Form M100 Request for Copy of Tax Return PDF Find Laws

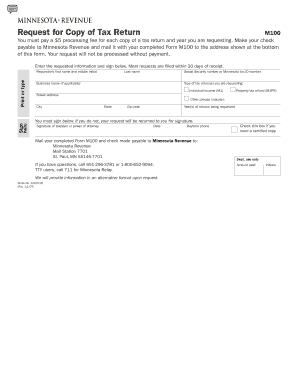

What is the Form M100 Request for Copy of Tax Return?

The Form M100 is a request for a copy of a tax return, typically used by individuals or businesses needing to obtain their past tax documents for various purposes, such as applying for loans, verifying income, or preparing for audits. This form is essential for taxpayers who may have lost their original documents or require duplicates for record-keeping. It serves as a formal request to the relevant tax authority to access previously filed tax returns.

How to Use the Form M100 Request for Copy of Tax Return

Using the Form M100 involves several straightforward steps. First, ensure that you have all necessary information, including your Social Security number, tax year for which you are requesting the return, and any other identifying details. Next, fill out the form accurately, providing all required information to avoid delays. After completing the form, submit it according to the instructions provided, which may include mailing it to a specific address or submitting it electronically, depending on the jurisdiction.

Steps to Complete the Form M100 Request for Copy of Tax Return

Completing the Form M100 requires careful attention to detail. Follow these steps:

- Gather necessary information, including your full name, address, Social Security number, and the tax year of the return.

- Fill out the form, ensuring that all fields are completed accurately.

- Review the form for any errors or omissions to prevent processing delays.

- Submit the form through the designated method, whether by mail or electronically, as specified in the instructions.

Legal Use of the Form M100 Request for Copy of Tax Return

The Form M100 is legally recognized as a valid request for obtaining copies of tax returns. It must be filled out in compliance with applicable laws and regulations governing tax documentation. When submitted correctly, it allows taxpayers to retrieve necessary documents while ensuring that their rights to access their financial information are upheld. Compliance with legal standards is crucial to ensure the request is honored by the tax authority.

Key Elements of the Form M100 Request for Copy of Tax Return

Understanding the key elements of the Form M100 is essential for successful completion. Important components include:

- Personal Information: This includes your name, address, and Social Security number.

- Tax Year: Specify the year for which you are requesting the tax return.

- Signature: A signature is required to validate the request, confirming that the information provided is accurate.

Form Submission Methods

The Form M100 can typically be submitted through various methods, including:

- Mail: Send the completed form to the designated tax authority address.

- Online: Some jurisdictions may allow electronic submission through their official websites.

- In-Person: Visit a local tax office to submit the form directly.

Quick guide on how to complete form m100 request for copy of tax return pdf find laws

Complete Form M100 Request For Copy Of Tax Return pdf Find Laws effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form M100 Request For Copy Of Tax Return pdf Find Laws on any device with the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to modify and electronically sign Form M100 Request For Copy Of Tax Return pdf Find Laws seamlessly

- Locate Form M100 Request For Copy Of Tax Return pdf Find Laws and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign Form M100 Request For Copy Of Tax Return pdf Find Laws and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form m100 request for copy of tax return pdf find laws

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form m100 in airSlate SignNow?

The form m100 is a customizable document template that allows businesses to streamline their signing process. With airSlate SignNow, users can efficiently create, send, and eSign the form m100, making it easier to gather necessary signatures and information.

-

How much does it cost to use the form m100 feature?

Pricing for using the form m100 feature in airSlate SignNow varies based on your subscription plan. We offer flexible pricing options that cater to businesses of all sizes, ensuring access to cost-effective solutions for document signing and management.

-

What are the key features of the form m100?

The form m100 includes several key features such as customizable fields, automatic reminders, and secure storage options. Users can benefit from our intuitive interface that simplifies the process of obtaining signatures while ensuring compliance and security.

-

Can the form m100 be integrated with other applications?

Yes, the form m100 can be seamlessly integrated with several popular applications. airSlate SignNow offers integration capabilities with platforms like Google Drive, Salesforce, and Microsoft Office, allowing users to enhance their workflow efficiency.

-

How does using the form m100 benefit businesses?

Utilizing the form m100 can signNowly reduce the time and resources required for document management. Businesses benefit from quicker turnaround times, increased productivity, and the ability to track document status in real-time, leading to improved operations.

-

Is the form m100 mobile-friendly?

Absolutely! The form m100 is designed to be mobile-responsive, allowing users to access and sign documents from any device. With airSlate SignNow’s mobile app, signing the form m100 on-the-go has never been easier.

-

What support is available for users of the form m100?

airSlate SignNow provides comprehensive support for users of the form m100, including tutorials, live chat, and email assistance. Our dedicated support team is here to help you navigate any challenges, ensuring you get the most out of the form m100.

Get more for Form M100 Request For Copy Of Tax Return pdf Find Laws

Find out other Form M100 Request For Copy Of Tax Return pdf Find Laws

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy