form 910 is legally binding when filled out and submitted according to state regulations. It is important to ensure that all information provided is accurate and truthful, as any discrepancies could lead to penalties or legal issues. The form must be signed by the taxpayer or an authorized representative to validate its contents. Compliance with the Idaho tax laws is essential for avoiding complications with the Idaho State Tax Commission.

Filing Deadlines for the Idaho Form 910

Filing deadlines for the Idaho Form 910 are typically aligned with federal tax deadlines. Generally, individual taxpayers must file by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to stay informed about any changes to filing deadlines to ensure timely submission and avoid penalties.

Form Submission Methods for the Idaho Form 910

The Idaho Form 910 can be submitted through various methods to accommodate different preferences:

- Online: Some taxpayers may have the option to file electronically through approved e-filing services.

- Mail: Completed forms can be sent to the Idaho State Tax Commission via standard postal services.

- In-Person: Taxpayers may also choose to deliver their forms directly to local tax commission offices.

Choosing the right submission method can help ensure that your form is processed efficiently.

Quick guide on how to complete idaho form 967

Complete Idaho Form 967 seamlessly on any device

Digital document management has gained immense traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow offers all the tools required to create, edit, and electronically sign your documents swiftly without any delays. Manage Idaho Form 967 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

The easiest way to revise and electronically sign Idaho Form 967 with minimal effort

- Locate Idaho Form 967 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Idaho Form 967 to guarantee exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the idaho form 967

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 910 Idaho and how is it used?

The form 910 Idaho is a vital document used for various state processes. It serves as an application form that residents must complete for specific services, and understanding its purpose is key to ensuring compliance with Idaho regulations.

-

How can airSlate SignNow help with completing the form 910 Idaho?

With airSlate SignNow, you can easily complete the form 910 Idaho digitally. Our platform allows for seamless eSigning and document management, making it convenient to fill out and submit this form securely.

-

What are the pricing options for using airSlate SignNow for form 910 Idaho?

AirSlate SignNow offers competitive pricing tiers that cater to different needs, including options for businesses handling the form 910 Idaho. By choosing a plan that suits your volume of transactions, you can take advantage of our robust features at an affordable rate.

-

What features does airSlate SignNow provide for the form 910 Idaho?

AirSlate SignNow includes features like customizable templates, eSigning, and secure storage, all beneficial for managing the form 910 Idaho. These tools streamline the process, ensuring that documents are completed accurately and efficiently.

-

How secure is my data when using airSlate SignNow for form 910 Idaho?

Your data is secure with airSlate SignNow while you handle the form 910 Idaho. We implement advanced encryption protocols and compliance standards to safeguard all information, ensuring that your documents remain confidential.

-

Can airSlate SignNow integrate with other applications for managing form 910 Idaho?

Yes, airSlate SignNow integrates seamlessly with various applications to help manage the form 910 Idaho. Whether using CRM tools or cloud storage services, our platform enhances your workflow by connecting to the software you already use.

-

What are the benefits of using airSlate SignNow for the form 910 Idaho compared to paper methods?

Using airSlate SignNow for the form 910 Idaho offers numerous benefits over traditional paper methods. It saves time, reduces errors, and provides an eco-friendly alternative, allowing you to manage paperwork more efficiently and conveniently.

Get more for Idaho Form 967

- Belize passport application form

- Aer bformb 700 1 aw2 application for financial assistance may 2016 aerhq

- Declaration a from the manufacturer of the industrial and form

- The european ecolabel for personal computers europa eu form

- Eu ecolabel for detergents and cleaning products user manual form

- Small group employer application healthallianceorg form

- Garden oaks veterinary clinic form

- Substance abuse ampamp recovery resourcesthe recovery village form

Find out other Idaho Form 967

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed