Fidelitycomgotoddnumber Form

What is the Fidelitycomgotoddnumber Form

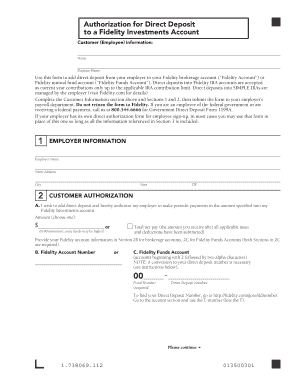

The Fidelitycomgotoddnumber form is a specific document used primarily for financial and administrative purposes. It serves as a means for individuals or businesses to provide essential information to Fidelity, a well-known financial services corporation. This form is crucial for various transactions, including account management, investment activities, and compliance with regulatory requirements. Understanding its purpose and function is vital for anyone engaging with Fidelity's services.

How to use the Fidelitycomgotoddnumber Form

Using the Fidelitycomgotoddnumber form involves several straightforward steps. First, ensure you have the correct version of the form, which can typically be obtained from Fidelity’s official resources. Next, gather all necessary information, such as personal identification details and account numbers. Carefully fill out the form, ensuring accuracy to avoid delays. Once completed, submit it as directed—either online, via mail, or in person, depending on the specific instructions provided by Fidelity.

Steps to complete the Fidelitycomgotoddnumber Form

Completing the Fidelitycomgotoddnumber form requires attention to detail. Follow these steps for successful completion:

- Obtain the form from Fidelity’s official website or customer service.

- Read the instructions thoroughly to understand the requirements.

- Fill in your personal information accurately, including your name, address, and account details.

- Double-check all entries for accuracy to prevent errors.

- Sign and date the form as required.

- Submit the form through the specified method.

Legal use of the Fidelitycomgotoddnumber Form

The legal use of the Fidelitycomgotoddnumber form is governed by various regulations that ensure the validity of the information provided. When completed accurately, the form can serve as a legally binding document, especially when it involves financial transactions. It is essential to comply with all relevant laws, such as the Electronic Signatures in Global and National Commerce (ESIGN) Act, which recognizes electronic signatures as valid. This compliance helps protect both the individual and Fidelity in any potential disputes.

Key elements of the Fidelitycomgotoddnumber Form

Several key elements are essential for the Fidelitycomgotoddnumber form to be valid and effective. These include:

- Personal Information: Accurate details about the individual or entity submitting the form.

- Account Information: Specific account numbers or identifiers related to Fidelity services.

- Signature: A valid signature, which may be electronic, confirming the authenticity of the submission.

- Date: The date of submission, which is crucial for record-keeping and compliance.

Examples of using the Fidelitycomgotoddnumber Form

There are various scenarios in which the Fidelitycomgotoddnumber form may be utilized. For instance, an individual may need to update their personal information for their investment account. Alternatively, a business may use the form to establish a new account or modify existing account details. Each use case underscores the importance of accurate completion and timely submission to ensure seamless interactions with Fidelity.

Quick guide on how to complete fidelitycomgotoddnumber form

Complete Fidelitycomgotoddnumber Form effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can obtain the correct form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your papers swiftly without delays. Manage Fidelitycomgotoddnumber Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and eSign Fidelitycomgotoddnumber Form with ease

- Find Fidelitycomgotoddnumber Form and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight important parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Fidelitycomgotoddnumber Form to ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fidelitycomgotoddnumber form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Fidelitycomgotoddnumber Form, and how does it work?

The Fidelitycomgotoddnumber Form is a digital document designed to simplify the process of managing forms and signatures. With airSlate SignNow, users can easily send, receive, and eSign this form electronically, reducing paperwork and enhancing efficiency in business operations.

-

How can I integrate the Fidelitycomgotoddnumber Form with my existing tools?

airSlate SignNow offers seamless integrations with popular tools and platforms, allowing you to connect the Fidelitycomgotoddnumber Form with your existing software stack. You can easily integrate it with CRM systems, cloud storage services, and more to streamline your workflow.

-

What features does airSlate SignNow offer for the Fidelitycomgotoddnumber Form?

AirSlate SignNow provides several valuable features for the Fidelitycomgotoddnumber Form, including customizable templates, automated workflows, and secure cloud storage. These features ensure that your documents are handled efficiently and securely.

-

Is the Fidelitycomgotoddnumber Form secure for sensitive information?

Yes, the Fidelitycomgotoddnumber Form created through airSlate SignNow is highly secure. The platform uses advanced encryption and complies with industry standards to protect your sensitive data throughout the signing process.

-

What are the pricing options for using the Fidelitycomgotoddnumber Form with airSlate SignNow?

AirSlate SignNow offers flexible pricing plans that cater to different business needs when using the Fidelitycomgotoddnumber Form. You can choose from a range of subscriptions that provide various features and functionalities to fit your budget.

-

Can I track the status of the Fidelitycomgotoddnumber Form once sent?

Yes, airSlate SignNow allows you to track the status of your Fidelitycomgotoddnumber Form in real-time. You will receive notifications when the document is opened, signed, or completed, ensuring you stay informed throughout the process.

-

How does eSigning the Fidelitycomgotoddnumber Form benefit businesses?

eSigning the Fidelitycomgotoddnumber Form with airSlate SignNow enhances efficiency and accelerates the signing process. It eliminates the need for printing and mailing, leading to faster turnaround times and improved customer satisfaction.

Get more for Fidelitycomgotoddnumber Form

Find out other Fidelitycomgotoddnumber Form

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later