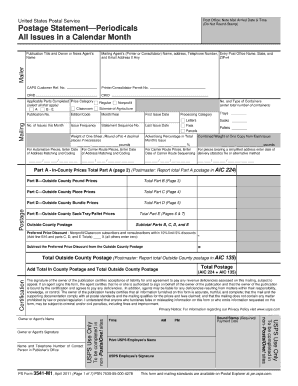

Form 3541

What is the Form 3541

The Form 3541 is a document used primarily for reporting specific tax-related information to the Internal Revenue Service (IRS). This form is essential for businesses and individuals who need to declare certain financial activities or transactions. It serves as a formal declaration that provides the IRS with necessary details to ensure compliance with federal tax laws. Understanding the purpose and requirements of Form 3541 is crucial for accurate tax reporting and avoidance of potential penalties.

How to use the Form 3541

Using the Form 3541 involves several key steps to ensure accurate completion and submission. First, gather all necessary financial documents and information that pertain to the form's requirements. Next, carefully fill out the form, ensuring that all sections are completed accurately. It is advisable to double-check the entries for any errors or omissions. Once completed, the form can be submitted to the IRS through the appropriate channels, which may include online submission or mailing the physical form. Maintaining a copy for personal records is also recommended.

Steps to complete the Form 3541

Completing the Form 3541 requires a systematic approach to ensure compliance and accuracy. Follow these steps:

- Review the instructions provided with the form to understand the specific requirements.

- Collect all necessary documentation, including income statements and expense records.

- Fill out the form, ensuring that all fields are completed as required.

- Verify the accuracy of the information entered, checking for any discrepancies.

- Sign and date the form where indicated.

- Submit the form via the chosen method, either electronically or by mail.

Legal use of the Form 3541

The legal use of Form 3541 is governed by IRS regulations, which stipulate how and when the form should be utilized. It is essential for users to ensure that the information provided is truthful and complete, as inaccuracies can lead to legal repercussions. The form must be filed within the designated deadlines to maintain compliance with tax laws. Additionally, using a reliable digital platform for eSigning the form can enhance its legal validity, ensuring that it meets all necessary electronic signature requirements.

Filing Deadlines / Important Dates

Filing deadlines for Form 3541 are critical to ensure compliance with IRS regulations. Typically, the form must be submitted by a specific date each year, often aligned with the tax filing deadline for individuals and businesses. It is important to stay informed about any changes to these deadlines, as late submissions can result in penalties or interest charges. Keeping a calendar of important tax dates can help in managing timely filings.

Who Issues the Form

The Form 3541 is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement of tax laws in the United States. The IRS provides the form along with guidelines on how to complete it, ensuring that taxpayers have the necessary resources to fulfill their reporting obligations. Understanding the issuing authority helps users recognize the importance of compliance and the need for accurate reporting.

Quick guide on how to complete form 3541

Complete Form 3541 seamlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly solution to traditional printed and signed documents, allowing you to obtain the correct form and securely store it in the cloud. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your papers swiftly without any delays. Administer Form 3541 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Form 3541 effortlessly

- Locate Form 3541 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using the tools specifically provided by airSlate SignNow.

- Generate your eSignature with the Sign feature, which only takes a few seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow manages all your document-related needs in just a few clicks from any device you prefer. Edit and eSign Form 3541 and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3541

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 3541 and how can airSlate SignNow help?

Form 3541 is a document used for various business and tax-related purposes. airSlate SignNow simplifies the process of completing, signing, and sending Form 3541, ensuring you can manage your documents efficiently and securely.

-

Are there any costs involved in using airSlate SignNow for Form 3541?

airSlate SignNow offers flexible pricing plans that cater to different business needs. You can choose a subscription that allows you to send and eSign documents like Form 3541 without breaking the bank.

-

What features does airSlate SignNow provide for managing Form 3541?

With airSlate SignNow, you gain access to a user-friendly interface, custom templates, and seamless eSignature capabilities specifically for Form 3541. These features enhance your workflow and ensure compliance with legal standards.

-

Can I integrate airSlate SignNow with other applications when working with Form 3541?

Absolutely! airSlate SignNow offers various integrations with popular applications, allowing you to seamlessly incorporate Form 3541 into your existing systems. This enhances productivity and ensures that all your tools work together fluidly.

-

Is there a free trial available for airSlate SignNow to try out Form 3541 features?

Yes, airSlate SignNow provides a free trial that allows you to explore its features, including those for Form 3541. During this trial, you can experience how easy it is to eSign and manage your documents before committing to a plan.

-

How secure is airSlate SignNow for handling my Form 3541 documents?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and compliance measures to ensure that your Form 3541 and other sensitive documents are protected at all times.

-

Can airSlate SignNow assist with tracking the status of Form 3541 documents?

Yes, airSlate SignNow includes robust tracking features that allow you to monitor the status of your Form 3541 documents. You will receive notifications when your documents are viewed and signed, providing you with peace of mind.

Get more for Form 3541

Find out other Form 3541

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free