Bi Weekly Payroll Form

What is the Bi Weekly Payroll

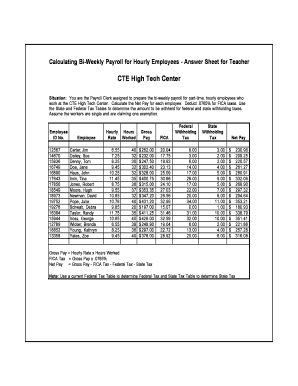

The bi weekly payroll is a payment schedule where employees receive their wages every two weeks. This system is commonly used for hourly employees, allowing for consistent and predictable pay periods. Each pay period typically consists of fourteen days, and employees receive their earnings based on the hours worked during that time. This approach helps employers manage payroll processing efficiently while providing employees with regular income.

How to Use the Bi Weekly Payroll

Using a bi weekly payroll system involves several steps. First, employers must determine the pay period and ensure that all hours worked by hourly employees are accurately recorded. Next, the payroll department calculates the total wages due by multiplying the hours worked by the employee's hourly rate. After calculating the total, employers must ensure that all deductions, such as taxes and benefits, are applied correctly before issuing payment. Finally, employees receive their paychecks or direct deposits based on the established schedule.

Steps to Complete the Bi Weekly Payroll

Completing the bi weekly payroll involves a series of organized steps:

- Track employee hours: Ensure all hours worked are logged accurately.

- Calculate gross pay: Multiply the total hours worked by the employee's hourly wage.

- Apply deductions: Subtract applicable taxes and benefits from the gross pay.

- Issue payments: Distribute paychecks or process direct deposits according to the payroll schedule.

- Maintain records: Keep detailed records of payroll transactions for compliance and auditing purposes.

Legal Use of the Bi Weekly Payroll

For a bi weekly payroll to be legally valid, it must comply with federal and state labor laws. Employers are required to pay employees for all hours worked and adhere to minimum wage laws. Additionally, accurate record-keeping is essential for compliance with tax regulations. Employers must also provide employees with a pay stub that outlines their earnings and deductions. Using a reliable electronic signature solution can help ensure that payroll documents are executed legally and securely.

Key Elements of the Bi Weekly Payroll

Several key elements are essential for an effective bi weekly payroll system:

- Accurate timekeeping: Implement a reliable method for tracking employee hours.

- Clear communication: Inform employees about pay periods and any changes in payroll policies.

- Compliance: Stay updated on labor laws and tax regulations to avoid penalties.

- Efficient processing: Use payroll software to streamline calculations and payments.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines that govern payroll practices, including tax withholding and reporting requirements. Employers must ensure they withhold the correct amount of federal income tax, Social Security, and Medicare taxes from employee wages. Additionally, employers are required to report payroll information on forms such as the W-2 and 941. Understanding these guidelines is crucial for maintaining compliance and avoiding potential fines.

Quick guide on how to complete bi weekly payroll

Complete Bi Weekly Payroll seamlessly on any device

Online document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can quickly locate the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents promptly without delays. Manage Bi Weekly Payroll on any device with the airSlate SignNow Android or iOS applications and enhance any document-centered process today.

The easiest way to modify and eSign Bi Weekly Payroll effortlessly

- Locate Bi Weekly Payroll and click on Get Form to begin.

- Make use of the tools we offer to finalize your form.

- Emphasize relevant portions of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose your preferred method to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow manages all your document administration requirements in just a few clicks from your chosen device. Modify and eSign Bi Weekly Payroll and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bi weekly payroll

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is bi weekly payroll for hourly employees?

Bi weekly payroll for hourly employees is a payroll schedule that pays employees every two weeks. This system benefits businesses by streamlining payroll processes and providing consistent pay periods for employees, which increases financial predictability. Understanding the specifics of bi weekly payroll for hourly employees answers can help businesses manage their payroll efficiently.

-

How does airSlate SignNow support bi weekly payroll for hourly employees?

AirSlate SignNow simplifies the payroll process by allowing businesses to easily send and eSign the necessary payroll documents. This not only saves time but also helps ensure compliance and accuracy in payroll handling. Utilizing airSlate SignNow for bi weekly payroll for hourly employees answers promotes a seamless experience for payroll management.

-

What are the benefits of using airSlate SignNow for payroll-related documents?

Using airSlate SignNow for payroll-related documents streamlines the signing and approval process, reduces paperwork, and enhances document security. The eSigning features offer businesses flexibility while ensuring compliance with digital signatures. Exploring the benefits through bi weekly payroll for hourly employees answers can clarify how this solution addresses your payroll needs effectively.

-

Are there any integrations available with airSlate SignNow for payroll systems?

Yes, airSlate SignNow offers integrations with various payroll systems such as ADP and QuickBooks, allowing for a more cohesive payroll process. These integrations enable users to transfer data seamlessly and maintain updated records efficiently. Finding out more through bi weekly payroll for hourly employees answers will enhance your understanding of these valuable integrations.

-

How secure is airSlate SignNow for handling payroll documents?

AirSlate SignNow employs advanced encryption and security features to protect sensitive payroll documents. This includes compliance with various data protection regulations ensuring that your payroll information remains confidential. For thorough insights, refer to bi weekly payroll for hourly employees answers on security measures.

-

What pricing plans does airSlate SignNow offer for businesses?

AirSlate SignNow offers flexible pricing plans suitable for businesses of all sizes, starting with a free trial and various monthly subscription options. This allows businesses to choose a plan that aligns with their specific needs while ensuring they have access to all necessary features for payroll. You can find a detailed breakdown in bi weekly payroll for hourly employees answers.

-

How does the eSigning process work for payroll documents?

The eSigning process with airSlate SignNow is simple: users upload the payroll document, specify who needs to sign, and send it out for signatures. Once the involved parties sign, they receive a notification, and the document is saved securely. Understanding this process helps clarify the efficiency outlined in bi weekly payroll for hourly employees answers.

Get more for Bi Weekly Payroll

- Personal financial statement first community bank and trust form

- Software development partnership agreement form

- Event photography contract jimmy mcdonald photography form

- Printable photo booth contract form

- North carolina service animal verification form

- Westside regional center intake application form

- Af oc 01pdf form

- Accuro forms

Find out other Bi Weekly Payroll

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast