You May Use OS 114 Schedule CT Only If You Have Been Accepted into the Reciprocal Tax Agreement Tax Ny Form

What is the You May Use OS 114 Schedule CT Only If You Have Been Accepted Into The Reciprocal Tax Agreement Tax Ny

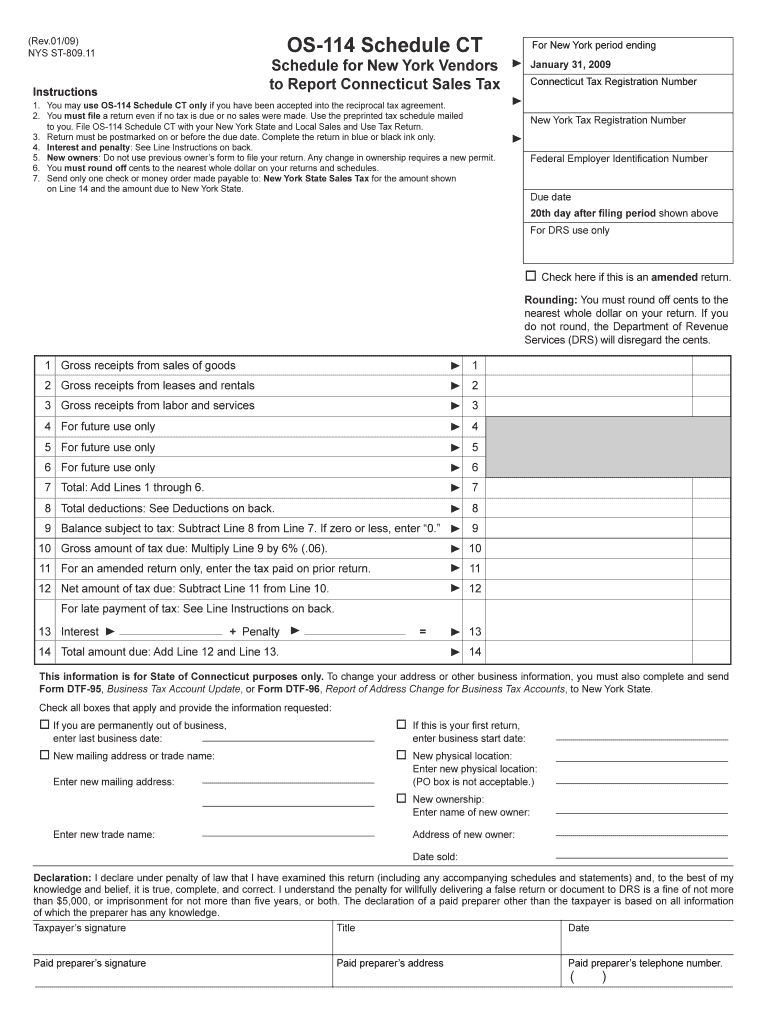

The OS 114 Schedule CT is a specific tax form utilized by individuals who have been accepted into the Reciprocal Tax Agreement in New York. This agreement allows residents of certain states to avoid double taxation on income earned in New York. The form is essential for claiming a credit for taxes paid to other states, ensuring that taxpayers are not unfairly taxed on the same income. Understanding this form is crucial for compliance with state tax regulations and for maximizing potential tax benefits.

How to use the You May Use OS 114 Schedule CT Only If You Have Been Accepted Into The Reciprocal Tax Agreement Tax Ny

To effectively use the OS 114 Schedule CT, first confirm your acceptance into the Reciprocal Tax Agreement. Once verified, gather all necessary documentation, including proof of income and taxes paid to your home state. Complete the form by accurately reporting your income and the taxes paid. Ensure all sections are filled out correctly to avoid delays in processing. After completion, submit the form alongside your New York state tax return to ensure you receive the appropriate tax credits.

Steps to complete the You May Use OS 114 Schedule CT Only If You Have Been Accepted Into The Reciprocal Tax Agreement Tax Ny

Completing the OS 114 Schedule CT involves several key steps:

- Verify your acceptance into the Reciprocal Tax Agreement.

- Collect relevant documents, including W-2s and 1099s.

- Fill out the OS 114 Schedule CT with accurate income figures.

- Calculate the taxes paid to your home state.

- Double-check all entries for accuracy.

- Attach the completed form to your New York state tax return.

- Submit your tax return by the designated filing deadline.

Legal use of the You May Use OS 114 Schedule CT Only If You Have Been Accepted Into The Reciprocal Tax Agreement Tax Ny

The legal use of the OS 114 Schedule CT is governed by New York state tax laws. This form must be used only by individuals who have been accepted into the Reciprocal Tax Agreement. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies could lead to penalties or audits. The form serves as a legal document that supports your claim for tax credits, making its proper use vital for compliance.

Eligibility Criteria

To be eligible to use the OS 114 Schedule CT, you must meet specific criteria. First, you need to be a resident of New York or have income sourced from New York. Additionally, you must have been accepted into the Reciprocal Tax Agreement, which typically involves residing in a state that has a tax agreement with New York. Ensure you have documentation that verifies your acceptance and the taxes paid to your home state to complete the form successfully.

Required Documents

When preparing to complete the OS 114 Schedule CT, gather the necessary documents to support your claims. Required documents typically include:

- W-2 forms from your employer(s).

- 1099 forms for any additional income.

- Proof of taxes paid to your home state.

- Any correspondence from the tax authority regarding your acceptance into the Reciprocal Tax Agreement.

Having these documents ready will facilitate a smoother completion process and ensure that your claims are substantiated.

Quick guide on how to complete you may use os 114 schedule ct only if you have been accepted into the reciprocal tax agreement tax ny

Easily Prepare [SKS] on Any Device

Managing documents online has gained signNow traction among companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents promptly without any delays. Handle [SKS] on any device with the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to Edit and eSign [SKS] Effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize relevant parts of your documents or redact sensitive information using features that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your amendments.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign [SKS] to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to You May Use OS 114 Schedule CT Only If You Have Been Accepted Into The Reciprocal Tax Agreement Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the you may use os 114 schedule ct only if you have been accepted into the reciprocal tax agreement tax ny

How to create an eSignature for your You May Use Os 114 Schedule Ct Only If You Have Been Accepted Into The Reciprocal Tax Agreement Tax Ny online

How to create an eSignature for your You May Use Os 114 Schedule Ct Only If You Have Been Accepted Into The Reciprocal Tax Agreement Tax Ny in Chrome

How to generate an electronic signature for putting it on the You May Use Os 114 Schedule Ct Only If You Have Been Accepted Into The Reciprocal Tax Agreement Tax Ny in Gmail

How to make an electronic signature for the You May Use Os 114 Schedule Ct Only If You Have Been Accepted Into The Reciprocal Tax Agreement Tax Ny straight from your smart phone

How to create an eSignature for the You May Use Os 114 Schedule Ct Only If You Have Been Accepted Into The Reciprocal Tax Agreement Tax Ny on iOS devices

How to make an electronic signature for the You May Use Os 114 Schedule Ct Only If You Have Been Accepted Into The Reciprocal Tax Agreement Tax Ny on Android devices

People also ask

-

What is OS 114 Schedule CT and who can use it?

OS 114 Schedule CT is a tax form used for individuals who have been accepted into the Reciprocal Tax Agreement Tax NY. You may use OS 114 Schedule CT only if you have been accepted into this agreement, allowing you to avoid double taxation on your income.

-

How do I know if I am eligible to use OS 114 Schedule CT?

You may use OS 114 Schedule CT only if you have been accepted into the Reciprocal Tax Agreement Tax NY. Check with your tax authority for your acceptance status or consult tax professionals for guidance.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow provides features like electronic signatures, document templates, and secure cloud storage. This makes it easier for users to manage their documents efficiently, especially if they need to use OS 114 Schedule CT after acceptance into the Reciprocal Tax Agreement Tax NY.

-

Is airSlate SignNow cost-effective for businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. With its affordable pricing plans, you can streamline your documentation process, which is especially useful if you may use OS 114 Schedule CT only if accepted into the Reciprocal Tax Agreement Tax NY.

-

Can I integrate airSlate SignNow with other software applications?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow. This is beneficial for businesses that need to prepare and sign OS 114 Schedule CT forms efficiently after acceptance into the Reciprocal Tax Agreement Tax NY.

-

What are the benefits of using airSlate SignNow for my document signing needs?

The benefits of using airSlate SignNow include increased efficiency, reduced paperwork, and enhanced security for your documents. For those who need access to OS 114 Schedule CT, these features ensure that your forms are processed smoothly after you have been accepted into the Reciprocal Tax Agreement Tax NY.

-

How secure is the eSigning process with airSlate SignNow?

airSlate SignNow employs advanced security measures to protect your documents and signatures. This is crucial for those who may use OS 114 Schedule CT only if accepted into the Reciprocal Tax Agreement Tax NY, ensuring your sensitive information is kept safe.

Get more for You May Use OS 114 Schedule CT Only If You Have Been Accepted Into The Reciprocal Tax Agreement Tax Ny

- Oklahoma backup withholding form

- Antrag auf ausstellung einer negativbescheinigung bzw auskunft landkreis rostock form

- Nyc component units financial statements office of the new york form

- Solutions worksheet answer key form

- Gsis naga form

- Tb xray ala moana form

- Law related employment affidavit form

- Sap treasury and risk management pdf form

Find out other You May Use OS 114 Schedule CT Only If You Have Been Accepted Into The Reciprocal Tax Agreement Tax Ny

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple