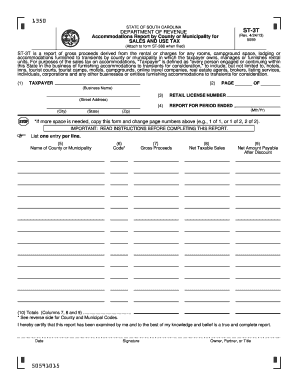

STATE of SOUTH CAROLINA ST 3T DEPARTMENT of REVENUE Form

What is the STATE OF SOUTH CAROLINA ST 3T DEPARTMENT OF REVENUE

The STATE OF SOUTH CAROLINA ST 3T DEPARTMENT OF REVENUE form is a crucial document used for tax-related purposes within the state of South Carolina. This form is specifically designed to facilitate the reporting and payment of various taxes owed to the state. It serves as an official declaration of income, deductions, and credits, ensuring compliance with state tax laws.

Steps to complete the STATE OF SOUTH CAROLINA ST 3T DEPARTMENT OF REVENUE

Completing the STATE OF SOUTH CAROLINA ST 3T DEPARTMENT OF REVENUE form involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Fill out the form accurately, ensuring all sections are completed to avoid delays.

- Review the form for any errors or omissions before submission.

- Submit the form electronically or via mail, depending on your preference and the guidelines provided.

Legal use of the STATE OF SOUTH CAROLINA ST 3T DEPARTMENT OF REVENUE

The legal use of the STATE OF SOUTH CAROLINA ST 3T DEPARTMENT OF REVENUE form is governed by state tax regulations. To be considered valid, the form must be completed in accordance with the guidelines set forth by the South Carolina Department of Revenue. This includes providing accurate information and ensuring that all signatures are properly executed. Failure to comply with these regulations can result in penalties or legal repercussions.

Form Submission Methods (Online / Mail / In-Person)

The STATE OF SOUTH CAROLINA ST 3T DEPARTMENT OF REVENUE form can be submitted through various methods:

- Online: Many taxpayers prefer to submit their forms electronically through the South Carolina Department of Revenue's online portal.

- Mail: The form can also be printed and mailed to the appropriate address as specified in the instructions.

- In-Person: Taxpayers have the option to submit the form in person at designated state revenue offices.

Key elements of the STATE OF SOUTH CAROLINA ST 3T DEPARTMENT OF REVENUE

Understanding the key elements of the STATE OF SOUTH CAROLINA ST 3T DEPARTMENT OF REVENUE form is essential for accurate completion. Important components typically include:

- Personal Information: Name, address, and Social Security number of the taxpayer.

- Income Details: Breakdown of all income sources, including wages and self-employment earnings.

- Deductions and Credits: Information on any deductions or credits being claimed to reduce tax liability.

- Signature: A declaration that the information provided is true and correct, requiring the taxpayer's signature.

Eligibility Criteria

Eligibility to use the STATE OF SOUTH CAROLINA ST 3T DEPARTMENT OF REVENUE form generally depends on the taxpayer's residency status and income level. Residents of South Carolina who meet specific income thresholds are required to file this form. Additionally, certain exemptions may apply based on age, disability, or other factors, which can influence the filing requirements.

Quick guide on how to complete state of south carolina st 3t department of revenue

Prepare STATE OF SOUTH CAROLINA ST 3T DEPARTMENT OF REVENUE effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage STATE OF SOUTH CAROLINA ST 3T DEPARTMENT OF REVENUE on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign STATE OF SOUTH CAROLINA ST 3T DEPARTMENT OF REVENUE with ease

- Obtain STATE OF SOUTH CAROLINA ST 3T DEPARTMENT OF REVENUE and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate producing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign STATE OF SOUTH CAROLINA ST 3T DEPARTMENT OF REVENUE and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state of south carolina st 3t department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the STATE OF SOUTH CAROLINA ST 3T DEPARTMENT OF REVENUE?

The STATE OF SOUTH CAROLINA ST 3T DEPARTMENT OF REVENUE is a governmental agency responsible for the collection of taxes, enforcement of tax laws, and providing guidance to residents and businesses on revenue-related issues. Utilizing tools like airSlate SignNow can enhance your experience with eSigning important documents needed for compliance.

-

How can airSlate SignNow benefit businesses dealing with the STATE OF SOUTH CAROLINA ST 3T DEPARTMENT OF REVENUE?

AirSlate SignNow streamlines the document signing process, allowing businesses to quickly send and receive signed documents necessary for transactions with the STATE OF SOUTH CAROLINA ST 3T DEPARTMENT OF REVENUE. This helps save time, reduces paperwork, and ensures compliance with state regulations.

-

What features does airSlate SignNow offer for compliance with the STATE OF SOUTH CAROLINA ST 3T DEPARTMENT OF REVENUE?

AirSlate SignNow provides essential features like customizable templates, audit trails, and secure eSigning to ensure compliance with the requirements of the STATE OF SOUTH CAROLINA ST 3T DEPARTMENT OF REVENUE. These tools help businesses maintain accuracy and legality in their documentation.

-

Is airSlate SignNow cost-effective for small businesses interacting with the STATE OF SOUTH CAROLINA ST 3T DEPARTMENT OF REVENUE?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses needing to interact with the STATE OF SOUTH CAROLINA ST 3T DEPARTMENT OF REVENUE. Its pricing plans are competitive and provide excellent value for the features offered, helping businesses manage their documents efficiently.

-

Can airSlate SignNow integrate with other tools used for the STATE OF SOUTH CAROLINA ST 3T DEPARTMENT OF REVENUE?

Absolutely! AirSlate SignNow integrates seamlessly with various tools and platforms that businesses may already be using to manage their interactions with the STATE OF SOUTH CAROLINA ST 3T DEPARTMENT OF REVENUE. This integration ensures a smooth workflow, enhancing productivity and compliance.

-

What types of documents can be signed using airSlate SignNow in relation to the STATE OF SOUTH CAROLINA ST 3T DEPARTMENT OF REVENUE?

AirSlate SignNow supports a wide range of documents that may need to be signed in relation to the STATE OF SOUTH CAROLINA ST 3T DEPARTMENT OF REVENUE, including tax forms, compliance documents, and contracts. This flexibility allows businesses to address various needs efficiently.

-

How secure is my data when using airSlate SignNow for the STATE OF SOUTH CAROLINA ST 3T DEPARTMENT OF REVENUE?

AirSlate SignNow prioritizes your security with end-to-end encryption and compliance with industry standards, ensuring that your data remains safe when dealing with the STATE OF SOUTH CAROLINA ST 3T DEPARTMENT OF REVENUE. This commitment to security provides peace of mind for all users.

Get more for STATE OF SOUTH CAROLINA ST 3T DEPARTMENT OF REVENUE

- Overview of student supports in tennessee tngov form

- Tennessee military department form

- K le form

- Building information form nycgov

- Fingerprint unit department of investigation nycgov form

- Summer camp self certification checklist nycgov form

- Expedited certificate of no effect application form

- Housing preservation ampamp development new york city form

Find out other STATE OF SOUTH CAROLINA ST 3T DEPARTMENT OF REVENUE

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe