Sa100 Form

What is the SA100?

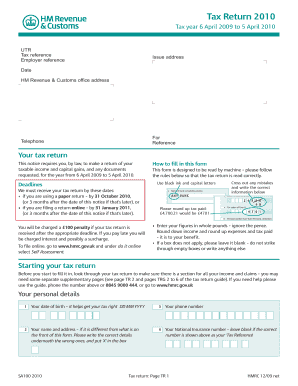

The SA100 form is a self-assessment tax return used by individuals in the United Kingdom to report their income and capital gains. Although primarily a UK form, understanding its purpose is essential for those who may have cross-border tax obligations. The SA100 is designed for individuals who are self-employed, have rental income, or receive income from other sources that are not taxed at source. It allows taxpayers to calculate their tax liability and report it to HM Revenue and Customs (HMRC).

Steps to Complete the SA100

Completing the SA100 form involves several key steps to ensure accuracy and compliance. Here is a simplified process:

- Gather all necessary financial documents, including income statements, receipts, and previous tax returns.

- Fill out personal information, including your name, address, and National Insurance number.

- Report your income from various sources, such as employment, self-employment, and investments.

- Calculate allowable expenses and deductions to reduce your taxable income.

- Complete the tax calculation section to determine your total tax liability.

- Review the form for accuracy and completeness before submission.

How to Obtain the SA100

The SA100 form can be obtained through various channels. Individuals can download it directly from the HMRC website or request a paper form to be sent to them. Additionally, many tax preparation software programs include the SA100 form, allowing users to complete it electronically. It is advisable to obtain the form well in advance of the filing deadline to ensure adequate time for completion.

Legal Use of the SA100

The SA100 form must be completed and submitted in accordance with UK tax laws. It is legally binding and serves as a declaration of your income and tax liability. Failure to submit the form accurately and on time can result in penalties and interest charges. Therefore, it is crucial to ensure that all information provided is truthful and complete, as any discrepancies may lead to further scrutiny from tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the SA100 are critical to avoid penalties. Typically, the deadline for submitting the paper version of the SA100 is October 31st of the tax year, while the deadline for online submissions is January 31st of the following year. It is important to keep track of these dates and plan accordingly to ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

The SA100 can be submitted through various methods, providing flexibility for taxpayers. Individuals can choose to file online through the HMRC website, which is the most efficient method. Alternatively, the completed paper form can be mailed to HMRC. In-person submissions are not typically available, but individuals can seek assistance at local tax offices if needed. Each method has specific guidelines that must be followed to ensure successful submission.

Quick guide on how to complete sa100

Prepare Sa100 effortlessly on any device

Managing documents online has gained immense popularity among businesses and individuals. It provides an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to find the right format and securely store it online. airSlate SignNow offers all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Sa100 on any platform using airSlate SignNow's Android or iOS applications and enhance any process that involves documents today.

How to modify and eSign Sa100 without hassle

- Find Sa100 and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or conceal sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method of sending your form, via email, SMS, or invitation link, or save it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Alter and eSign Sa100 and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sa100

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SA100 form 2023?

The SA100 form 2023 is a self-assessment tax return form used by self-employed individuals and sole traders in the UK to report their income and tax obligations. This form is essential for ensuring compliance with HMRC regulations and allows taxpayers to calculate their National Insurance contributions and income tax due.

-

How does airSlate SignNow facilitate signing the SA100 form 2023?

airSlate SignNow makes it simple to eSign the SA100 form 2023 by providing a user-friendly interface and secure, legally-binding signature options. Users can upload their completed forms, invite other parties to sign, and track the signing process, ensuring a seamless experience.

-

Is there a cost associated with using airSlate SignNow for the SA100 form 2023?

Yes, while airSlate SignNow offers various pricing plans, the cost is generally cost-effective, especially compared to traditional paperwork processes. Investing in airSlate SignNow will streamline your filing of the SA100 form 2023 and save you time and potential penalties due to late submissions.

-

What features does airSlate SignNow offer for managing the SA100 form 2023?

airSlate SignNow includes features such as document templates, audit trails, real-time status tracking, and multiple signing options that simplify the management of the SA100 form 2023. These tools enhance efficiency and help ensure that your tax documents are processed quickly and accurately.

-

Can I integrate airSlate SignNow with my accounting software for the SA100 form 2023?

Absolutely! airSlate SignNow can seamlessly integrate with various accounting software solutions, allowing for easy import and export of financial data relevant to the SA100 form 2023. This integration helps to streamline the tax preparation process and minimize errors.

-

What are the benefits of using airSlate SignNow for the SA100 form 2023?

Using airSlate SignNow for the SA100 form 2023 offers numerous benefits, including increased efficiency, enhanced security through encrypted signatures, and the convenience of accessing documents from anywhere. This solution optimizes the entire process, making it easier to manage your tax submissions.

-

Is airSlate SignNow secure for handling the SA100 form 2023?

Yes, airSlate SignNow employs robust security measures to protect your sensitive information, including the SA100 form 2023. With features like encryption, multi-factor authentication, and compliance with industry standards, you can trust that your documents are safe and secure.

Get more for Sa100

Find out other Sa100

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online