Land Transfer Tax Affidavit Form

What is the Land Transfer Tax Affidavit

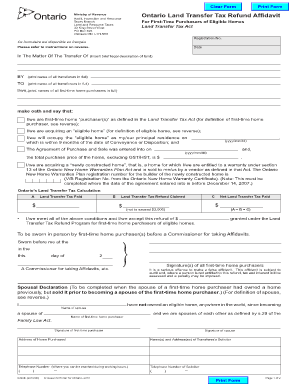

The land transfer tax affidavit is a legal document required during the transfer of real estate ownership in various jurisdictions, including Ontario. This form certifies the details of the property transfer and the applicable taxes owed. It serves as a declaration by the buyer or seller regarding the transaction, ensuring compliance with local tax regulations.

How to Use the Land Transfer Tax Affidavit

Using the land transfer tax affidavit involves several steps. First, ensure you have the correct version of the form, which may vary by state or region. Next, fill out the required information accurately, including details about the property, the parties involved, and any exemptions that may apply. Once completed, the affidavit must be signed and dated by the relevant parties to validate the document.

Steps to Complete the Land Transfer Tax Affidavit

Completing the land transfer tax affidavit requires careful attention to detail. Follow these steps:

- Obtain the correct form from your local tax authority or online resources.

- Fill in the property details, including address, parcel number, and sale price.

- Provide information about the buyer and seller, including names and contact information.

- Indicate any exemptions or deductions applicable to the transaction.

- Review the form for accuracy and completeness.

- Sign and date the affidavit where required.

Legal Use of the Land Transfer Tax Affidavit

The land transfer tax affidavit is legally binding when completed correctly. It must comply with the relevant state laws and regulations governing real estate transactions. Failure to submit a valid affidavit may result in penalties, including fines or additional taxes owed. Therefore, it is essential to ensure that all information provided is truthful and accurate to avoid legal complications.

Required Documents

When preparing to submit the land transfer tax affidavit, certain documents may be required. These typically include:

- Proof of identity for all parties involved in the transaction.

- Documentation of the property, such as a deed or title report.

- Any prior tax documents related to the property, if applicable.

- Evidence of any exemptions claimed, such as a first-time homebuyer certificate.

Eligibility Criteria

Eligibility to file a land transfer tax affidavit can vary based on state regulations. Generally, any individual or entity involved in the purchase or transfer of real estate must complete this affidavit. Specific exemptions may apply based on factors such as the type of property, the relationship between the buyer and seller, or the purpose of the transaction. It is advisable to check local laws to determine eligibility and any applicable exemptions.

Quick guide on how to complete land transfer tax affidavit

Complete Land Transfer Tax Affidavit effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage Land Transfer Tax Affidavit on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign Land Transfer Tax Affidavit with ease

- Find Land Transfer Tax Affidavit and then select Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which only takes seconds and has the same legal validity as a traditional wet ink signature.

- Verify all the details and then click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Leave behind issues of lost or misfiled documents, cumbersome form searching, or mistakes requiring new document prints. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Land Transfer Tax Affidavit and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the land transfer tax affidavit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a land transfer tax affidavit?

A land transfer tax affidavit is a legal document that outlines the amount of tax due when transferring real estate ownership. It serves as a declaration to local authorities regarding the applicable taxes, ensuring compliance with state regulations. Understanding this document is essential for buyers and sellers in real estate transactions.

-

How does airSlate SignNow simplify the land transfer tax affidavit process?

AirSlate SignNow streamlines the creation and signing of a land transfer tax affidavit with its user-friendly interface. Our platform allows you to easily fill out, send, and eSign documents electronically, saving time and reducing paperwork. You can quickly initiate the affidavit process from anywhere, ensuring a smoother real estate transaction.

-

Is there a cost associated with using airSlate SignNow for land transfer tax affidavits?

Yes, there are various pricing plans available for using airSlate SignNow, which cater to businesses of all sizes. Our plans are designed to be cost-effective while providing essential features for managing documents, including land transfer tax affidavits. You can choose a plan that fits your needs and budget.

-

Can I integrate airSlate SignNow with other software for handling land transfer tax affidavits?

Absolutely! AirSlate SignNow offers integrations with various third-party applications, enabling you to manage a seamless workflow for land transfer tax affidavits. By connecting our platform with your existing tools, you can enhance efficiency and ensure all documents are synchronized correctly.

-

What features does airSlate SignNow offer for managing land transfer tax affidavits?

AirSlate SignNow provides features such as document templates, in-app signing, and customizable workflows specifically for land transfer tax affidavits. You can also track document statuses in real-time, ensuring that all parties are informed throughout the signing process. These features contribute to a more efficient transaction experience.

-

How secure is the information in my land transfer tax affidavit when using airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure servers to protect sensitive information contained in your land transfer tax affidavit. Our compliance with industry standards ensures that your documents remain confidential and secure during the entire signing process.

-

Can airSlate SignNow help expedite the signing of land transfer tax affidavits?

Yes, airSlate SignNow is designed to expedite the signing process for land transfer tax affidavits. With features like instant notifications and reminders for signers, you can signNowly reduce the time it takes to gather signatures. This efficiency enhances the overall transaction experience for both buyers and sellers.

Get more for Land Transfer Tax Affidavit

- Foc motion county form

- Psi packet michigan form

- Motion and order for discharge from probation michigan form

- Residence history form

- Business tax returns for the past 7 years or period of form

- Mn accommodations request form

- Marriage fee educators statement form

- Minnesota state board of law examiners contact form

Find out other Land Transfer Tax Affidavit

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed