Petition Form 1 Tax Court Help

What is the Petition Form 1 Tax Court Help

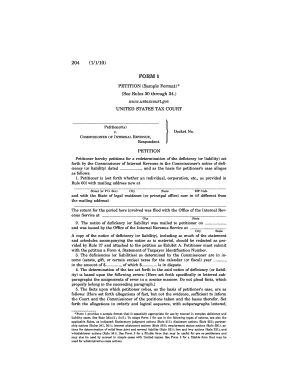

The Petition Form 1 Tax Court Help is a legal document used by individuals to initiate a case in the United States Tax Court. This form allows taxpayers to challenge decisions made by the Internal Revenue Service (IRS) regarding tax disputes, such as audits, tax assessments, or penalties. Completing this form is essential for taxpayers seeking to resolve their tax issues through the judicial system. It serves as the foundation for presenting one’s case and requires accurate information to ensure proper processing by the court.

Steps to Complete the Petition Form 1 Tax Court Help

Completing the Petition Form 1 Tax Court Help involves several key steps:

- Gather necessary information: Collect all relevant details, including your personal information, tax year in question, and the specific IRS action you are disputing.

- Fill out the form: Carefully complete each section of the petition, ensuring that all information is accurate and clearly presented.

- Review for errors: Double-check the form for any mistakes or omissions. This step is crucial to avoid delays in processing.

- Sign and date: Ensure that you sign and date the petition where required, as an unsigned form may be rejected.

Legal Use of the Petition Form 1 Tax Court Help

The legal use of the Petition Form 1 Tax Court Help is governed by federal tax law. This form must be filed within a specific timeframe after receiving a notice from the IRS, typically within ninety days. Filing the petition correctly and on time is essential for maintaining your right to contest the IRS's determination. The form serves as a formal request for the court to review the case, making it a critical component of the taxpayer's legal rights.

Filing Deadlines / Important Dates

Filing deadlines for the Petition Form 1 Tax Court Help are strict. Typically, taxpayers must file their petition within ninety days of receiving a notice of deficiency from the IRS. Missing this deadline can result in the loss of the right to contest the IRS's decision. It is advisable to keep track of important dates, including the date of the IRS notice and the filing date of the petition, to ensure compliance with all legal requirements.

Required Documents

When filing the Petition Form 1 Tax Court Help, certain documents may be required to support your case. These documents can include:

- IRS notices: Any correspondence received from the IRS related to the tax issue.

- Tax returns: Copies of the relevant tax returns for the years in question.

- Supporting evidence: Any additional documentation that supports your position, such as receipts or financial statements.

Form Submission Methods

The Petition Form 1 Tax Court Help can be submitted through various methods:

- Online: Some jurisdictions may allow electronic filing of the petition.

- Mail: You can send the completed form to the appropriate Tax Court address via postal service.

- In-Person: It may also be possible to file the petition in person at your local Tax Court office.

Eligibility Criteria

To file the Petition Form 1 Tax Court Help, taxpayers must meet specific eligibility criteria. Generally, this includes:

- Taxpayer status: You must be an individual or entity that has received a notice from the IRS.

- Timeliness: The petition must be filed within the stipulated time frame after receiving the IRS notice.

- Subject matter: The dispute must involve a tax issue that falls under the jurisdiction of the Tax Court.

Quick guide on how to complete petition form 1 tax court help

Complete Petition Form 1 Tax Court Help effortlessly on any device

Digital document management has surged in popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents swiftly without any hold-ups. Handle Petition Form 1 Tax Court Help on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to edit and eSign Petition Form 1 Tax Court Help without hassle

- Find Petition Form 1 Tax Court Help and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your changes.

- Select how you would like to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious document searches, or errors that require printing new copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device you prefer. Modify and eSign Petition Form 1 Tax Court Help and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the petition form 1 tax court help

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Petition Form 1 for Tax Court and how does it work?

The Petition Form 1 for Tax Court is a legal document used to initiate a case in tax court. With airSlate SignNow, you can easily fill out and eSign this form online, ensuring that you meet all necessary requirements for your tax court petition. Our platform streamlines this process, making it efficient and user-friendly.

-

How can airSlate SignNow assist me with my Petition Form 1 for Tax Court?

airSlate SignNow provides comprehensive tools for managing your Petition Form 1 for Tax Court. You can create, edit, and eSign your petition directly on our platform, minimizing the hassle often associated with legal paperwork. Plus, our software allows for easy document sharing and collaboration with legal professionals.

-

What are the pricing options for using airSlate SignNow to complete the Petition Form 1 for Tax Court?

airSlate SignNow offers various pricing plans tailored to different user needs, including a free trial. For completing your Petition Form 1 for Tax Court, you can choose a plan that best fits your budget and requirements. Our cost-effective solutions ensure you have access to all essential features without breaking the bank.

-

What features does airSlate SignNow offer for the Petition Form 1 for Tax Court?

Our platform includes a range of features designed to enhance your experience with the Petition Form 1 for Tax Court. Key features include customizable templates, advanced eSignature options, and secure storage of your documents. These tools ensure that your petition process is efficient, secure, and compliant with legal standards.

-

Can I track the status of my Petition Form 1 for Tax Court using airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking of all your documents, including the Petition Form 1 for Tax Court. You can receive notifications when a signature is completed or when your document is viewed. This transparency ensures you stay informed throughout the entire process.

-

Is it easy to integrate airSlate SignNow with other applications while preparing my Petition Form 1 for Tax Court?

Absolutely! airSlate SignNow offers seamless integration with various applications, making it easier to manage your Petition Form 1 for Tax Court. Whether you're using cloud storage services or document management systems, our platform allows for effortless connectivity and enhances your workflow.

-

Are there any benefits to using airSlate SignNow for my Petition Form 1 for Tax Court compared to traditional methods?

Using airSlate SignNow for your Petition Form 1 for Tax Court offers signNow benefits over traditional methods. Our digital platform saves you time by reducing paperwork, enables quick access to your forms, and improves collaboration with your legal team. Moreover, it enhances security and helps prevent errors associated with physical document handling.

Get more for Petition Form 1 Tax Court Help

- International acceptance letter normandale community college normandale form

- Please complete this questionnaire attach the requested document see document list below form

- Avoid bad survey questions loaded question leading form

- Sa427 form

- Carer payment medical report sa427 form

- Functional assessment interview form

- Il486 de ins form

- Important notice certificate of insurance de ins form

Find out other Petition Form 1 Tax Court Help

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online