Life Insurance Claim Form Employee and Retiree Benefits State Benefits Iowa

What is the Life Insurance Claim Form Employee and Retiree Benefits State Benefits Iowa

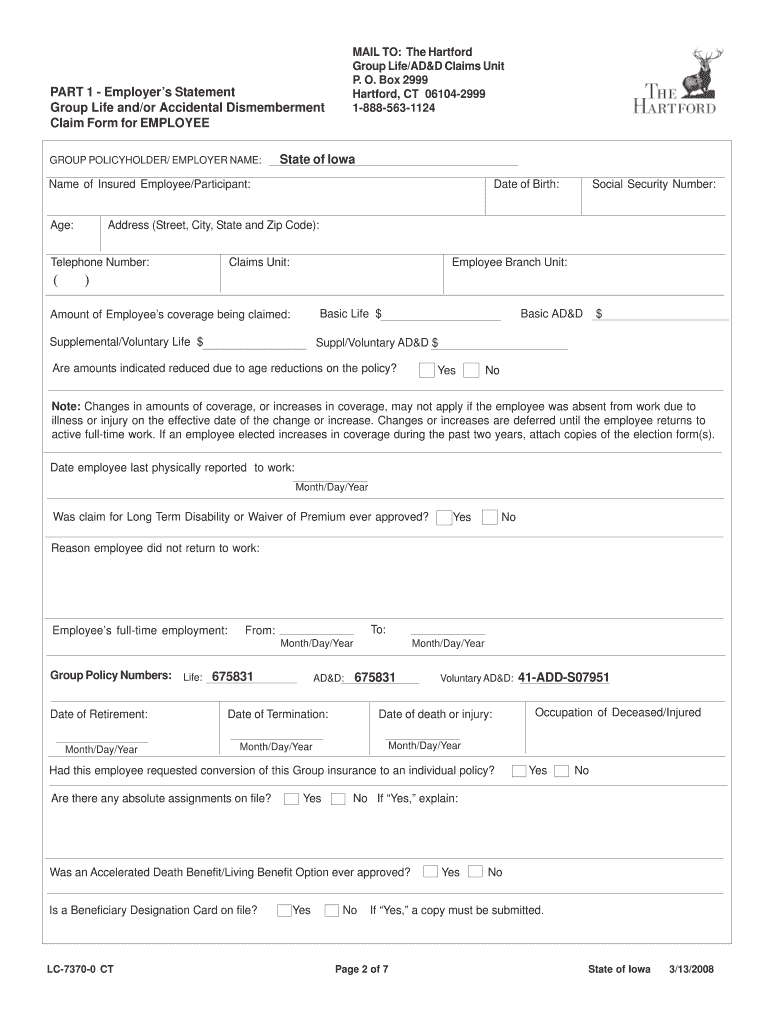

The Life Insurance Claim Form for Employee and Retiree Benefits in Iowa is a crucial document that enables beneficiaries to claim life insurance benefits upon the death of an insured individual. This form is specifically designed for employees and retirees who have group life insurance policies provided by their employer or state benefits. It outlines the necessary information required to process the claim, including details about the deceased, the policy, and the claimant's relationship to the insured.

How to use the Life Insurance Claim Form Employee and Retiree Benefits State Benefits Iowa

Using the Life Insurance Claim Form involves several steps to ensure that the claim is processed smoothly. First, gather all relevant information, including the policy number and personal identification details of both the insured and the claimant. Next, carefully fill out the form, ensuring that all sections are completed accurately. It is essential to provide any required supporting documents, such as a death certificate, to validate the claim. Finally, submit the completed form through the designated method, whether online, by mail, or in person, as specified by the insurance provider.

Steps to complete the Life Insurance Claim Form Employee and Retiree Benefits State Benefits Iowa

Completing the Life Insurance Claim Form requires attention to detail. Follow these steps:

- Obtain the form from your employer or the insurance provider's website.

- Read the instructions carefully to understand the requirements.

- Fill in the claimant's personal information, including name, address, and contact details.

- Provide information about the deceased, including full name, date of birth, and date of death.

- Include the policy number and any relevant details about the insurance coverage.

- Attach necessary documents, such as a certified death certificate.

- Review the form for accuracy before submission.

Legal use of the Life Insurance Claim Form Employee and Retiree Benefits State Benefits Iowa

The Life Insurance Claim Form is legally binding when completed and submitted correctly. To ensure its validity, it must meet specific legal requirements, such as being signed by the claimant and including all necessary documentation. Compliance with state laws and regulations is crucial, as these govern the processing of life insurance claims. Additionally, using a secure electronic signature solution can enhance the form's legitimacy and protect sensitive information during submission.

Required Documents for the Life Insurance Claim Form Employee and Retiree Benefits State Benefits Iowa

When submitting the Life Insurance Claim Form, certain documents are typically required to support the claim. These may include:

- A certified copy of the death certificate.

- The original life insurance policy or a copy, if available.

- Identification documents for the claimant, such as a driver's license or Social Security number.

- Any additional forms or documents requested by the insurance provider.

Form Submission Methods for the Life Insurance Claim Form Employee and Retiree Benefits State Benefits Iowa

The Life Insurance Claim Form can be submitted through various methods, depending on the insurance provider's guidelines. Common submission methods include:

- Online submission via the insurance provider's secure portal.

- Mailing the completed form and supporting documents to the designated address.

- In-person submission at the insurance company's local office or designated location.

Quick guide on how to complete life insurance claim form employee and retiree benefits state benefits iowa

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork since you can locate the necessary template and safely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The Easiest Method to Modify and Electronically Sign [SKS] with Ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and holds the same legal value as a conventional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Alter and electronically sign [SKS] and ensure outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

If an insured parent dies without filling out a beneficiary form and the will is silent on the insurance proceeds, to whom do the benefits go to? Does the situation need go to probate court?

A policy in the United States cannot and should not be issued without a beneficiary. It is a legal requirement that 1) impedes speculation in human life and 2) reduces the likelihood/incidence of Stranger Originated Life Insurance (a.k.a Stoli).So, what is the real situation here? Are you saying a company actually issued coverage leaving that crucial part of the form blank?If so, depending on the size of the policy and the litigation costs that will ensue to straighten up the mess, you might consider legal action against the insurance company and/or the agent for dereliction of duty.One of the strengths of life insurance is its rapid provision of liquidity, which it accomplishes by paying proceeds according to contract as opposed to by Will or Trust. It's as simple as verifying the death, submitting the claim, and then a check gets cut from the insurance company to the beneficiary. Nothing needs to go through probate or the estate settlement process, which can take months.If this valuable convenience was lost due to a failure of the agent and/or the insurance company, I think legal action should be considered.

-

How much does the US governmental entities (I'll settle for Federal, but I'd like to find state and local as well) spend on an employee’s and a retiree’s health benefits?

How much does the US governmental entities (I'll settle for Federal, but I'd like to find state and local as well) spend on an employee’s and a retiree’s health benefits?depends on the coverage methodseveral replies on several systemsActual users on Medicare are at 15,000 per person per yearof the 60 million on medicare, 20 million use company / retired employee insurances instead

-

How can a widow find out if her husband was truly in the military and if she is due widow’s benefits? He took his own life, claiming to be a retired Major, USMC with 20 years service.

If your deceased husband (sorry for your loss) was actually in the USMC or any of the other military services and was discharged he will have a DD214 document. The DD214 is legal poof of his service. If you cannot locate this document, contact HQ USMC Washington DC. You will need his dates of service, SSN, rank, and MOS. They will direct you to the proper channel to pursue your inquiry. If HQ USMC doesn't have a record of his service then he probably didn't serve.Good Luck

-

I purchased a very large life insurance policy and named my niece as beneficiary. However, she declined to give me her Social Security number. How difficult will it be for her to claim benefits in the event of my demise?

Hey, if this is legit, just shoot me the insurance companies name and I’ll list myself ;) Other than that, it shouldn’t be excessively difficult. (depending on state) They’ll probably ask her for her birth certificate, state ID, and a certified copy of your death certificate. If there is any other information required, it should be listed in your insurance policy. Your insurance policy should also specify how the beneficiary gets paid out. If it’s a big concern to you, write it into your will/trust.

-

If your employer is considering adding a group term life insurance plan to the employee benefits package and the premium cost would be fully paid by the organization, then how will this impact the employees' net pay and the employer's payroll costs?

Employees do not have to pay taxes on life insurance that is provided and paid by the employer unless the amount of insurance provided is over $50,000.00. There is no effect on net pay because the premium isn’t taken out of the employee’s pay pre-tax . Likewise, the employer’s payroll costs do not increase.An employer can deduct life insurance as a business expense. But it isn’t advisable because beneficiaries then have to pay taxes on the life insurance monies received. The employer’s purpose in purchasing life insurance would be an interest in increasing benefits offfered to employees so that families have some financial protection when an employee dies. Most employers that offer health insurance also provide group term life insurance as it is relatively reasonably priced.Some employers also offer the option for employees to purchase additional term life insurance which can then be paid through payroll deduction on a pre-tax or post-tax basis. However, a word of caution - group term life insurance of more than $50,000.00 paid directly or indirectly by an employer is still taxable as income to the employee. Group Term Life InsuranceThe point of pre-tax deductions is to take money out of employee gross pay, before any taxes are withheld, to reduce taxable income. Pre-tax deductions also benefit the employer by reducing taxes paid. Pre-tax deductions for health insurance are especially beneficial with the high cost of premiums for employers and a portion of the premiums being passed onto employees - both employers and employees benefit. Pre-Tax Deductions vs. Post-Tax Deductions: What’s the Difference?

-

How does one go about getting coaching clients and filling a practice as a newly certified life coach, since coaches have no access to the benefit of insurance referrals?

Hi…My first thought is that if you haven't, please get a copy and read this book…The Prosperous Coach: Increase Income and Impact for You and Your Clients Amazon.com: The Prosperous Coach: Increase Income and Impact for You and Your Clients eBook: Steve Chandler, Rich Litvin: Kindle StoreMore than anything else, this book has helped me to build a thriving coaching practice.Chandler's philosophy on building a successful coaching practice is simple. Begin with service. Don't look for clients, look for people who you can serve. This may seem overly simplistic at first but therein lies its genius. People can always tell the difference between when you have something that you want verses when you have something to give. It took me a while to shift my mind in this direction. I thought I was doing it for a long time, but there was always a hidden agenda in my attempts to serve others and really all I was doing was trying to land a new client. It would drive me crazy when I would have this amazing initial conversation (or enrollment conversation) and the person would decline to continue! I knew that I was a good coach. I knew that I was making an impact. But the person could feel my neediness and it would repel them.It wasn't until I began to understand what service really is that this changed. I begin to meet people and invite them to have a conversation with me with no agenda, other than that I might be of service to them. And yes, this approach does involve giving what some people would call “free coaching” (sometimes up to 2 hours!). We would sit down, in person or on the phone, and I would give this person everything I could, holding nothing back. At the end of that time, I wouldn't even ask them to coach with me…I didn't need to! They would ask me. Then it's just a simple matter of discussing logistics ... Fees, time commitment, Etc.And you know what I found? When I would serve that person with all my heart for an hour or two, they would build deep trust in my commitment to helping them create the life that they desired and that trust turned out to be all that was missing. Clients began saying yes to my coaching programs far more often.Today, my coaching practice is full with new people wanting to come on board all the time. I continue to offer complimentary experiences because that has proven to be the most effective method that I found. I don't personally agree with 20 or 30 minute teaser sessions where we focus on a problem and try and tell the person how amazing we would be at solving it. I prefer to go ahead and start solving their problems! Believe me, if you're a good coach and you help them they'll want to work with you!By the way, one of the things that I love about this approach is that I love to coach! I love engaging with people and their world. It's a pleasure to spend this time with them. I offer less of these sessions currently as my time is more limited. But as a new coach, I can't think of a better way for you to both build your practice and get more experience than what I've described above.If there's some other way that I can be of service to you, please let me know.

-

How long are payroll companies allowed to 'keep' money before distributing to intended purpose (examp-union check deductions taken out of employer/employee checks that are to ultimately pay for insurance and other benefits for union workers)?

It doesn’t quite work the way you think.In my experience, other than payroll-related taxes (federal, state, FICA, local), third-party payroll companies (such as ADP, for example) are never in possession of any deductions withheld from employees’ paychecks.Those amounts are submitted to ‘whomever’ directly from your employer. On what frequency, it probably varies depending on when it is due and what it is for. There are no employment laws I am aware of that says an employer ‘must’ remit these withholdings within a certain window of time after the check has been issued.

Related searches to Life Insurance Claim Form Employee And Retiree Benefits State Benefits Iowa

Create this form in 5 minutes!

How to create an eSignature for the life insurance claim form employee and retiree benefits state benefits iowa

How to make an eSignature for your Life Insurance Claim Form Employee And Retiree Benefits State Benefits Iowa online

How to make an eSignature for the Life Insurance Claim Form Employee And Retiree Benefits State Benefits Iowa in Chrome

How to create an electronic signature for signing the Life Insurance Claim Form Employee And Retiree Benefits State Benefits Iowa in Gmail

How to make an eSignature for the Life Insurance Claim Form Employee And Retiree Benefits State Benefits Iowa right from your smartphone

How to generate an electronic signature for the Life Insurance Claim Form Employee And Retiree Benefits State Benefits Iowa on iOS

How to generate an eSignature for the Life Insurance Claim Form Employee And Retiree Benefits State Benefits Iowa on Android

People also ask

-

What is the Life Insurance Claim Form for Employee and Retiree Benefits in Iowa?

The Life Insurance Claim Form for Employee and Retiree Benefits in Iowa is a document that beneficiaries need to submit to claim life insurance benefits. This form ensures that the claims process is straightforward and efficient for both employees and retirees entitled to benefits in the state.

-

How can I access the Life Insurance Claim Form for Employee and Retiree Benefits in Iowa?

You can easily access the Life Insurance Claim Form for Employee and Retiree Benefits in Iowa through your employer's HR portal or by contacting your benefits administrator. Additionally, airSlate SignNow offers a seamless way to manage and sign these forms electronically.

-

What are the benefits of using airSlate SignNow for the Life Insurance Claim Form?

Using airSlate SignNow for the Life Insurance Claim Form for Employee and Retiree Benefits in Iowa improves efficiency and reduces paperwork. Our platform allows for quick electronic signatures and ensures that your claims are processed promptly, making it easier for beneficiaries to receive their entitled benefits.

-

Is there a cost associated with using airSlate SignNow for the Life Insurance Claim Form?

airSlate SignNow offers a cost-effective solution for managing the Life Insurance Claim Form for Employee and Retiree Benefits in Iowa. Pricing is competitive and scales based on the features you need, ensuring that it fits within your budget while providing robust document management capabilities.

-

What features does airSlate SignNow offer for managing the Life Insurance Claim Form?

airSlate SignNow provides features such as e-signature capabilities, document storage, and secure sharing for the Life Insurance Claim Form for Employee and Retiree Benefits in Iowa. These features enhance user experience, streamline the claims process, and ensure compliance with state requirements.

-

Can I track the status of my Life Insurance Claim Form submission through airSlate SignNow?

Yes, airSlate SignNow allows users to track the status of their submissions for the Life Insurance Claim Form for Employee and Retiree Benefits in Iowa. This feature provides peace of mind by keeping you informed about the progress of your claims process.

-

Does airSlate SignNow integrate with other systems for handling employee benefits?

Absolutely! airSlate SignNow integrates seamlessly with various HR and benefits management systems, enhancing the workflow for the Life Insurance Claim Form for Employee and Retiree Benefits in Iowa. These integrations help ensure that all your employee benefit processes are connected and efficient.

Get more for Life Insurance Claim Form Employee And Retiree Benefits State Benefits Iowa

Find out other Life Insurance Claim Form Employee And Retiree Benefits State Benefits Iowa

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation