Employee Form

What is the Employee Form

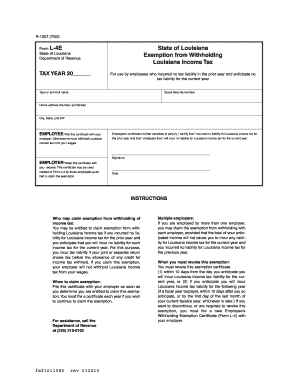

The Employee Form, often referred to in contexts involving tax withholding, is a document that allows employers to gather necessary information from employees to calculate the appropriate amount of federal income tax to withhold from their paychecks. This form is crucial for ensuring compliance with IRS regulations and helps both employers and employees manage their tax obligations effectively. The R 1307 exempt designation on this form indicates that an employee qualifies for exemption from withholding, meaning no federal income tax will be deducted from their wages.

How to use the Employee Form

Utilizing the Employee Form effectively involves a few straightforward steps. First, employees should accurately fill out their personal information, including their name, address, and Social Security number. Next, they should indicate their filing status and any exemptions they may claim, including the R 1307 exempt status if applicable. Once completed, the form should be submitted to the employer, who will use the information to determine the correct withholding amount. It is essential for employees to review their form periodically, especially if their financial situation changes.

Steps to complete the Employee Form

Completing the Employee Form involves several key steps:

- Begin by entering your personal details, such as your full name and Social Security number.

- Select your filing status, which can affect your tax withholding.

- If you qualify for the R 1307 exempt status, ensure that you indicate this clearly on the form.

- Review the form for accuracy before submission to avoid any issues with tax withholding.

- Submit the completed form to your employer for processing.

Legal use of the Employee Form

The Employee Form must be completed in accordance with IRS regulations to ensure its legal validity. When an employee claims R 1307 exempt, they must meet specific criteria set forth by the IRS, which typically includes not having a tax liability in the previous year and expecting none in the current year. Employers are responsible for verifying the information provided and ensuring that proper procedures are followed to maintain compliance with tax laws. Failure to adhere to these legal requirements can result in penalties for both the employee and employer.

IRS Guidelines

IRS guidelines outline the requirements for completing the Employee Form, including the necessary information needed to determine withholding amounts. Employees should familiarize themselves with these guidelines to ensure accuracy. The IRS provides detailed instructions on how to claim exemptions, including the R 1307 exempt status, which can significantly impact an employee's take-home pay. Understanding these guidelines is essential for proper tax planning and compliance.

Filing Deadlines / Important Dates

Staying aware of filing deadlines is crucial for both employees and employers. The Employee Form should be submitted to the employer as soon as employment begins or when there are changes in tax status. Important dates include the start of the tax year, typically January first, and any deadlines for submitting updated forms throughout the year. Employers must also be mindful of deadlines for submitting tax payments to the IRS based on the information provided in the Employee Form.

Quick guide on how to complete employee form 12394793

Effortlessly Prepare Employee Form on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly without any delays. Handle Employee Form on any platform with the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to Modify and Electronically Sign Employee Form with Ease

- Obtain Employee Form and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal status as a conventional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Employee Form and ensure seamless communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the employee form 12394793

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does 'r 1307 exempt' mean in the context of document signing?

The term 'r 1307 exempt' refers to specific regulations regarding exempt businesses and their document signing requirements. These exemptions can simplify the eSignature process when using services like airSlate SignNow for compliant document management. Understanding these regulations ensures your business adheres to legal standards while utilizing electronic signatures.

-

How can airSlate SignNow help businesses that are r 1307 exempt?

For businesses classified as r 1307 exempt, airSlate SignNow offers tailored solutions that streamline document workflows without the added complexities of specific regulations. Our platform ensures compliance while providing an easy-to-use interface for sending and signing documents electronically. This way, you can focus on your core business activities.

-

Are there any costs associated with using airSlate SignNow for r 1307 exempt documents?

airSlate SignNow offers competitive pricing plans that cater to all types of businesses, including those dealing with r 1307 exempt documents. Our pricing structure is transparent and designed to be cost-effective, ensuring that you only pay for the features and capabilities you need. You can choose a plan that aligns with your business needs without hidden fees.

-

What are the key features of airSlate SignNow for r 1307 exempt transactions?

Key features of airSlate SignNow for handling r 1307 exempt transactions include robust eSignature capabilities, customizable templates, and secure document storage. These features ensure that your signing processes are not only efficient but also adhere to relevant regulations. Additionally, our platform provides real-time tracking and reporting.

-

Is airSlate SignNow easy to integrate with existing systems for r 1307 exempt businesses?

Yes, airSlate SignNow is designed for seamless integration with a variety of existing business systems, including CRM and project management tools. This allows r 1307 exempt businesses to adopt electronic signing without disruptions. Our API and integrations facilitate a smoother transition to digital document management.

-

What benefits can r 1307 exempt organizations expect from using airSlate SignNow?

Organizations that are r 1307 exempt will benefit from increased efficiency, reduced paperwork, and improved compliance with document management practices. By using airSlate SignNow, businesses can accelerate their signing processes, enhance security, and save on operational costs. This translates to better overall productivity.

-

Can airSlate SignNow assist with tracking documents related to r 1307 exempt processes?

Absolutely! airSlate SignNow includes advanced tracking features that allow r 1307 exempt businesses to monitor the status of their documents in real-time. You will receive notifications and updates when documents are viewed, signed, or completed, ensuring you stay informed throughout the process.

Get more for Employee Form

Find out other Employee Form

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA