Personal Holding Company 2024-2026

What is the Personal Holding Company

A Personal Holding Company (PHC) is a specific type of corporation that primarily holds passive income-generating assets, such as stocks, bonds, and real estate. In the United States, a PHC is subject to unique tax regulations under the Internal Revenue Code. To qualify as a PHC, a corporation must meet certain criteria, including the requirement that at least 60% of its adjusted ordinary gross income consists of passive income. This structure can be beneficial for individuals looking to manage their investments and minimize tax liabilities.

How to use the Personal Holding Company

Utilizing a Personal Holding Company can provide various advantages, particularly in managing investments and income. By establishing a PHC, individuals can consolidate their passive income streams, which can lead to more efficient tax management. The income generated within the PHC can be retained and reinvested without immediate taxation at the individual level. This allows for strategic investment decisions while potentially deferring personal tax obligations until distributions are made.

Key elements of the Personal Holding Company

Understanding the key elements of a Personal Holding Company is crucial for effective management. These elements include:

- Income Composition: At least 60% of the company's income must come from passive sources.

- Ownership Structure: Typically owned by a small number of individuals, often family members.

- Tax Implications: PHCs face specific tax rates on undistributed income, which can influence financial planning.

- Regulatory Compliance: Adhering to IRS guidelines is essential to maintain PHC status and avoid penalties.

IRS Guidelines

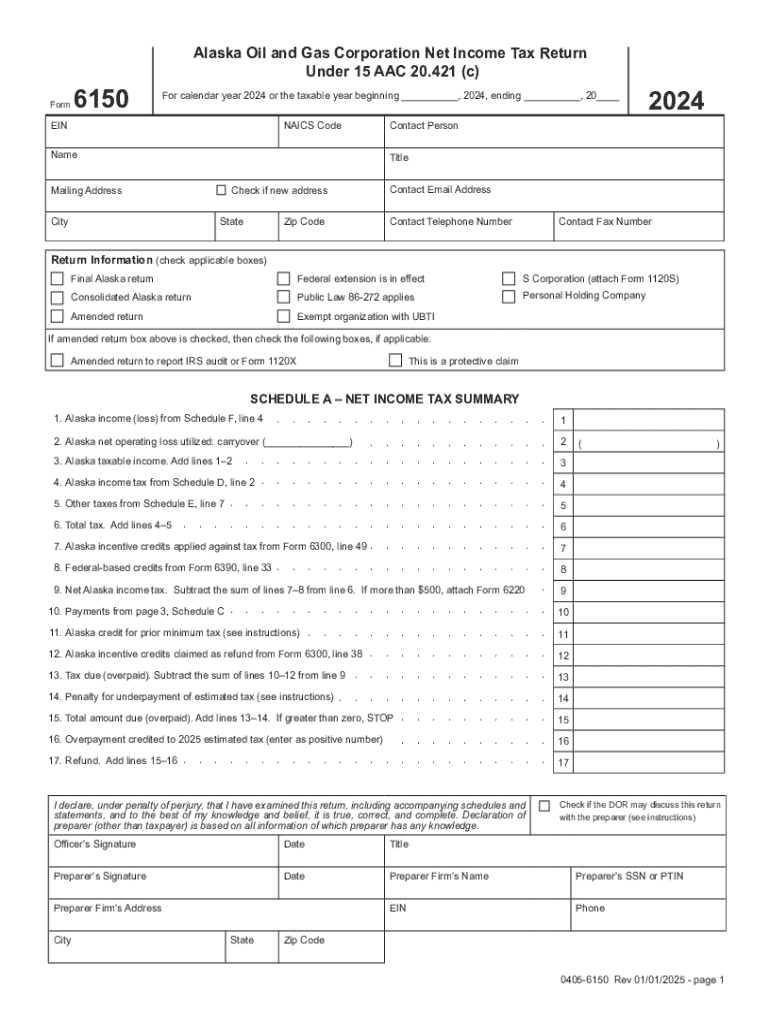

The Internal Revenue Service (IRS) provides specific guidelines regarding Personal Holding Companies. These guidelines outline the requirements for qualification, tax treatment, and reporting obligations. Corporations must file Form 1120, U.S. Corporation Income Tax Return, and indicate their status as a PHC. Additionally, the IRS monitors compliance with the passive income requirements and the distribution of earnings to shareholders. Failure to adhere to these guidelines can result in significant tax penalties.

Required Documents

To establish and maintain a Personal Holding Company, several documents are necessary. Key documents include:

- Articles of Incorporation: This foundational document outlines the company's purpose and structure.

- Bylaws: Internal rules governing the management and operation of the PHC.

- Tax Returns: Annual Form 1120 filings that report income, deductions, and tax liabilities.

- Meeting Minutes: Records of shareholder and board meetings, which are important for governance and compliance.

Eligibility Criteria

Eligibility to form a Personal Holding Company involves meeting specific criteria set by the IRS. These include:

- The corporation must be a domestic corporation.

- At least 50% of the stock must be owned by five or fewer individuals.

- At least 60% of the corporation's adjusted ordinary gross income must come from passive sources.

Individuals considering this structure should evaluate their income sources and ownership arrangements to ensure compliance with these eligibility requirements.

Create this form in 5 minutes or less

Find and fill out the correct personal holding company

Create this form in 5 minutes!

How to create an eSignature for the personal holding company

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Personal Holding Company?

A Personal Holding Company is a type of corporation that primarily holds and manages investments or assets. It allows individuals to consolidate their investments under one entity, providing potential tax benefits and simplified management. Understanding how a Personal Holding Company works can help you make informed decisions about your financial strategy.

-

How can airSlate SignNow benefit my Personal Holding Company?

airSlate SignNow offers a streamlined solution for sending and eSigning documents, which is essential for managing a Personal Holding Company. With its user-friendly interface, you can easily handle contracts, agreements, and other important documents. This efficiency can save you time and reduce administrative burdens.

-

What features does airSlate SignNow provide for Personal Holding Companies?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for a Personal Holding Company. These tools help ensure that your documents are handled efficiently and securely. Additionally, the platform supports collaboration, making it easier to work with advisors or partners.

-

Is airSlate SignNow cost-effective for a Personal Holding Company?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses, including Personal Holding Companies. With various pricing plans available, you can choose one that fits your budget while still accessing essential features. This affordability allows you to manage your documents without overspending.

-

Can I integrate airSlate SignNow with other tools for my Personal Holding Company?

Absolutely! airSlate SignNow offers integrations with various applications that can enhance the functionality of your Personal Holding Company. Whether you use accounting software or project management tools, these integrations can streamline your workflow and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for document management in a Personal Holding Company?

Using airSlate SignNow for document management in your Personal Holding Company provides numerous benefits, including enhanced security, ease of access, and improved collaboration. The platform ensures that your sensitive documents are protected while allowing you to access them from anywhere. This flexibility is crucial for managing your investments effectively.

-

How does airSlate SignNow ensure the security of documents for a Personal Holding Company?

airSlate SignNow prioritizes security with features like encryption, secure cloud storage, and compliance with industry standards. This ensures that all documents related to your Personal Holding Company are protected from unauthorized access. You can have peace of mind knowing that your sensitive information is safe.

Get more for Personal Holding Company

- Property tax exemptions form 2002

- State form 56305

- Reciprocal nonresident indiana individual income tax return yours a form

- Bt 1 form 43760 2014

- Np 20 indiana nonprofit organizationamp39s annual report law latte form

- State form 44468 rps

- K40 2011 form

- K 59 kansas high performance incentive program hpip credits

Find out other Personal Holding Company

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online