NOTICE of ALLOWANCE and FEES DUE Uspto Form

What is the notice of allowance and fees due USPTO?

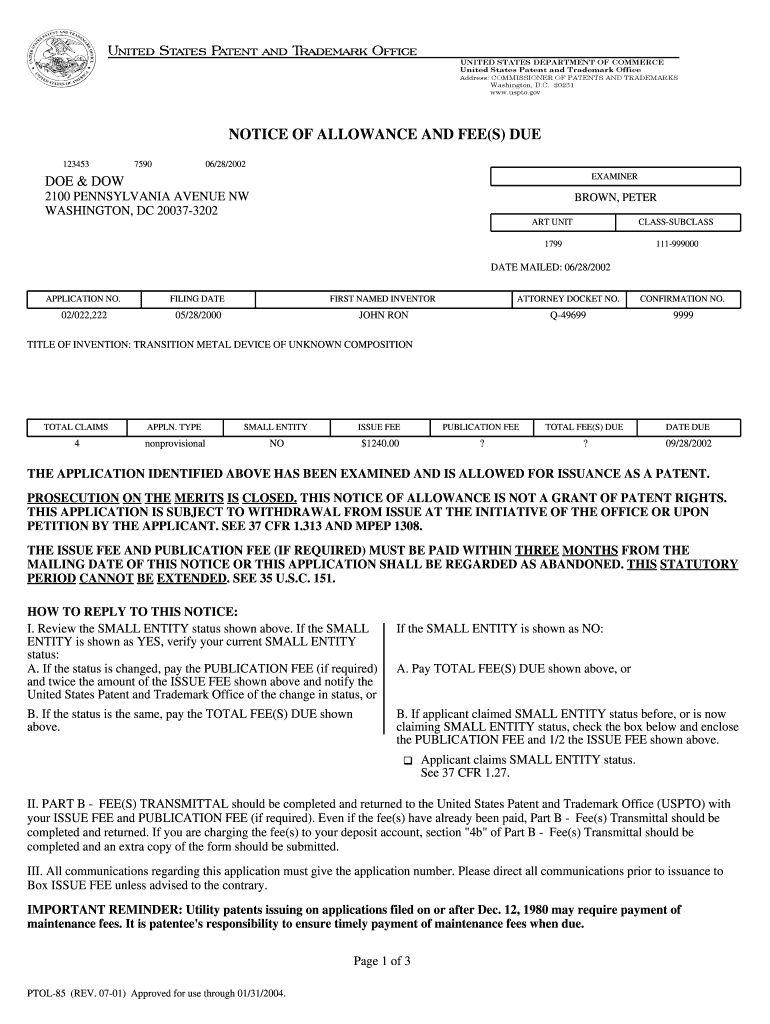

The notice of allowance and fees due USPTO is an important document issued by the United States Patent and Trademark Office (USPTO). It signifies that a patent application has successfully passed the examination process and is ready for the applicant to pay the required fees to obtain the patent. This notice outlines the specific fees due and provides a timeline for payment, ensuring that applicants are informed of their next steps in the patenting process.

How to obtain the notice of allowance and fees due USPTO

To obtain the notice of allowance and fees due from the USPTO, applicants typically receive it through the Electronic Filing System (EFS-Web). After the examination process is complete, the USPTO will send the notice electronically to the applicant's registered email address. It is essential for applicants to ensure their contact information is up to date in the USPTO system to avoid missing this critical document.

Steps to complete the notice of allowance and fees due USPTO

Completing the notice of allowance and fees due involves several key steps:

- Review the notice carefully to understand the fees and deadlines.

- Gather necessary documents and information to support the payment.

- Access the USPTO’s payment portal through EFS-Web.

- Input the required payment information and submit the payment.

- Keep a copy of the payment confirmation for your records.

Legal use of the notice of allowance and fees due USPTO

The notice of allowance and fees due serves as a legally binding document in the patent application process. It confirms that the USPTO has found the application to meet all necessary criteria for patentability. Paying the fees outlined in the notice is crucial for securing patent rights, and failure to do so within the specified timeframe can result in the abandonment of the application.

Key elements of the notice of allowance and fees due USPTO

Key elements of the notice include:

- The application number and title.

- A detailed breakdown of the fees due.

- The deadline for fee payment.

- Instructions for submitting payments electronically.

- Contact information for any questions regarding the notice.

Form submission methods for the notice of allowance and fees due USPTO

Applicants can submit the notice of allowance and fees due through various methods:

- Online via the USPTO’s Electronic Filing System (EFS-Web).

- By mail, though this method may delay processing times.

- In-person at designated USPTO offices, if necessary.

Quick guide on how to complete can i get notice for allowance via efs web

Complete can i get notice for allowance via efs web seamlessly on any device

Digital document management has become increasingly popular with businesses and individuals alike. It offers a perfect eco-friendly option to traditional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly without hold-ups. Handle can i get notice for allowance via efs web on any device with airSlate SignNow's Android or iOS applications, and simplify any document-related process today.

The easiest way to modify and electronically sign notice of allowance with ease

- Obtain can i get notice for allowance via efs web and click on Get Form to initiate.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or hide sensitive information using tools that airSlate SignNow supplies specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign notice of allowance and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs notice of allowance

-

Can I print a notice of intent form to homeschool in Nevada, fill it out, and turn it in?

It's best to ask homeschoolers in your state. Every state has different laws. What works in one may not work in another.This looks like the information you need: Notice of Intent (NOI)

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

-

How do very mixed race people fill out official documents and forms that ask for race if one is only allowed to choose one race?

None of the above?

-

My husband of 30 years passed a few weeks ago and he had some pay due to him. His employer said I need to fill out a W-9 Trustee form. Any advice or guidance at this difficult time will help?

I’m assuming that your husband had a minimal estate plan. If he had an estate plan/will, the lawyer that he used should give you a free consult.Once a person dies, their SSN goes away. If your husband has a will, it will name an executor. If he died without a will (“intestate,”) state law will determine the executor. In either case you will need to go to court to get an executor approved.The executor files the W-9. My wife is an executor for her aunt. I was an executor for my mom. We were both named in wills. We both filed the W-9 before obtaining official court blessing.You should check with your county court house. In MI and NC it’s the Probate Court. In MD it’s the Orphans’ Court. They can help you. Many states have streamlined probate procedures, and you might not need a lawyer. If they tell you that you need a lawyer, you should talk to at least two. They should give you a free consutation.

Related searches to can i get notice for allowance via efs web

Create this form in 5 minutes!

How to create an eSignature for the notice of allowance

How to generate an electronic signature for your Notice Of Allowance And Fees Due Uspto in the online mode

How to make an electronic signature for the Notice Of Allowance And Fees Due Uspto in Google Chrome

How to make an electronic signature for signing the Notice Of Allowance And Fees Due Uspto in Gmail

How to create an eSignature for the Notice Of Allowance And Fees Due Uspto right from your smartphone

How to make an electronic signature for the Notice Of Allowance And Fees Due Uspto on iOS devices

How to create an eSignature for the Notice Of Allowance And Fees Due Uspto on Android devices

People also ask notice of allowance

-

Can I get notice for allowance via efs web?

Yes, you can get notice for allowance via efs web. This process allows users to receive timely notifications about their allowance status, ensuring they stay informed about important updates.

-

What features does airSlate SignNow offer regarding efs web notifications?

AirSlate SignNow provides features that enable users to set up automatic notifications, including updates on allowance applications. With our efs web integration, you can efficiently manage and track your documents with instant alerts.

-

Is there a cost associated with receiving notices for allowance via efs web?

There is no additional cost associated with receiving notices for allowance via efs web when you use airSlate SignNow. Our pricing is designed to be transparent and inclusive of all key features, ensuring you have access to essential notifications without hidden fees.

-

How can airSlate SignNow help me streamline my allowance application process?

AirSlate SignNow streamlines your allowance application process by incorporating efs web capabilities, which allow for quick submissions and receiving notices without delays. This efficient workflow saves time and reduces paperwork, making it easier for clients to manage their applications.

-

Does airSlate SignNow integrate with other applications to enhance the efs web experience?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing the efs web experience by ensuring all necessary documents are easily accessible. This integration supports improved communication and collaboration across your team.

-

What benefits can I expect from using airSlate SignNow for efs web notices?

By using airSlate SignNow for efs web notices, you can expect improved efficiency and organization in your allowance management process. The platform allows for real-time updates, ensures compliance, and streamlines document workflows, signNowly enhancing productivity.

-

Can I customize my notification settings for allowance via efs web?

Absolutely, you can customize your notification settings for receiving allowance updates via efs web with airSlate SignNow. This feature allows you to choose how and when you receive notifications, ensuring you are always informed according to your preferences.

Get more for can i get notice for allowance via efs web

Find out other notice of allowance

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy