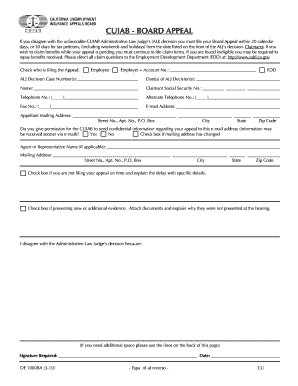

DE 1000BA State of California Form

What is the DE 1000BA State Of California

The DE 1000BA State Of California form is a critical document used primarily for reporting the wages and taxes of employees in California. This form is essential for employers who need to comply with state regulations regarding payroll reporting. It provides a detailed account of employee earnings, deductions, and tax withholdings, ensuring that both employers and employees meet their tax obligations. Understanding the purpose and requirements of this form is vital for maintaining compliance with California's employment laws.

How to use the DE 1000BA State Of California

Using the DE 1000BA State Of California form involves several key steps. First, employers must gather all necessary information about their employees, including Social Security numbers, wage details, and tax withholdings. Once the information is compiled, it should be entered accurately into the form. Employers can complete the form digitally, which streamlines the process and reduces the likelihood of errors. After filling out the form, it must be submitted to the appropriate state agency, either electronically or via mail, depending on the employer's preference and compliance requirements.

Steps to complete the DE 1000BA State Of California

Completing the DE 1000BA State Of California form requires careful attention to detail. Follow these steps to ensure accurate submission:

- Gather employee information, including names, addresses, and Social Security numbers.

- Collect wage data for the reporting period, including gross pay, deductions, and net pay.

- Fill out the form, ensuring all information is entered correctly and completely.

- Review the form for any errors or omissions before submission.

- Submit the completed form electronically or by mail, depending on your chosen method.

Legal use of the DE 1000BA State Of California

The DE 1000BA State Of California form is legally binding when completed and submitted according to state regulations. It serves as an official record of employee wages and tax withholdings, which can be referenced in audits or legal proceedings. Employers must ensure that the form is filled out accurately to avoid potential penalties. Compliance with state laws regarding payroll reporting is essential for maintaining good standing with tax authorities and avoiding legal complications.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines for the DE 1000BA State Of California form to remain compliant with state regulations. Typically, the form is due on a quarterly basis, with deadlines falling at the end of the month following the close of each quarter. For example, the deadlines for the first quarter would be April 30, for the second quarter July 31, for the third quarter October 31, and for the fourth quarter January 31 of the following year. Staying aware of these dates is crucial for timely submissions and avoiding penalties.

Who Issues the Form

The DE 1000BA State Of California form is issued by the California Employment Development Department (EDD). This state agency is responsible for managing unemployment insurance, disability insurance, and payroll tax programs. Employers can access the form through the EDD's official website or by contacting their office for assistance. It is important for employers to use the most current version of the form to ensure compliance with any updates in state regulations.

Quick guide on how to complete de 1000ba state of california

Accomplish DE 1000BA State Of California effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents promptly without delays. Manage DE 1000BA State Of California on any device using the airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

How to modify and eSign DE 1000BA State Of California without any hassle

- Find DE 1000BA State Of California and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive details using tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your adjustments.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Quit worrying about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign DE 1000BA State Of California and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the de 1000ba state of california

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the DE 1000BA State Of California form?

The DE 1000BA State Of California form is a crucial document used for filing business taxes in California. It helps businesses comply with state requirements and provides detailed information for tax assessment. Understanding this form is essential for any business operating within California.

-

How does airSlate SignNow support the DE 1000BA State Of California filing process?

airSlate SignNow streamlines the process of filing the DE 1000BA State Of California by allowing users to eSign documents digitally. This saves time and reduces the need for physical paperwork, ensuring compliance with California's regulations. Our platform simplifies the entire process, making it user-friendly and efficient.

-

What are the pricing options for using airSlate SignNow with the DE 1000BA State Of California?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes, making it affordable to manage the DE 1000BA State Of California filings. Plans vary based on features, including the number of documents and users. We provide transparent pricing, so you know exactly what to expect without hidden fees.

-

Are there any integrations available with airSlate SignNow for handling DE 1000BA State Of California forms?

Yes, airSlate SignNow integrates seamlessly with various applications to handle DE 1000BA State Of California forms efficiently. Integrate with tools like Google Drive, Dropbox, and others to access your documents easily. This enhances your workflow, ensuring a hassle-free experience when managing important tax-related documentation.

-

What benefits does airSlate SignNow offer for businesses completing the DE 1000BA State Of California?

By using airSlate SignNow for the DE 1000BA State Of California, businesses can enjoy faster turnaround times and increased security for their documents. The platform ensures that all signatures are legally binding and encrypted, which is crucial for compliance. Additionally, our easy-to-use interface allows anyone in your organization to navigate the process effortlessly.

-

Is airSlate SignNow compliant with California regulations for the DE 1000BA?

Yes, airSlate SignNow is designed to comply with California’s regulations regarding the DE 1000BA State Of California. We prioritize legal compliance and maintain high-security standards to ensure your documents are handled appropriately. This dedication makes us a trusted solution for businesses dealing with state tax forms.

-

How can I get started with airSlate SignNow for my DE 1000BA State Of California documents?

Getting started with airSlate SignNow for your DE 1000BA State Of California documents is simple. Sign up for a free trial on our website to explore the features we offer. Once you create your account, you can begin uploading documents and utilizing our eSigning capabilities immediately.

Get more for DE 1000BA State Of California

Find out other DE 1000BA State Of California

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document