Form 941c1 Me

What is the Form 941c1 Me

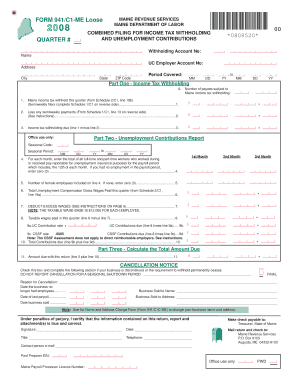

The Form 941c1 Me is a specific variant of the IRS Form 941, which is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is particularly relevant for adjustments made to previously filed Forms 941. It allows employers to correct errors in their payroll tax filings, ensuring accurate reporting and compliance with IRS regulations. Understanding the purpose and function of the Form 941c1 Me is essential for businesses to maintain proper tax records and avoid penalties.

How to use the Form 941c1 Me

Using the Form 941c1 Me involves several key steps. First, employers should gather all relevant payroll information, including the original Form 941 and any supporting documents. Next, the form must be filled out accurately, detailing the adjustments needed. This includes specifying the tax periods affected and the nature of the corrections. Once completed, the form should be submitted to the IRS, either electronically or by mail, depending on the employer's filing preferences. It is crucial to ensure that all information is accurate to avoid further complications with the IRS.

Steps to complete the Form 941c1 Me

Completing the Form 941c1 Me requires careful attention to detail. Here are the steps to follow:

- Review the original Form 941 for the tax period you are correcting.

- Identify the specific errors or adjustments that need to be made.

- Fill out the Form 941c1 Me, clearly indicating the corrections and the tax periods involved.

- Double-check all entries for accuracy, ensuring that all required fields are completed.

- Submit the completed form to the IRS, following the appropriate submission method.

Legal use of the Form 941c1 Me

The legal use of the Form 941c1 Me is governed by IRS regulations, which stipulate that employers must report accurate payroll tax information. This form serves as a legal document that can be used to rectify errors in previously submitted Forms 941. Ensuring compliance with these regulations is vital, as inaccuracies can lead to penalties or audits. Employers should keep a copy of the completed form for their records, as it may be required for future reference or in the event of an IRS inquiry.

Filing Deadlines / Important Dates

Filing deadlines for the Form 941c1 Me align with the deadlines for the original Form 941. Employers must be aware of these dates to ensure timely submission and avoid penalties. Typically, Form 941 is due quarterly, and any corrections made using Form 941c1 Me should be submitted as soon as the errors are identified. Keeping track of these deadlines is essential for maintaining compliance with IRS requirements.

Form Submission Methods (Online / Mail / In-Person)

The Form 941c1 Me can be submitted to the IRS through various methods. Employers have the option to file electronically using authorized e-file providers, which is often the fastest method. Alternatively, the form can be mailed to the appropriate IRS address based on the employer's location. In-person submission is generally not available for this form, making electronic and mail submissions the primary options. Choosing the right method can help ensure timely processing and reduce the risk of delays.

Quick guide on how to complete form 941c1 me 115849

Easily Prepare [SKS] on Any Gadget

Managing documents online has gained popularity among businesses and individuals. It offers a superb eco-friendly substitute for traditional printed and signed paperwork, allowing you to retrieve the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to swiftly create, modify, and eSign your documents without delays. Manage [SKS] on any gadget using the airSlate SignNow Android or iOS applications, and enhance any document-focused process today.

How to Alter and eSign [SKS] Effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunts, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in a few clicks from any device of your choice. Modify and eSign [SKS] to guarantee excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 941c1 Me

Create this form in 5 minutes!

How to create an eSignature for the form 941c1 me 115849

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 941c1 Me and how can it benefit my business?

Form 941c1 Me is specifically designed to assist businesses in correcting discrepancies on their Form 941 submissions. By using airSlate SignNow, you can easily create, send, and eSign Form 941c1 Me, ensuring seamless compliance and reducing the hassle of manual errors.

-

How much does airSlate SignNow cost for using Form 941c1 Me?

airSlate SignNow offers flexible pricing plans that are cost-effective for businesses of all sizes. You will find that using the platform to manage Form 941c1 Me can save you time and resources, ultimately maximizing the value you gain from our services.

-

Can I integrate Form 941c1 Me with my existing software?

Yes, airSlate SignNow allows for easy integration with various business software, enabling you to streamline your workflow when managing Form 941c1 Me. This integration helps minimize manual entry and enhances overall efficiency.

-

What features does airSlate SignNow offer for managing Form 941c1 Me?

With airSlate SignNow, users can enjoy features like customizable templates for Form 941c1 Me, real-time tracking, and secure cloud storage. These features provide flexibility and security, making document handling both convenient and efficient.

-

Is it easy to eSign Form 941c1 Me using airSlate SignNow?

Absolutely! AirSlate SignNow makes eSigning Form 941c1 Me simple and straightforward. Users can easily add their signatures digitally, which saves time and accelerates the overall document approval process.

-

What security measures are in place when using Form 941c1 Me on airSlate SignNow?

airSlate SignNow prioritizes your security with advanced encryption technology and compliance with regulations. When managing Form 941c1 Me, you can trust that your sensitive information is protected at all times.

-

Can I access Form 941c1 Me on mobile devices?

Yes, airSlate SignNow is compatible with mobile devices, allowing you to manage Form 941c1 Me on-the-go. This flexibility ensures you never miss an opportunity to handle your important documents, regardless of your location.

Get more for Form 941c1 Me

- Optional notice required only if the homeowner has borrowed or is borrowing money to finance the form

- Glossary of terms cloudcroft properties form

- Real estate part 3 flashcardsquizlet form

- Cause a loss of your property if you fail to pay the amount agreed upon form

- This contract creates a mortgage or lien against your property to secure payment and may form

- Full text of ampquotthe times news idaho newspaper 1996 01 04ampquot form

- Chapter 713 section 20 2011 florida the florida senate form

- Obligation for any and all loss damage claim or liability form

Find out other Form 941c1 Me

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online