Max Life Policy Bond Download Form

What is the Max Life Policy Bond Download

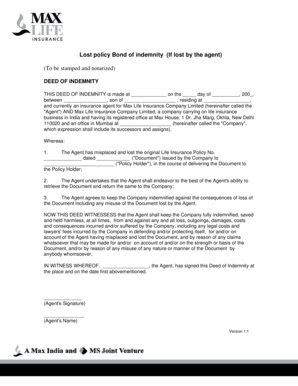

The Max Life Policy Bond Download refers to a digital version of the insurance bond document provided by Max Life Insurance. This document serves as a formal agreement between the policyholder and the insurance company, detailing the terms and conditions of the insurance coverage. It is essential for policyholders to have access to this document, as it outlines the benefits, premiums, and obligations associated with the insurance policy. The digital format allows for easy storage and retrieval, making it convenient for users to manage their insurance documents electronically.

How to use the Max Life Policy Bond Download

Using the Max Life Policy Bond Download involves several straightforward steps. First, ensure you have the necessary software to open the document, typically a PDF reader. Once downloaded, review the document carefully to understand the terms of your policy. If you need to make any amendments or add information, you can do so using electronic signature tools. This ensures that any changes made are legally binding and compliant with eSignature laws. Finally, store the document securely in a digital format for easy access in the future.

Steps to complete the Max Life Policy Bond Download

Completing the Max Life Policy Bond Download involves a series of clear steps:

- Download the policy bond document from the official Max Life Insurance website.

- Open the document using a compatible PDF reader.

- Review all sections of the policy bond to understand your coverage.

- Fill in any required information, ensuring accuracy.

- Sign the document electronically using a trusted eSignature tool to validate the agreement.

- Save the completed document securely on your device.

Legal use of the Max Life Policy Bond Download

The legal use of the Max Life Policy Bond Download is governed by various laws that recognize electronic signatures as valid. To ensure that your completed document holds legal weight, it must comply with the ESIGN Act and UETA. This means that the electronic signature must be captured in a manner that verifies the identity of the signer and their intent to sign. Additionally, maintaining an audit trail of the signing process can further substantiate the document's legal standing in case of disputes.

Key elements of the Max Life Policy Bond Download

Several key elements are crucial to the Max Life Policy Bond Download:

- Policy Number: A unique identifier for your insurance policy.

- Insured Information: Details about the policyholder and any covered individuals.

- Coverage Details: Information on the type of coverage provided, including limits and exclusions.

- Premium Amount: The cost of the policy, including payment schedules.

- Terms and Conditions: Legal stipulations that govern the policy.

How to obtain the Max Life Policy Bond Download

To obtain the Max Life Policy Bond Download, policyholders can visit the official Max Life Insurance website. After logging into their account, they can navigate to the documents section where the policy bond is available for download. If you do not have an online account, you may need to register or contact customer service for assistance. Once you have access, simply follow the prompts to download the document directly to your device.

Quick guide on how to complete max life policy bond download

Complete Max Life Policy Bond Download effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Max Life Policy Bond Download on any platform with the airSlate SignNow applications for Android or iOS and enhance any document-related procedure today.

The easiest way to modify and eSign Max Life Policy Bond Download with ease

- Obtain Max Life Policy Bond Download and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select signNow sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you want to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Max Life Policy Bond Download and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the max life policy bond download

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a LIC policy bond sample?

A LIC policy bond sample is a document that outlines the terms, conditions, and benefits of a life insurance policy offered by Life Insurance Corporation (LIC). It typically includes details such as premium amounts, maturity benefits, and the coverage period. Reviewing a LIC policy bond sample can help potential buyers understand what to expect from their investment.

-

How can I obtain a LIC policy bond sample?

You can obtain a LIC policy bond sample directly from the official LIC website or through authorized LIC agents. It’s important to compare various samples to evaluate their features and benefits. Always ensure that the sample reflects the latest offerings from LIC to make an informed decision.

-

What are the key features of a LIC policy bond?

Key features of a LIC policy bond include guaranteed returns, life coverage, tax benefits, and optional riders for added protection. Each policy may vary, so it’s advisable to study a LIC policy bond sample to understand specific features applicable to each option. This helps in choosing a policy that best fits your financial goals.

-

Are LIC policy bonds cost-effective?

Yes, LIC policy bonds are generally considered cost-effective due to their guaranteed returns and risk coverage. The investment in these policies ensures financial security for the policyholder and their beneficiaries. A detailed LIC policy bond sample can help you see the potential savings and benefits over time.

-

What are the benefits of investing in a LIC policy bond?

Investing in a LIC policy bond offers several benefits including financial security, return on investment, and tax deductions under Section 80C. Additionally, these policies can also provide life cover which ensures that your loved ones are financially protected. Reviewing a LIC policy bond sample can help you understand the specific advantages of different plans.

-

Can I integrate LIC policy bonds with other financial products?

Yes, LIC policy bonds can often be integrated with other financial products such as mutual funds or fixed deposits. This allows you to create a diversified investment portfolio that balances risk and returns. Assessing a LIC policy bond sample alongside other financial products can aid in making comprehensive financial decisions.

-

What factors should I consider when selecting a LIC policy bond?

When selecting a LIC policy bond, consider factors such as your financial goals, premium affordability, policy duration, and expected returns. Analyzing a LIC policy bond sample can provide insights into these factors, as different policies cater to varying needs. Ultimately, choose a bond that aligns with your long-term financial strategy.

Get more for Max Life Policy Bond Download

Find out other Max Life Policy Bond Download

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile