Notice to New Tax Division Individuals Affected by Confidential Justice Form

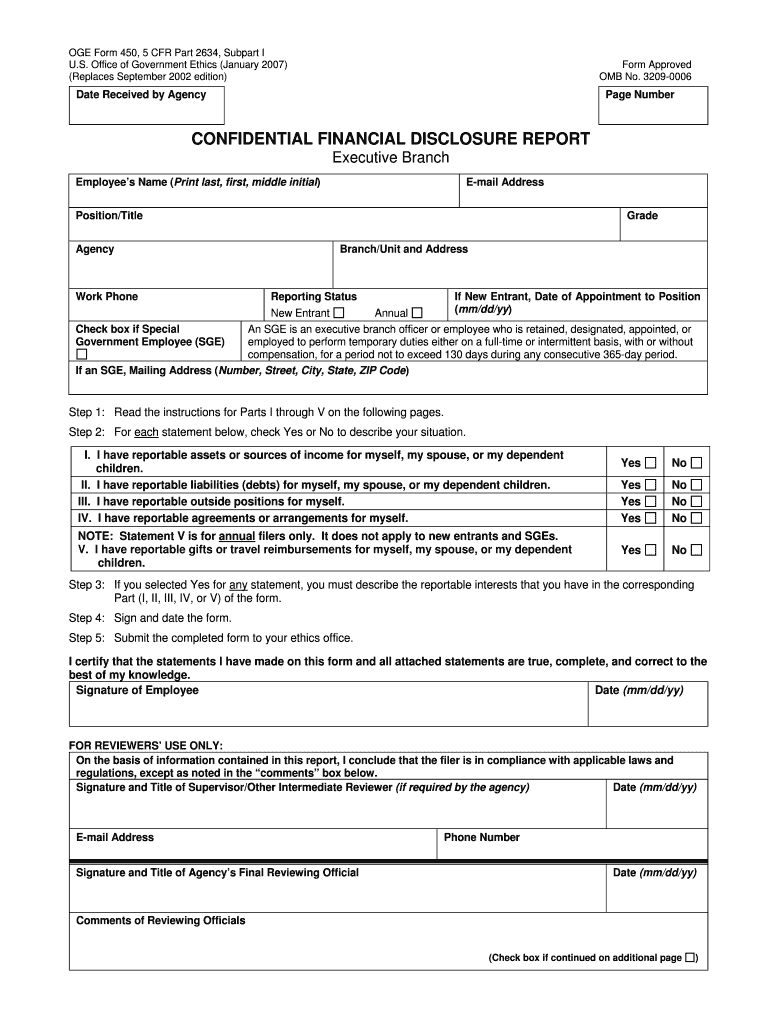

What is the Notice To New Tax Division Individuals Affected By Confidential Justice

The Notice To New Tax Division Individuals Affected By Confidential Justice is an official document that informs individuals about their rights and responsibilities under specific legal circumstances. It is particularly relevant for those who may be impacted by confidential justice matters, ensuring they understand the implications for their tax obligations. This notice serves as a crucial communication tool from the tax division, providing clarity on how these legal issues may affect their financial standing and tax filings.

Steps to complete the Notice To New Tax Division Individuals Affected By Confidential Justice

Completing the Notice To New Tax Division Individuals Affected By Confidential Justice involves several key steps to ensure accuracy and compliance. First, individuals should carefully read the notice to understand its contents fully. Next, gather all necessary documentation that may be required, such as identification and any relevant tax records. When filling out the form, ensure that all information is accurate and complete. After completing the form, review it for any errors before submission. Finally, retain a copy of the completed notice for personal records.

Legal use of the Notice To New Tax Division Individuals Affected By Confidential Justice

The legal use of the Notice To New Tax Division Individuals Affected By Confidential Justice is essential for ensuring compliance with tax laws. This document acts as a formal acknowledgment of any confidential justice issues that may influence an individual's tax situation. Properly completing and submitting this notice can help prevent legal complications and ensure that individuals meet their tax obligations. It is important to follow all legal guidelines associated with this notice to maintain its validity and effectiveness.

Key elements of the Notice To New Tax Division Individuals Affected By Confidential Justice

Key elements of the Notice To New Tax Division Individuals Affected By Confidential Justice include the individual's personal information, a detailed description of the confidential justice matter, and any specific instructions related to tax obligations. Additionally, the notice may outline deadlines for responses or actions required by the individual. Understanding these elements is crucial for effective communication with the tax division and ensuring compliance with legal requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Notice To New Tax Division Individuals Affected By Confidential Justice are critical to avoid penalties and ensure compliance. Individuals must be aware of specific dates by which the notice must be submitted, as well as any related deadlines for additional documentation or responses. Keeping a calendar of these important dates can help individuals stay organized and ensure they meet all necessary requirements in a timely manner.

Who Issues the Form

The Notice To New Tax Division Individuals Affected By Confidential Justice is typically issued by the relevant tax authority or division within the government. This could include federal, state, or local tax agencies, depending on the jurisdiction and the nature of the confidential justice matter. Understanding the issuing authority helps individuals know where to direct questions or concerns regarding the notice.

Quick guide on how to complete notice to new tax division individuals affected by confidential justice

Complete [SKS] effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely preserve it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to submit your form, whether via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from your chosen device. Modify and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Notice To New Tax Division Individuals Affected By Confidential Justice

Create this form in 5 minutes!

How to create an eSignature for the notice to new tax division individuals affected by confidential justice

How to create an electronic signature for your Notice To New Tax Division Individuals Affected By Confidential Justice in the online mode

How to create an electronic signature for your Notice To New Tax Division Individuals Affected By Confidential Justice in Chrome

How to generate an electronic signature for putting it on the Notice To New Tax Division Individuals Affected By Confidential Justice in Gmail

How to generate an eSignature for the Notice To New Tax Division Individuals Affected By Confidential Justice straight from your mobile device

How to make an eSignature for the Notice To New Tax Division Individuals Affected By Confidential Justice on iOS devices

How to create an eSignature for the Notice To New Tax Division Individuals Affected By Confidential Justice on Android OS

People also ask

-

What is the 'Notice To New Tax Division Individuals Affected By Confidential Justice'?

The 'Notice To New Tax Division Individuals Affected By Confidential Justice' is a formal communication directed towards individuals involved in legal matters handled by the new tax division. This notice outlines the rights and resources available to those affected, ensuring transparency and clarity in the process.

-

How can airSlate SignNow assist with the 'Notice To New Tax Division Individuals Affected By Confidential Justice'?

airSlate SignNow provides an intuitive platform for sending and eSigning official documents related to the 'Notice To New Tax Division Individuals Affected By Confidential Justice'. This makes it easy for affected individuals to receive, review, and respond to these notices securely and efficiently.

-

What features are included with airSlate SignNow for handling legal notices?

airSlate SignNow offers features such as customizable templates, secure eSigning, automatic reminders, and audit trails. These functionalities ensure that your handling of the 'Notice To New Tax Division Individuals Affected By Confidential Justice' is both efficient and legally compliant.

-

Is airSlate SignNow a cost-effective solution for managing tax division notices?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing documents such as the 'Notice To New Tax Division Individuals Affected By Confidential Justice'. With various pricing plans, businesses can select one that fits their budget while still accessing all essential features.

-

Can I integrate airSlate SignNow with other tools I currently use?

Absolutely! airSlate SignNow offers seamless integrations with various tools and platforms, enhancing your ability to manage the 'Notice To New Tax Division Individuals Affected By Confidential Justice'. This includes CRM systems, cloud storage services, and more.

-

How does eSigning work with airSlate SignNow for legal documents?

eSigning with airSlate SignNow is simple and secure. Users can easily sign documents related to the 'Notice To New Tax Division Individuals Affected By Confidential Justice' electronically, ensuring that signatures are legally binding and easily verifiable through our audit trail feature.

-

What kind of support does airSlate SignNow offer for users dealing with notices?

Users dealing with the 'Notice To New Tax Division Individuals Affected By Confidential Justice' can rely on airSlate SignNow's comprehensive support options. We offer 24/7 customer support, detailed guides, and tutorials to ensure you get the most out of our platform.

Get more for Notice To New Tax Division Individuals Affected By Confidential Justice

Find out other Notice To New Tax Division Individuals Affected By Confidential Justice

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement