8871 Form

What is the 8871

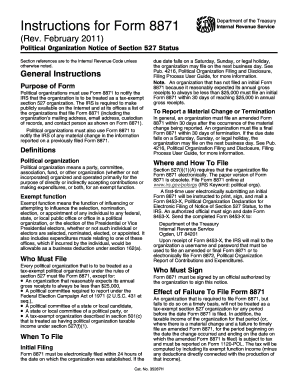

The 8871 form, officially known as IRS Form 8871, is a document used by organizations to apply for recognition of tax-exempt status under Section 501(c)(4) of the Internal Revenue Code. This form is essential for social welfare organizations that wish to operate without federal income tax obligations. By filing Form 8871, organizations can inform the IRS of their intent to operate as a tax-exempt entity, allowing them to receive contributions that may be tax-deductible for donors.

How to Use the 8871

Using Form 8871 involves several steps to ensure compliance with IRS regulations. Organizations must accurately complete the form, providing detailed information about their purpose, activities, and financial structure. It is crucial to follow the IRS guidelines closely, as any inaccuracies or omissions can lead to delays or denial of tax-exempt status. Once completed, the form can be submitted electronically or by mail, depending on the organization's preference and capabilities.

Steps to Complete the 8871

Completing Form 8871 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information about your organization, including its mission, activities, and financial data.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or missing information before submission.

- Submit the form electronically via the IRS website or send it by mail to the designated address.

Legal Use of the 8871

The legal use of Form 8871 is governed by IRS regulations. Organizations must ensure that they meet the eligibility criteria for tax-exempt status under Section 501(c)(4). This includes operating primarily for the promotion of social welfare and not for profit. Compliance with these legal requirements is essential to maintain tax-exempt status and avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for Form 8871 are critical to ensure timely recognition of tax-exempt status. Organizations must file the form within 27 months of formation to receive retroactive tax-exempt status. If filed after this period, the organization may only receive tax-exempt status from the date of filing. Keeping track of these deadlines is vital for compliance and financial planning.

Form Submission Methods (Online / Mail / In-Person)

Organizations can submit Form 8871 through various methods. The preferred method is electronic submission via the IRS e-file system, which allows for faster processing. Alternatively, organizations can mail the completed form to the appropriate IRS address listed in the instructions. In-person submission is not typically available for this form, making electronic and mail options the most practical choices for most organizations.

Quick guide on how to complete 8871

Effortlessly Complete 8871 on Any Device

Managing documents online has become increasingly popular among companies and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing users to locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and electronically sign your documents without delays. Handle 8871 on any platform using airSlate SignNow apps for Android or iOS and streamline your document-related tasks today.

How to Alter and Electronically Sign 8871 with Ease

- Locate 8871 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with specialized tools from airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a handwritten signature.

- Review all the information and click the Done button to save your modifications.

- Choose your preferred method to send your form: via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device you choose. Edit and electronically sign 8871 and ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 8871

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8871 and why is it important?

Form 8871 is a key document for organizations that wish to apply for tax-exempt status under Section 501(c)(3). This form is crucial as it allows your organization to operate without federal income tax liability. Understanding its significance can help ensure compliance and proper operational status for nonprofits.

-

How can airSlate SignNow help me with form 8871?

airSlate SignNow streamlines the process of preparing, sending, and eSigning form 8871. With its user-friendly interface, you can easily collect necessary signatures, make revisions, and ensure timely submissions. This efficient solution helps you focus on your nonprofit's mission rather than getting bogged down in paperwork.

-

What features does airSlate SignNow offer for managing form 8871?

airSlate SignNow includes robust features like document templates, unlimited eSignature requests, and real-time collaboration. You can track document statuses and set reminders to ensure that form 8871 is submitted on time. These features simplify your workflow and support efficient form management.

-

Is airSlate SignNow cost-effective for processing form 8871?

Yes, airSlate SignNow offers competitive pricing plans tailored for organizations handling form 8871. Whether you're a small nonprofit or a larger organization, our cost-effective solutions provide excellent value without sacrificing features. This allows you to manage your documents within budget.

-

Can I integrate airSlate SignNow with other applications for form 8871 processes?

Absolutely! airSlate SignNow seamlessly integrates with various applications such as Google Drive, Dropbox, and CRM systems. These integrations allow for streamlined workflows when handling form 8871 and provide centralized access to all your documents and data.

-

What are the benefits of using airSlate SignNow for eSigning form 8871?

Using airSlate SignNow for eSigning form 8871 ensures that document workflows are faster and more secure. The platform provides options for advanced authentication and legally binding signatures, which add legitimacy to your submissions. This means faster processing and fewer errors when working with this important form.

-

How secure is airSlate SignNow when handling form 8871?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like form 8871. We utilize advanced encryption technologies and comply with industry standards to ensure that your data is protected. Feel confident in the safety and integrity of your documents at all times.

Get more for 8871

Find out other 8871

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document