Sending in Proof of Your No Claims Bonus Autonet Insurance Form

What is a no claim bonus certificate?

A no claim bonus certificate is an official document provided by an insurance company that confirms a policyholder has not made any claims during a specified period. This certificate serves as proof of the policyholder's claim-free history, which can lead to discounts on future insurance premiums. Typically, the longer the no claim period, the higher the discount offered on subsequent policies. It is essential for individuals looking to switch insurance providers or renew their existing policies, as it can significantly impact their premium rates.

How to obtain a no claim bonus certificate

To obtain a no claim bonus certificate, policyholders should contact their insurance provider directly. Most companies have a straightforward process for issuing this document. Policyholders may need to provide their policy number and personal identification details. Some insurers allow requests to be made through their website or customer service hotline. Once the request is submitted, the insurance company will verify the claim history and issue the certificate, usually within a few business days.

Steps to complete the no claim bonus certificate form

Filling out a no claim bonus certificate form typically involves several steps:

- Gather necessary information, including your policy number, personal details, and the period for which you are claiming the no claim bonus.

- Access the form from your insurance provider's website or request it directly from their customer service.

- Carefully fill out the form, ensuring all information is accurate and complete.

- Submit the form as instructed, either online or via mail, depending on the insurer's requirements.

- Keep a copy of the submitted form for your records.

Legal use of the no claim bonus certificate

A no claim bonus certificate is legally recognized as proof of a policyholder's claim history. It can be used in various contexts, such as when applying for new insurance policies or negotiating premiums with insurers. The certificate must be accurate and issued by a legitimate insurance company to ensure its validity. Misrepresentation or falsification of this document can lead to legal consequences and may affect future insurance coverage.

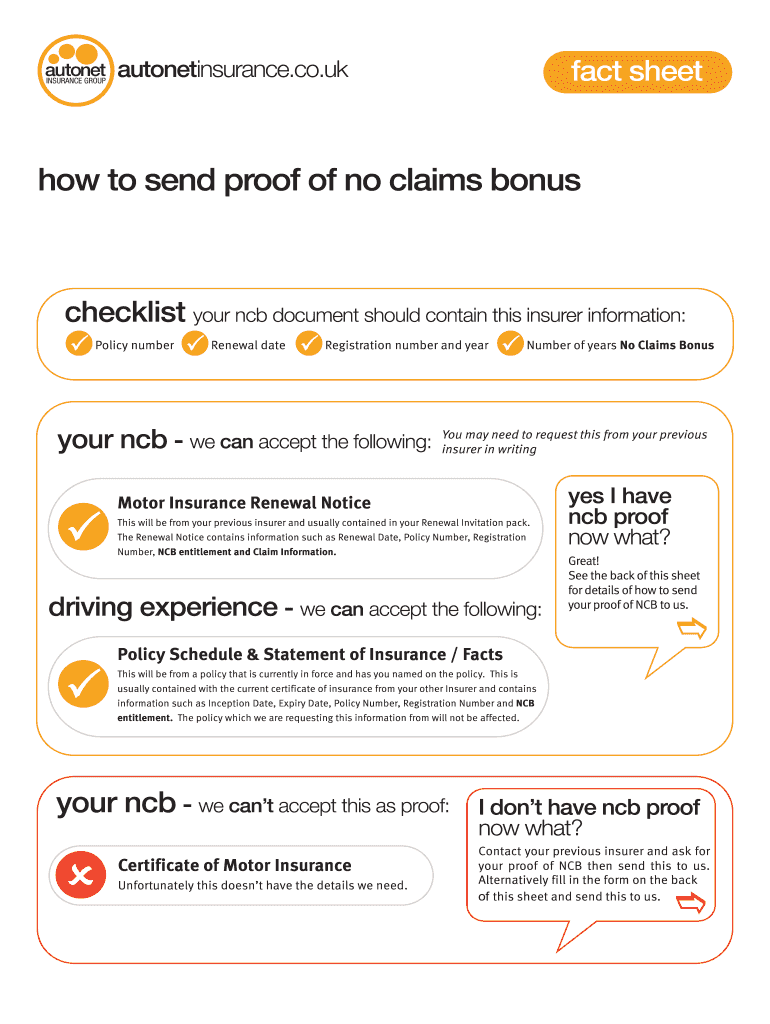

Key elements of a no claim bonus certificate

Several key elements are typically included in a no claim bonus certificate:

- Policyholder Information: Name, address, and contact details of the policyholder.

- Policy Details: Policy number, type of coverage, and the effective dates of the policy.

- Claim History: A statement confirming that no claims have been made during the specified period.

- Issuer Information: Details of the insurance company, including contact information and an official signature or seal.

Examples of using a no claim bonus certificate

There are several practical scenarios where a no claim bonus certificate can be beneficial:

- When switching insurance providers, the certificate can help secure lower premiums by demonstrating a claim-free history.

- During policy renewals, presenting the certificate may lead to additional discounts from the current insurer.

- In negotiations with insurance agents, having this certificate can strengthen a policyholder's position for better rates.

Quick guide on how to complete sending in proof of your no claims bonus autonet insurance

Complete Sending In Proof Of Your No Claims Bonus Autonet Insurance effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents swiftly without delays. Handle Sending In Proof Of Your No Claims Bonus Autonet Insurance on any platform using airSlate SignNow Android or iOS applications and enhance any document-related task today.

The simplest way to modify and eSign Sending In Proof Of Your No Claims Bonus Autonet Insurance with ease

- Obtain Sending In Proof Of Your No Claims Bonus Autonet Insurance and click Get Form to start.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your updates.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Sending In Proof Of Your No Claims Bonus Autonet Insurance and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sending in proof of your no claims bonus autonet insurance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a certificate of no claim insurance?

A certificate of no claim insurance is a document confirming that your insurance policy has not been subject to any claims during a specified period. This certificate can be crucial for lowering future insurance premiums or switching providers. Understanding this document can signNowly aid in managing your insurance effectively.

-

Why is a certificate of no claim insurance important?

Obtaining a certificate of no claim insurance is essential as it serves as proof of your claims history to insurers. A clean record can often result in better premiums and helps demonstrate your reliability as an insured individual. This certificate also plays a role in increasing your chances of obtaining favorable insurance terms.

-

How can airSlate SignNow help with my certificate of no claim insurance?

airSlate SignNow offers a streamlined process for generating and eSigning your certificate of no claim insurance. Our platform ensures that all your documents are secure and legally binding, giving you peace of mind. Additionally, you can track the status of your certificates in real-time, making the entire process effortless.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow provides various pricing plans tailored to different business needs, starting from a cost-effective monthly subscription. Each plan includes features that facilitate the management of documents such as your certificate of no claim insurance. You can choose a plan that fits your budget while meeting your business requirements.

-

Is airSlate SignNow compliant with legal standards for certificate of no claim insurance?

Yes, airSlate SignNow adheres to all legal standards required for eSigning documents, including a certificate of no claim insurance. Our platform complies with eSignature laws to ensure that your documents are legally binding and recognized. This compliance provides you with the security you need for all your insurance documents.

-

Can I integrate airSlate SignNow with my existing systems?

Absolutely! airSlate SignNow integrates seamlessly with various business applications and software, allowing you to manage your certificate of no claim insurance more efficiently. These integrations help streamline workflows and eliminate redundancies, making it easier to handle essential documents.

-

What are the benefits of using airSlate SignNow for insurance documents?

Using airSlate SignNow for your insurance documents, including your certificate of no claim insurance, provides numerous benefits such as enhanced security, ease of use, and time savings. Our platform allows for quick access to eSigning and document tracking, ensuring you can manage your insurance needs without hassle. This efficiency helps you stay organized and focused on your business.

Get more for Sending In Proof Of Your No Claims Bonus Autonet Insurance

- Plan of careanaphylaxis plan of care dsbn form

- Employers exposure incident reporting form peir

- Patient amp employer information

- Accidentincident report form 4 h alberta

- Special incident report form

- How you decide to allocate your assets is the very heart of your financial strategy form

- F51 122a industrial alliance form

- Maternity andor parental benefits annex 3 form

Find out other Sending In Proof Of Your No Claims Bonus Autonet Insurance

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT