PLAN of CONNECTICUT INC POOLED TRUST a POOLED TRUST for Planofct Form

What is the PLAN OF CONNECTICUT INC POOLED TRUST A POOLED TRUST FOR Planofct

The PLAN OF CONNECTICUT INC POOLED TRUST A POOLED TRUST FOR Planofct is a specialized financial instrument designed to manage and protect the assets of individuals with disabilities or special needs. This pooled trust allows multiple beneficiaries to share resources while maintaining eligibility for government benefits such as Medicaid and Supplemental Security Income (SSI). By pooling funds, the trust can provide a higher level of investment management and reduce administrative costs, making it a beneficial option for families seeking to ensure their loved ones' financial security.

How to use the PLAN OF CONNECTICUT INC POOLED TRUST A POOLED TRUST FOR Planofct

Using the PLAN OF CONNECTICUT INC POOLED TRUST involves several straightforward steps. First, individuals or their guardians must complete the necessary application forms to enroll in the trust. Once enrolled, beneficiaries can deposit funds into the pooled trust account. The trust then manages these funds, ensuring they are used for the beneficiary's needs while complying with legal requirements. It is crucial to keep records of all transactions and distributions to maintain transparency and accountability.

Steps to complete the PLAN OF CONNECTICUT INC POOLED TRUST A POOLED TRUST FOR Planofct

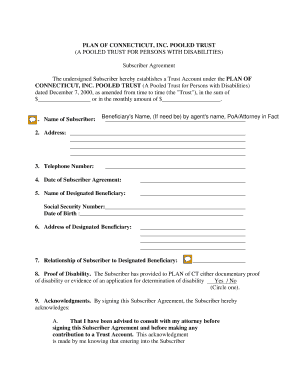

Completing the PLAN OF CONNECTICUT INC POOLED TRUST requires careful attention to detail. The steps include:

- Gather necessary documentation, including identification and proof of disability.

- Complete the application form accurately, ensuring all required fields are filled.

- Submit the application to the trust administrator for review.

- Once approved, fund the trust account with the desired amount.

- Maintain ongoing communication with the trust administrator regarding distributions and account management.

Legal use of the PLAN OF CONNECTICUT INC POOLED TRUST A POOLED TRUST FOR Planofct

The legal use of the PLAN OF CONNECTICUT INC POOLED TRUST is governed by state and federal laws that protect the rights of individuals with disabilities. This trust structure complies with the requirements set forth in the Omnibus Budget Reconciliation Act, which allows for the preservation of government benefits while providing additional financial support. It is essential for trustees and beneficiaries to understand these legal frameworks to ensure proper management and utilization of trust assets.

Key elements of the PLAN OF CONNECTICUT INC POOLED TRUST A POOLED TRUST FOR Planofct

Key elements of the PLAN OF CONNECTICUT INC POOLED TRUST include:

- Beneficiary Eligibility: Individuals with disabilities or special needs.

- Pooling of Resources: Funds from multiple beneficiaries are combined for investment purposes.

- Trustee Management: A designated trustee oversees the trust, ensuring compliance and proper fund allocation.

- Government Benefit Protection: The trust structure helps maintain eligibility for essential benefits.

State-specific rules for the PLAN OF CONNECTICUT INC POOLED TRUST A POOLED TRUST FOR Planofct

State-specific rules for the PLAN OF CONNECTICUT INC POOLED TRUST may vary, reflecting local regulations and policies regarding pooled trusts. In Connecticut, the trust must adhere to specific guidelines outlined by the state’s Department of Social Services. These rules typically address eligibility criteria, allowable expenditures, and reporting requirements. It is advisable for participants to consult with legal experts familiar with Connecticut's regulations to ensure compliance and optimal use of the trust.

Quick guide on how to complete plan of connecticut inc pooled trust a pooled trust for planofct

Prepare PLAN OF CONNECTICUT INC POOLED TRUST A POOLED TRUST FOR Planofct effortlessly on any device

Online document handling has become increasingly favored by businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, alter, and electronically sign your documents swiftly without delays. Manage PLAN OF CONNECTICUT INC POOLED TRUST A POOLED TRUST FOR Planofct on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign PLAN OF CONNECTICUT INC POOLED TRUST A POOLED TRUST FOR Planofct with ease

- Find PLAN OF CONNECTICUT INC POOLED TRUST A POOLED TRUST FOR Planofct and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to share your form—via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing out new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any chosen device. Edit and electronically sign PLAN OF CONNECTICUT INC POOLED TRUST A POOLED TRUST FOR Planofct and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the plan of connecticut inc pooled trust a pooled trust for planofct

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PLAN OF CONNECTICUT INC POOLED TRUST A POOLED TRUST FOR Planofct?

The PLAN OF CONNECTICUT INC POOLED TRUST A POOLED TRUST FOR Planofct is designed to provide a vehicle for individuals to save for their future without jeopardizing their eligibility for government assistance. This pooled trust offers financial protection while allowing participants to benefit from the pooled resources.

-

How does the PLAN OF CONNECTICUT INC POOLED TRUST A POOLED TRUST FOR Planofct work?

Participants in the PLAN OF CONNECTICUT INC POOLED TRUST A POOLED TRUST FOR Planofct contribute their funds, which are then pooled together with other members for investment and management. This structure not only ensures professional oversight but also maximizes the growth potential of the funds while maintaining compliance with various regulations.

-

What are the benefits of enrolling in the PLAN OF CONNECTICUT INC POOLED TRUST A POOLED TRUST FOR Planofct?

By enrolling in the PLAN OF CONNECTICUT INC POOLED TRUST A POOLED TRUST FOR Planofct, individuals gain access to financial management services that protect their assets while allowing them to remain eligible for benefits. Furthermore, pooled trusts often have lower administrative costs, making them a more efficient option for trust management.

-

What is the cost associated with the PLAN OF CONNECTICUT INC POOLED TRUST A POOLED TRUST FOR Planofct?

The costs for the PLAN OF CONNECTICUT INC POOLED TRUST A POOLED TRUST FOR Planofct vary depending on the specific services required. Typically, participants can expect to pay a modest setup fee and ongoing management fees that are competitive within the industry, ensuring affordability for all clients.

-

Is the PLAN OF CONNECTICUT INC POOLED TRUST A POOLED TRUST FOR Planofct suitable for everyone?

While the PLAN OF CONNECTICUT INC POOLED TRUST A POOLED TRUST FOR Planofct is particularly beneficial for individuals with disabilities or those seeking to protect their government benefits, it can also serve anyone looking for a secure way to manage their assets. It is advisable to consult with a financial advisor to determine individual suitability.

-

Can I access my funds in the PLAN OF CONNECTICUT INC POOLED TRUST A POOLED TRUST FOR Planofct?

Yes, participants can access their funds in the PLAN OF CONNECTICUT INC POOLED TRUST A POOLED TRUST FOR Planofct under specific conditions. Withdrawals can be made for approved expenses related to the beneficiary’s needs, ensuring that the funds are used in compliance with trust guidelines.

-

What documents are needed to set up the PLAN OF CONNECTICUT INC POOLED TRUST A POOLED TRUST FOR Planofct?

To set up the PLAN OF CONNECTICUT INC POOLED TRUST A POOLED TRUST FOR Planofct, clients typically need to provide identification documents, proof of disability if applicable, and any legal documentation related to their financial situation. Ensuring accurate and complete paperwork can expedite the process.

Get more for PLAN OF CONNECTICUT INC POOLED TRUST A POOLED TRUST FOR Planofct

- Gc 141 order appointing temporary california courts form

- Prepare your inventories accountings and petitions to the form

- On demand court records form

- Fillable online courts ca gc 210ca guardianship petition form

- Detroit local news michigan news the detroit news form

- Innovative sports management inc dba integrated sports form

- Gc 250 attorney or party without attorney for court use form

- Orange county california forms

Find out other PLAN OF CONNECTICUT INC POOLED TRUST A POOLED TRUST FOR Planofct

- How To eSign West Virginia Termination Letter Template

- How To eSign Pennsylvania Independent Contractor Agreement Template

- eSignature Arkansas Affidavit of Heirship Secure

- How Can I eSign Alaska Emergency Contact Form

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online