0708 NYS ST 809 Tax Ny Form

Understanding the NYS ST 809 Form

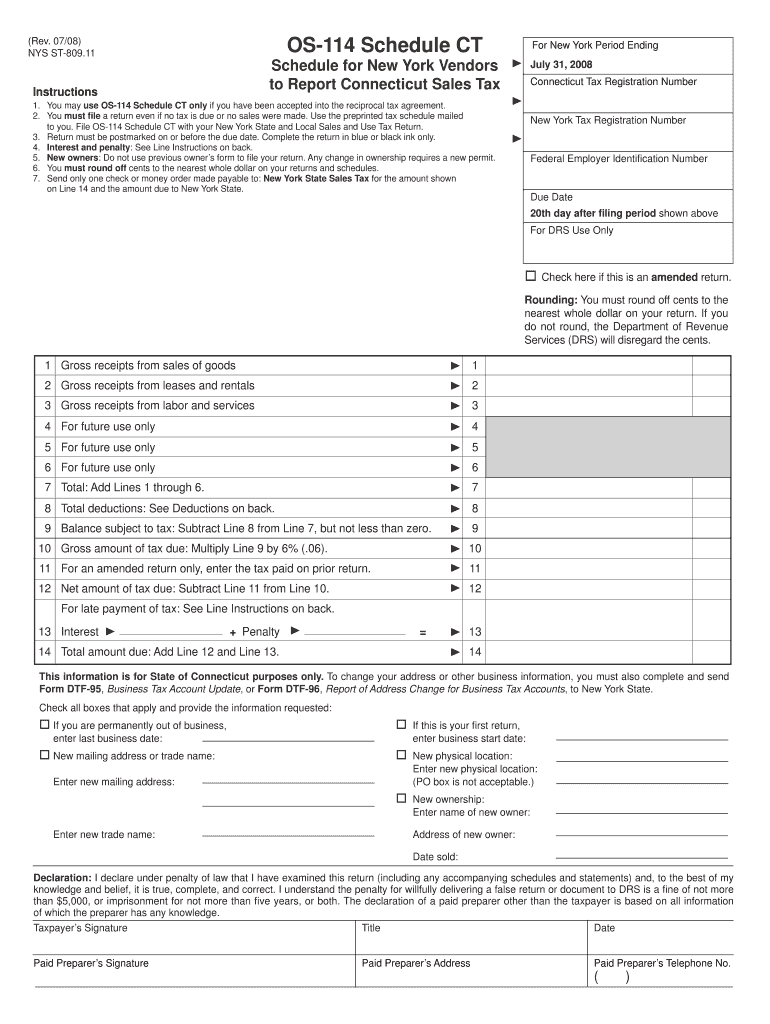

The NYS ST 809 form, also known as the 809 form, is a tax document used in New York State. It is primarily utilized for sales tax exemption purposes. This form allows certain organizations, such as non-profits and government entities, to purchase goods and services without paying sales tax. Understanding the specific requirements and implications of the ST 809 form is crucial for eligible entities to ensure compliance and maximize their tax benefits.

Steps to Complete the NYS ST 809 Form

Completing the NYS ST 809 form requires careful attention to detail. Here are the essential steps:

- Begin by downloading the form from the New York State Department of Taxation and Finance website.

- Fill out the required fields, including the name and address of the purchaser, the type of organization, and the purpose of the purchase.

- Clearly indicate the items being purchased and their intended use.

- Sign and date the form to certify its accuracy.

- Keep a copy for your records and provide the original to the vendor at the time of purchase.

Legal Use of the NYS ST 809 Form

The NYS ST 809 form is legally binding when completed accurately and used for its intended purpose. It is essential to ensure that the organization qualifies for sales tax exemption under New York State law. Misuse of the form can result in penalties, including the requirement to pay back taxes. Organizations should familiarize themselves with the legal stipulations surrounding the form to avoid compliance issues.

Required Documents for the NYS ST 809 Form

When completing the NYS ST 809 form, certain documents may be necessary to support the exemption claim. These include:

- Proof of the organization's tax-exempt status, such as a determination letter from the IRS.

- Documentation that outlines the purpose of the purchases.

- Any additional forms or identification required by the vendor.

Filing Deadlines and Important Dates for the NYS ST 809 Form

While the NYS ST 809 form is not submitted to the state, it is important to be aware of any deadlines related to tax-exempt purchases. Vendors may have their own policies regarding the acceptance of the ST 809 form, so it is advisable to check with them ahead of time. Additionally, organizations should maintain accurate records of all transactions made using the form for tax reporting purposes.

Examples of Using the NYS ST 809 Form

Organizations can use the NYS ST 809 form in various scenarios. For instance:

- A non-profit organization purchasing office supplies for its operations.

- A government agency acquiring equipment for public use.

- A school purchasing educational materials for classroom use.

In each case, the form allows these entities to avoid paying sales tax, thereby maximizing their budgets for essential services.

Quick guide on how to complete 0708 nys st 809 tax ny

Effortlessly Prepare 0708 NYS ST 809 Tax Ny on Any Device

The management of online documents has become increasingly favored by both businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and seamlessly. Manage 0708 NYS ST 809 Tax Ny from any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Modify and eSign 0708 NYS ST 809 Tax Ny with Ease

- Find 0708 NYS ST 809 Tax Ny and click on Get Form to begin.

- Utilize the tools provided to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, invite link, or downloading it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or errors that require new printouts. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign 0708 NYS ST 809 Tax Ny to ensure effective communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

Which areas are considered part of Yonkers when applying for a job in NY state? I noticed there's a separate tax form to fill out where you check off if you presently live in Yonkers or not. Are Tuckahoe and/or Crestwood included?

Crestwood IS a neighborhood in the city of Yonkers. Tuckahoe is NOT. Tuckahoe is a village in the town of Eastchester. Tuckahoe Road however is a street in Yonkers. It does not run through any other municipality. Another way for you to tell if you live in the city of Yonkers is if Mayor Mike Spano is your mayor. If he is, you are a resident of Yonkers.

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

Create this form in 5 minutes!

How to create an eSignature for the 0708 nys st 809 tax ny

How to make an eSignature for the 0708 Nys St 809 Tax Ny in the online mode

How to make an eSignature for your 0708 Nys St 809 Tax Ny in Chrome

How to make an electronic signature for signing the 0708 Nys St 809 Tax Ny in Gmail

How to create an electronic signature for the 0708 Nys St 809 Tax Ny straight from your smartphone

How to generate an eSignature for the 0708 Nys St 809 Tax Ny on iOS devices

How to generate an electronic signature for the 0708 Nys St 809 Tax Ny on Android

People also ask

-

What is the st 809 form used for?

The st 809 form is typically used for specific tax and business documentation purposes. Businesses need this form to ensure compliance with regulations and properly document transactions. airSlate SignNow makes it easy to complete and eSign the st 809 form electronically.

-

How does airSlate SignNow simplify the completion of the st 809?

With airSlate SignNow, the completion of the st 809 is streamlined through our user-friendly interface. You can easily fill out the form online, track its progress, and securely eSign it. This saves time and reduces the hassle associated with traditional paper processes.

-

Is airSlate SignNow affordable for businesses needing the st 809?

Yes, airSlate SignNow offers competitive pricing plans tailored for businesses that need to manage documents like the st 809. Our cost-effective solution means you can handle your documentation needs without stretching your budget. You can choose a plan that fits your usage and requirements.

-

What features does airSlate SignNow provide for managing documents like the st 809?

airSlate SignNow includes features like electronic signatures, document templates, and real-time tracking for forms like the st 809. These features enhance efficiency and security, making it easier to manage your documents from start to finish. You can maintain an organized flow and get documents signed faster.

-

Can I integrate airSlate SignNow with other applications for st 809 management?

Yes, airSlate SignNow easily integrates with a variety of applications to help you manage your st 809 and other documents. Common integrations include CRM systems, cloud storage services, and productivity tools. This enables a seamless workflow and a more connected document management process.

-

How secure is my information when using airSlate SignNow for the st 809?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like the st 809. We use industry-standard encryption and security protocols to protect your data. You can be confident that your information is safe and secure during the entire documentation process.

-

Can st 809 documents be edited after they are eSigned?

Once the st 809 document has been eSigned in airSlate SignNow, it cannot be edited to ensure the integrity of the signed document. However, if changes are needed, you can create a new version or use the template feature to make adjustments while keeping track of previous versions.

Get more for 0708 NYS ST 809 Tax Ny

- Us department justice omb 1115 0062 form

- Checklist for end of tenancy cleaning form

- Exam cover page template word form

- Sa reserve bank forms p65

- Metric conversion worksheet 1 answer key form

- Personal holding company form

- Tc 502 application to cancel registration forms ampamp publications

- Fl 100 petitionmarriagedomestic partnership form

Find out other 0708 NYS ST 809 Tax Ny

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free