Gab 131 Form

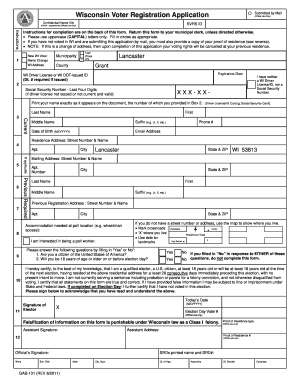

What is the Gab 131 Form

The Gab 131 Form is a document used primarily for tax purposes in the United States. It serves as a means for taxpayers to report specific financial information to the Internal Revenue Service (IRS). This form is essential for individuals and businesses who need to disclose income, deductions, and other relevant financial data. Understanding its purpose and requirements is crucial for compliance with tax regulations.

How to use the Gab 131 Form

Using the Gab 131 Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, such as income statements and receipts for deductions. Next, fill out the form with precise information, ensuring all sections are completed accurately. After completing the form, review it for errors before submitting it to the IRS. It is advisable to keep a copy for personal records.

Steps to complete the Gab 131 Form

Completing the Gab 131 Form requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents.

- Fill in your personal information, including name, address, and Social Security number.

- Report your income accurately, including wages, interest, and dividends.

- Detail any deductions you are claiming, ensuring you have supporting documentation.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Gab 131 Form

The Gab 131 Form is legally binding when completed correctly and submitted to the IRS. It is essential to comply with all applicable tax laws and regulations to avoid penalties. The form must be signed by the taxpayer, and any false information can lead to legal consequences. Ensuring that the form is filled out accurately and submitted on time is crucial for maintaining compliance.

Filing Deadlines / Important Dates

Timely submission of the Gab 131 Form is critical to avoid penalties. The IRS typically sets specific deadlines for tax filings, which may vary each year. Generally, individual taxpayers must file their forms by April 15. However, extensions may be available under certain circumstances. It is important to stay informed about these deadlines to ensure compliance.

Form Submission Methods (Online / Mail / In-Person)

The Gab 131 Form can be submitted through various methods, depending on the taxpayer's preference. Options include:

- Online submission through the IRS e-file system.

- Mailing a physical copy of the form to the appropriate IRS address.

- In-person submission at designated IRS offices, although this may require an appointment.

Each method has its advantages, and taxpayers should choose the one that best fits their needs.

Quick guide on how to complete gab 131 form

Complete Gab 131 Form effortlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed materials, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to produce, modify, and electronically sign your documents swiftly without any delays. Manage Gab 131 Form on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The simplest way to revise and eSign Gab 131 Form with ease

- Find Gab 131 Form and then click Get Form to begin.

- Use the tools provided to fill out your form.

- Highlight important parts of the documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature with the Sign tool, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your adjustments.

- Select your preferred method for submitting your form, whether via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing additional copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any chosen device. Modify and eSign Gab 131 Form to maintain excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gab 131 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Gab 131 Form?

The Gab 131 Form is a specialized document used for various organizational purposes, often related to financial and performance reporting. With airSlate SignNow, you can easily create, manage, and eSign the Gab 131 Form, ensuring efficient processing and compliance.

-

How does airSlate SignNow simplify the Gab 131 Form eSigning process?

airSlate SignNow offers a user-friendly platform that allows you to eSign the Gab 131 Form swiftly and securely. Our solution reduces paperwork and eliminates the need for in-person signatures, enabling faster approvals and document workflows.

-

Is there a cost associated with using airSlate SignNow for the Gab 131 Form?

Yes, airSlate SignNow operates on a subscription model that is cost-effective for businesses of all sizes. We offer various pricing plans designed to fit your budget, which includes all necessary features to manage the Gab 131 Form and other documents efficiently.

-

What features does airSlate SignNow offer for managing the Gab 131 Form?

airSlate SignNow provides a range of features for managing the Gab 131 Form, including customizable templates, automated workflows, and real-time tracking of document status. These tools help enhance productivity and ensure that your documents are processed without delays.

-

Can I integrate airSlate SignNow with other software to handle the Gab 131 Form?

Absolutely! airSlate SignNow supports seamless integrations with various software applications, allowing you to manage the Gab 131 Form alongside your existing systems. This integration facilitates smoother workflows and better data management across platforms.

-

What are the benefits of using airSlate SignNow for the Gab 131 Form?

Using airSlate SignNow for the Gab 131 Form offers numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security for your documents. Our platform also provides insights and analytics, helping you to optimize your document management processes.

-

Is airSlate SignNow suitable for businesses of all sizes to handle the Gab 131 Form?

Yes, airSlate SignNow is designed to cater to businesses of all sizes, making it an excellent choice for handling the Gab 131 Form. Whether you're a small startup or a large corporation, our scalable solutions can meet your document needs efficiently.

Get more for Gab 131 Form

- Medicine and surgery nebraska dhhs nebraskagov form

- Covid 19 updates town of cortlandt ny form

- Report of animal bite scratch or contact form

- What need to knowhttpsodhohiogov form

- Prior authorization form outpatient therapycardiac or pulmonary rehab request providers amerihealth caritas pa chc prior

- 1129 form dhec

- Notice of competitive funding opportunity scgov form

- Certificate of adoption texas department of state health services dshs state tx form

Find out other Gab 131 Form

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF