Individual Characteristics Form ICF Work State of Michigan Michigan

Understanding the Individual Characteristics Form ICF Work State of Michigan

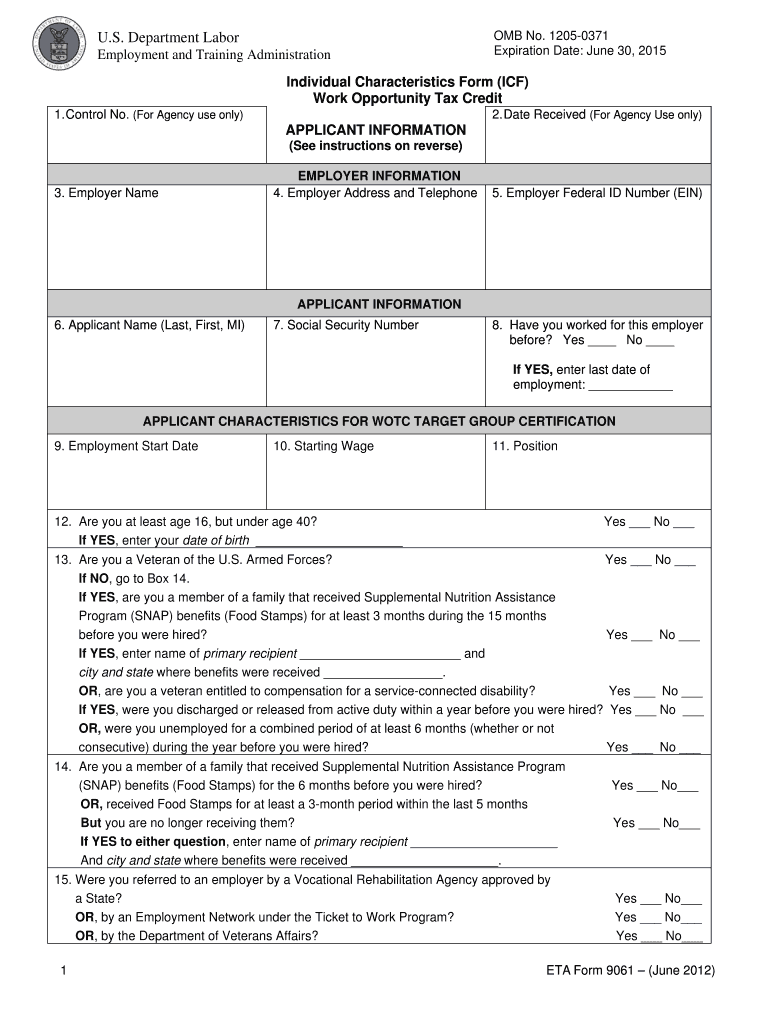

The Individual Characteristics Form (ICF) is a crucial document used within the State of Michigan for various purposes, including assessments and eligibility determinations. This form collects essential personal information that helps organizations understand the unique characteristics of individuals. It is particularly relevant in contexts such as social services, healthcare, and educational assessments.

How to Use the Individual Characteristics Form ICF Work State of Michigan

Using the Individual Characteristics Form involves several steps to ensure accurate and effective completion. First, gather all necessary personal information, including demographic details and any relevant background information. Next, fill out the form carefully, ensuring that all sections are completed as required. Finally, submit the form according to the specific guidelines provided by the organization requesting it, which may include online submission or mailing a physical copy.

Steps to Complete the Individual Characteristics Form ICF Work State of Michigan

Completing the Individual Characteristics Form requires attention to detail. Begin by reading the instructions thoroughly to understand what information is needed. Follow these steps:

- Provide personal identification details, such as your name, address, and date of birth.

- Fill in sections regarding educational background and employment history, if applicable.

- Include any additional information that may be relevant to the purpose of the form.

- Review the completed form for accuracy and completeness before submission.

Legal Use of the Individual Characteristics Form ICF Work State of Michigan

The legal use of the Individual Characteristics Form is governed by various regulations that ensure its validity and compliance with state laws. When completed correctly, the form serves as an official document that can be used in legal and administrative processes. It is important to understand that any misinformation or incomplete submissions may lead to legal repercussions or delays in processing.

Key Elements of the Individual Characteristics Form ICF Work State of Michigan

Several key elements make up the Individual Characteristics Form. These include:

- Personal Information: Essential details like name, address, and contact information.

- Demographic Data: Information regarding age, gender, and ethnicity.

- Background Information: Educational and employment history relevant to the form's purpose.

- Signature: A declaration that the information provided is accurate and complete.

State-Specific Rules for the Individual Characteristics Form ICF Work State of Michigan

Michigan has specific rules governing the use and submission of the Individual Characteristics Form. These rules may include deadlines for submission, required documentation, and procedures for updating information. It is essential to familiarize yourself with these regulations to ensure compliance and avoid any potential issues.

Quick guide on how to complete individual characteristics form icf work state of michigan michigan

Complete Individual Characteristics Form ICF Work State Of Michigan Michigan effortlessly on any gadget

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools you require to create, amend, and eSign your documents quickly without delays. Manage Individual Characteristics Form ICF Work State Of Michigan Michigan on any gadget with airSlate SignNow Android or iOS applications and enhance any document-focused activity today.

The easiest way to modify and eSign Individual Characteristics Form ICF Work State Of Michigan Michigan with ease

- Locate Individual Characteristics Form ICF Work State Of Michigan Michigan and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method of submitting your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate producing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Individual Characteristics Form ICF Work State Of Michigan Michigan and ensure excellent communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How will the passage of "right to work" measures in Michigan affect the state economy?

It's not clear yet what kind of impact the new legislation will have, particularly given the structural problems associated with Michigan (state)'s heavily manufacturing-based economy.There's no question that "Right to Work" laws, by design, weaken Labor Unions' influence. But how unions' influence impacts workers is a narrower question than how the new law will affect the state's economy.Unions have many impacts on workers, including maintaining strong protections for incumbents and accompanying hostility to new entrants. While it might be true that average wages in right-to-work states go down, as Dave Hogg outlines, it's also true that the "average wages" statistics don't account for workers that are unable to find jobs - and that's a particularly bad problem in Michigan now, as it is in most of the rest of the U.S. To the extent that the new law encourages employment in Michigan, it's definitely a good thing.Don't believe me? Here's Google's Unemployment Rate chart for Michigan and for the U.S., from 2000 to the most recent data (Note: I didn't pick 2000 for any reason aside from showing some context for the current numbers):Michigan's been hit hard by the The Great Recession (2007–2012), and still has an unemployment rate higher than the rest of the U.S. And this isn't a problem that's going to be fixed easily given its large manufacturing industry - mass-employment manufacturing is difficult to maintain in the U.S., and we have a long-term economic trend of offshoring that kind of work to cheaper locales. That's not going to change, not in this global economy, no matter what unions do.Further, if unions raise average wages at the cost of higher unemployment rates, that's a public policy problem that this law will arguably address. Unemployment, particularly in the long-term, is insanely harmful to workers, and I'm not convinced that it's a better outcome to have union members enjoying relatively higher wages while non-members face higher unemployment rates. (I'm also well aware that the comparison between alternatives is never that stark, but that's why this is a particularly difficult policy issue: if it was easy, we'd have solved it).Some obvious drawbacks to the law include reduced union influence (though to the state legislators, that's obviously a feature, not a bug), and possibly lower wages, on average. But even the Washington Post article that Dave linked suggesting that result (also available here: What do ‘right-to-work’ laws do to a state’s economy?) says as one of its major points that "The broader economic effects of right-to-work laws are often difficult to disentangle." And this is true of much economic policy making: the The Economy of the United States of America is so big and so complex that it's a rarity that a given economic result may be attributable to a single cause.I think Michigan's problems are much bigger than union membership, and we'll have to wait to see definitively what happens as a result of this new law. But I'd suggest that any apocalyptic political rhetoric you're hearing is way overblown. If this change is truly a bad outcome, the voters will elect representatives that will vote to reverse it. (Democracy works!)

-

Could an expert tell me how an out of state executor from Washington can legally transfer pistols and rifles which are located in Michigan and to be sold in Michigan?

I am not an expert on Michigan law, but i can read the instructions. I suggest the executor begin by going to the Michigan State Police web site, MSP - Firearmswhere there is a link to a compilation of firearms laws. http://www.legislature.mi.gov/do...Page 8 of that says:8) This section does not prevent the transfer of ownership of pistols to an heir or devisee, whether by testamentary bequest or by the laws of intestacy regardless of whether the pistol is registered with this state. An individual who has inherited a pistol shall obtain a license as required in this section within 30 days of taking physical possession of the pistol. The license may be signed by a next of kin of the decedent or the person authorized to dispose of property under the estates and protected individuals code, 1998 PA 386, MCL 700.1101 to 700.8206, including when the next of kin is the individual inheriting the pistol. If the heir or devisee is not qualified for a license under this section, the heir or devisee may direct the next of kin or person authorized to dispose of property under the estates and protected individuals code, 1998 PA 386, MCL 700.1101 to 700.8206, to dispose of the pistol in any manner that is lawful and the heir or devisee considers appropriate. The person authorized to dispose of property under the estates and protected individuals code, 1998 PA 386, MCL 700.1101 to 700.8206, is not required to obtain a license under this section if he or she takes temporary lawful possession of the pistol in the process of disposing of the pistol pursuant to the decedent’s testamentary bequest or the laws ofand so on.If the executor is still nervous I suggest he or she get advice from a member of the Michigan bar.

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

Which ITR form should I fill for payments received from the USA to a salaried individual in India for freelancing work, and how should I declare this in ITR? There is no TDS record of this payment as it is outside India.

You can use ITR-1 to show it as Income from Other SOurcesIf you want to claim expense against this income, then you are better off showing it in ITR-2 again as Income from Other Sources. In this case dont claim too many expenses against Income from Other Sources because that usually triggers a scrutinyIf this is going to be regular, then you will need to fill ITR-3 and show this as Income from Business/Profession. The negative of this ITR is that it is quite voluminous and you will have to prepare a Balance Sheet and Profit and loss account even if your income from this source exceeds an amount as low as Rs. 1,20,000/-.

-

How does one run for president in the united states, is there some kind of form to fill out or can you just have a huge fan base who would vote for you?

If you’re seeking the nomination of a major party, you have to go through the process of getting enough delegates to the party’s national convention to win the nomination. This explains that process:If you’re not running as a Democrat or Republican, you’ll need to get on the ballot in the various states. Each state has its own rules for getting on the ballot — in a few states, all you have to do is have a slate of presidential electors. In others, you need to collect hundreds or thousands of signatures of registered voters.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the individual characteristics form icf work state of michigan michigan

How to make an electronic signature for your Individual Characteristics Form Icf Work State Of Michigan Michigan in the online mode

How to create an electronic signature for your Individual Characteristics Form Icf Work State Of Michigan Michigan in Chrome

How to make an electronic signature for signing the Individual Characteristics Form Icf Work State Of Michigan Michigan in Gmail

How to create an eSignature for the Individual Characteristics Form Icf Work State Of Michigan Michigan straight from your smart phone

How to generate an eSignature for the Individual Characteristics Form Icf Work State Of Michigan Michigan on iOS

How to create an electronic signature for the Individual Characteristics Form Icf Work State Of Michigan Michigan on Android devices

People also ask

-

What is an individual characteristics form?

An individual characteristics form is a document that collects specific personal attributes or details about an individual. It is often used for various purposes such as onboarding, surveys, or assessments. Utilizing airSlate SignNow, you can easily create and send this form for electronic signing.

-

How does airSlate SignNow help with the individual characteristics form?

airSlate SignNow simplifies the process of creating and managing individual characteristics forms by providing customizable templates and intuitive tools. You can quickly modify your form to fit your specific needs and ensure that it captures all necessary information. Additionally, the platform allows for seamless e-signing, making the process efficient and secure.

-

Is there a cost associated with using airSlate SignNow for individual characteristics forms?

Yes, airSlate SignNow offers various pricing plans, allowing you to choose one that fits your budget and needs for managing individual characteristics forms. Each plan provides different features and benefits, ensuring you can find the best solution for your organization. You can review the pricing options on our website to determine the best fit for your requirements.

-

What features does airSlate SignNow offer for individual characteristics forms?

airSlate SignNow provides a range of features for individual characteristics forms, including customizable templates, secure electronic signatures, and real-time tracking. You can also easily integrate this solution with various third-party applications to enhance your workflow further. These features are designed to streamline your document management processes and improve overall efficiency.

-

Can I integrate airSlate SignNow with other tools for my individual characteristics form?

Absolutely! airSlate SignNow supports various integrations with popular tools and applications that can enhance how you handle individual characteristics forms. Whether you need to connect with CRMs, cloud storage services, or other documents management systems, our integrations make it easy to create a seamless workflow tailored to your business needs.

-

How secure is the individual characteristics form when using airSlate SignNow?

The security of your individual characteristics form is a top priority at airSlate SignNow. The platform employs advanced encryption and compliance features to ensure that all data is protected during the signing process. This commitment to security helps you maintain confidentiality and protect sensitive information when managing your forms.

-

Can I track responses to my individual characteristics form in airSlate SignNow?

Yes, airSlate SignNow allows you to track responses to your individual characteristics form in real time. You can see when recipients view and sign the document, helping you manage your workflow efficiently. This feature is vital for keeping your projects on schedule and ensuring all necessary steps are completed.

Get more for Individual Characteristics Form ICF Work State Of Michigan Michigan

- Personal health record template 536242863 form

- Practice what you teach travel consent form prometour

- Allied universal orientation test answers form

- Va form 21 0960p 4

- Huddle meeting agenda fca resources form

- Crapaud community curling club form

- Oxygen prescription form

- Schedule i nebraska adjustments to income form

Find out other Individual Characteristics Form ICF Work State Of Michigan Michigan

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form