Request to Add or Remove Tax Codes Paylocity Form

What is the Request to Add or Remove Tax Codes Paylocity

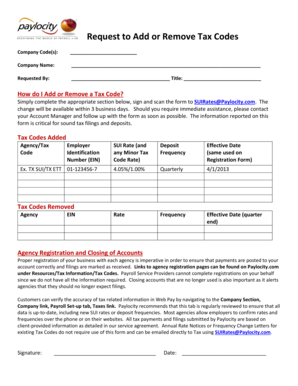

The Request to Add or Remove Tax Codes Paylocity is a specific form used by employees to modify their tax withholding status. This form allows individuals to communicate changes in their personal tax situation to their employer, ensuring that the correct amount of taxes is withheld from their paychecks. It is essential for maintaining compliance with federal and state tax regulations, as well as for optimizing personal tax liabilities.

How to Use the Request to Add or Remove Tax Codes Paylocity

Using the Request to Add or Remove Tax Codes Paylocity involves a few straightforward steps. First, employees need to access the form through their employer's Paylocity portal. After downloading or opening the form, they should fill in the required fields, including personal information and the specific tax codes they wish to add or remove. Once completed, the form can be submitted electronically through the portal or printed and handed to the HR department for processing.

Steps to Complete the Request to Add or Remove Tax Codes Paylocity

Completing the Request to Add or Remove Tax Codes Paylocity involves several key steps:

- Log in to your Paylocity account.

- Locate the Request to Add or Remove Tax Codes form.

- Fill in your personal details, including your name, employee ID, and any other required information.

- Indicate the tax codes you wish to add or remove, ensuring accuracy.

- Review the completed form for any errors or omissions.

- Submit the form electronically or print it for manual submission.

Legal Use of the Request to Add or Remove Tax Codes Paylocity

The Request to Add or Remove Tax Codes Paylocity is legally binding when completed correctly. To ensure its validity, the form must meet specific legal requirements, including proper signatures and adherence to state and federal tax laws. Employers and employees alike should retain copies of the submitted form for their records, as it may be necessary for future tax filings or audits.

Key Elements of the Request to Add or Remove Tax Codes Paylocity

Several key elements must be included in the Request to Add or Remove Tax Codes Paylocity for it to be processed effectively:

- Employee Information: Full name, employee ID, and contact details.

- Tax Code Changes: Clear indication of which tax codes are being added or removed.

- Signature: A signature or electronic confirmation to validate the request.

- Date of Submission: The date when the request is submitted, which is crucial for processing timelines.

Filing Deadlines / Important Dates

Filing deadlines for the Request to Add or Remove Tax Codes Paylocity can vary based on the employer's payroll schedule. It is important for employees to submit their requests in advance of payroll processing dates to ensure that changes take effect in a timely manner. Typically, requests should be submitted at least one payroll cycle before the desired changes are reflected in paychecks.

Quick guide on how to complete request to add or remove tax codes paylocity

Complete Request To Add Or Remove Tax Codes Paylocity effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can obtain the right format and securely save it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly without delays. Handle Request To Add Or Remove Tax Codes Paylocity on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The simplest way to modify and eSign Request To Add Or Remove Tax Codes Paylocity without any hassle

- Locate Request To Add Or Remove Tax Codes Paylocity and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Request To Add Or Remove Tax Codes Paylocity and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the request to add or remove tax codes paylocity

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are paylocity tax forms?

Paylocity tax forms are essential documents used for reporting employee wages and withholding taxes to the IRS. These forms help businesses manage payroll obligations accurately and efficiently. Using airSlate SignNow, you can easily send and eSign paylocity tax forms, streamlining your tax reporting process.

-

How does airSlate SignNow simplify the process of handling paylocity tax forms?

airSlate SignNow simplifies the handling of paylocity tax forms by providing a user-friendly interface that allows for quick collection of electronic signatures. You can customize your tax forms and send them directly to employees, ensuring compliance and reducing paperwork. This efficiency helps you save time and resources.

-

Does airSlate SignNow offer integrations with payroll software for paylocity tax forms?

Yes, airSlate SignNow offers integrations with various payroll software, allowing seamless handling of paylocity tax forms. These integrations enable automated workflows, so you can easily manage tax form distribution and collection alongside payroll management. This reduces the risk of errors and enhances operational efficiency.

-

What pricing options are available for using airSlate SignNow with paylocity tax forms?

airSlate SignNow provides flexible pricing plans tailored to different business needs, including those specifically using paylocity tax forms. You can choose from monthly or annual subscriptions, with features that scale according to your company's size and requirements. Additionally, there are often promotions for new customers.

-

Can I customize paylocity tax forms within airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize paylocity tax forms to fit their specific business requirements. You can add branding, modify fields, and adjust layouts to enhance the document's appearance and ensure it meets compliance standards before sending it out for signatures.

-

What are the security features for managing paylocity tax forms with airSlate SignNow?

airSlate SignNow prioritizes security and offers advanced features to protect your paylocity tax forms. Documents are encrypted, and access controls ensure that only authorized personnel can view or edit sensitive information. This provides peace of mind while handling personal employee data.

-

How quickly can I get my paylocity tax forms signed using airSlate SignNow?

With airSlate SignNow, you can get your paylocity tax forms signed within minutes. The platform sends instant notifications to recipients, enabling a quick turnaround for signatures. This efficiency is crucial, especially during tax season when timely document processing is essential.

Get more for Request To Add Or Remove Tax Codes Paylocity

Find out other Request To Add Or Remove Tax Codes Paylocity

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will