Satisfaction of Mortgage Form Florida

What is the satisfaction of mortgage form Florida

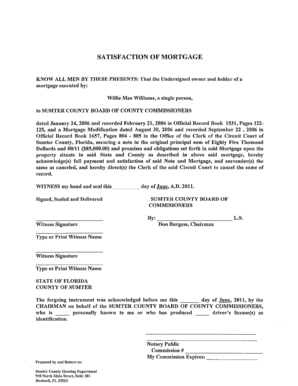

The satisfaction of mortgage form Florida is a legal document that indicates a mortgage has been paid off in full. This form is crucial for both lenders and borrowers as it formally releases the borrower from the mortgage obligation. Once completed and filed, it serves as proof that the lender no longer has a claim against the property, allowing the borrower to clear their title. This document is essential for any homeowner looking to sell or refinance their property after paying off their mortgage.

How to use the satisfaction of mortgage form Florida

Using the satisfaction of mortgage form Florida involves several steps to ensure it is completed correctly. First, the borrower must obtain the form, which can typically be found through county clerk offices or online resources. Once acquired, the borrower fills out the necessary information, including details about the mortgage, the lender, and the property. After completion, the form must be signed by the lender, who verifies that the mortgage has been satisfied. Finally, the signed form should be filed with the appropriate county office to make the satisfaction official.

Steps to complete the satisfaction of mortgage form Florida

Completing the satisfaction of mortgage form Florida requires careful attention to detail. Follow these steps:

- Obtain the satisfaction of mortgage form from a reliable source.

- Fill in the borrower’s name, lender’s name, mortgage details, and property information accurately.

- Ensure the lender signs the form to validate the satisfaction of the mortgage.

- Make copies of the completed form for personal records.

- Submit the signed form to the county clerk's office where the mortgage was originally recorded.

Legal use of the satisfaction of mortgage form Florida

The legal use of the satisfaction of mortgage form Florida is governed by state laws. This document must be executed according to Florida statutes to be considered valid. It is important to ensure that all required information is accurately provided and that it is signed by the appropriate parties. Failure to properly complete and file this form can result in complications regarding property ownership and title issues. Thus, understanding the legal implications is essential for both borrowers and lenders.

Key elements of the satisfaction of mortgage form Florida

Several key elements must be included in the satisfaction of mortgage form Florida to ensure its validity:

- The full name and address of the borrower.

- The full name and address of the lender.

- A description of the mortgage, including the date it was executed and the amount.

- A statement confirming that the mortgage has been paid in full.

- The signatures of both the borrower and the lender.

- The date of the signing.

How to obtain the satisfaction of mortgage form Florida

Obtaining the satisfaction of mortgage form Florida can be done through several avenues. Borrowers can visit their local county clerk's office, where the form is often available. Additionally, many counties provide downloadable versions of the form on their official websites. It is advisable to ensure that the version obtained is the most current and meets all state requirements. In some cases, legal professionals can also assist in procuring the form and ensuring its proper completion.

Quick guide on how to complete satisfaction of mortgage form florida

Complete Satisfaction Of Mortgage Form Florida effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents swiftly without delays. Manage Satisfaction Of Mortgage Form Florida on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Satisfaction Of Mortgage Form Florida seamlessly

- Find Satisfaction Of Mortgage Form Florida and click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Mark essential sections of the documents or censor sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and then click on the Done button to secure your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Satisfaction Of Mortgage Form Florida and guarantee exceptional communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the satisfaction of mortgage form florida

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a satisfaction of mortgage in Florida?

A satisfaction of mortgage in Florida is a legal document that confirms that a mortgage has been paid in full and that the lender no longer has any claim to the property. This document is important for property owners to ensure clear title and is typically recorded with the county's Clerk of Court.

-

How do I obtain a satisfaction of mortgage in Florida?

To obtain a satisfaction of mortgage in Florida, you need to request it from your lender after paying off the mortgage. Once your lender has issued the satisfaction document, it can be recorded with the county to affirm that the mortgage obligation has been fulfilled.

-

What are the fees associated with recording a satisfaction of mortgage in Florida?

The fees for recording a satisfaction of mortgage in Florida vary by county, typically ranging from $10 to $50. It's advisable to check with your local Clerk of Court for exact pricing to ensure you are prepared for any costs involved.

-

What features does airSlate SignNow offer for handling satisfaction of mortgage documents?

airSlate SignNow provides an easy-to-use platform that allows users to eSign and send satisfaction of mortgage documents securely. With automated workflows and document templates, you can manage the mortgage satisfaction process efficiently and seamlessly streamline your document management.

-

How does airSlate SignNow improve the eSigning process for a satisfaction of mortgage in Florida?

airSlate SignNow enhances the eSigning process for satisfaction of mortgage documents in Florida by offering fast, secure, and legally binding electronic signatures. This boosts efficiency by minimizing paperwork and reducing the time it takes to finalize and record important mortgage documents.

-

Is airSlate SignNow compliant with Florida's electronic signature laws?

Yes, airSlate SignNow complies with Florida's electronic signature laws, ensuring that electronic signatures on satisfaction of mortgage documents are valid and enforceable. This compliance gives users the peace of mind that their eSigned documents meet legal standards.

-

What are the benefits of using airSlate SignNow for satisfaction of mortgage documents?

Using airSlate SignNow for satisfaction of mortgage documents provides numerous benefits, including faster processing times, improved document security, and reduced administrative costs. Additionally, it allows users to easily manage multiple transactions in one platform, simplifying the overall process.

Get more for Satisfaction Of Mortgage Form Florida

- Associate degree nursing program student handbook 2019 2020 academic year form

- Student name student id b0 form

- 2018 2019 verification work sheet v1 form

- New preferred first name policycal lutheran registrar form

- Please complete sign and return this form via mail fax or e mail at least 4 business days before the date of the

- Employee tuition waiver request radford university form

- Policy motor vehicle record form

- Declaration honors form

Find out other Satisfaction Of Mortgage Form Florida

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form