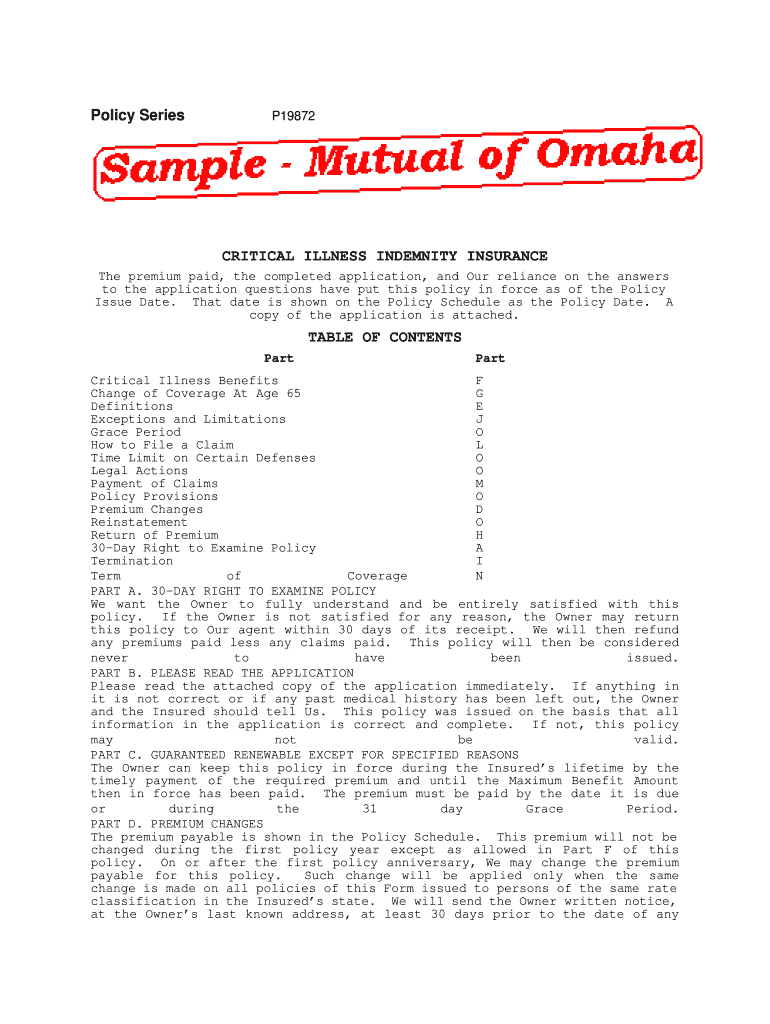

Policy Series P19872 CRITICAL ILLNESS INDEMNITY INSURANCE the Premium Paid, the Completed Application, and Our Reliance on the a Form

Understanding the Policy Series P19872 Critical Illness Indemnity Insurance

The Policy Series P19872 Critical Illness Indemnity Insurance is designed to provide financial protection in the event of a critical illness diagnosis. This insurance policy covers various conditions that may significantly impact an individual's health and financial stability. It is essential to understand the specific terms and conditions outlined in the policy, including the coverage limits and exclusions. The premium paid for this insurance is determined by various factors, including age, health status, and the specific coverage options selected.

Steps to Complete the Policy Series P19872 Critical Illness Indemnity Insurance Application

Completing the application for the Policy Series P19872 Critical Illness Indemnity Insurance involves several key steps:

- Gather necessary personal information, including your full name, address, and Social Security number.

- Provide details about your health history, including any pre-existing conditions or prior illnesses.

- Choose the coverage options that best suit your needs, which may include specific critical illnesses you wish to be covered for.

- Review the premium costs associated with your selected coverage options.

- Sign the application electronically, ensuring that all information is accurate and complete.

Legal Use of the Policy Series P19872 Critical Illness Indemnity Insurance

The legal use of the Policy Series P19872 Critical Illness Indemnity Insurance is governed by federal and state regulations. It is crucial to comply with these regulations to ensure that your insurance policy is valid and enforceable. The electronic signature used during the application process must meet the requirements set forth by the ESIGN Act and UETA, ensuring that the application is legally binding. Understanding these legal frameworks can help you navigate the application process effectively.

Eligibility Criteria for the Policy Series P19872 Critical Illness Indemnity Insurance

To qualify for the Policy Series P19872 Critical Illness Indemnity Insurance, applicants must meet specific eligibility criteria. Generally, these criteria include:

- Being a resident of the United States.

- Meeting the age requirements, typically between eighteen and sixty-five years old.

- Providing truthful and complete information regarding health history and current medical conditions.

Meeting these criteria is essential for the approval of the application and to ensure that coverage is provided when needed.

How to Obtain the Policy Series P19872 Critical Illness Indemnity Insurance

Obtaining the Policy Series P19872 Critical Illness Indemnity Insurance can be done through various channels. Interested individuals can:

- Contact an insurance agent or broker who specializes in health insurance products.

- Visit the insurance provider's website to access online application forms.

- Request information through customer service to understand the policy details and application process.

Each of these methods provides a pathway to secure the necessary coverage for critical illnesses.

Key Elements of the Policy Series P19872 Critical Illness Indemnity Insurance

Understanding the key elements of the Policy Series P19872 Critical Illness Indemnity Insurance is vital for making informed decisions. Important components include:

- Coverage details, specifying which critical illnesses are included.

- The premium payment structure, outlining how and when payments are due.

- The claims process, detailing how to file a claim in the event of a covered illness.

- Exclusions and limitations, which clarify what is not covered under the policy.

Being aware of these elements can help policyholders navigate their coverage effectively.

Quick guide on how to complete policy series p19872 critical illness indemnity insurance the premium paid the completed application and our reliance on the

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to modify and electronically sign [SKS] without hassle

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Select how you want to share your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign [SKS] to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What is the difference between critical insurance and health insurance?

Critical Illness is also a form of health insurance, but the difference is in coverage for specific critical illnesses. Here, I will try to make a clear picture of these two:Health Insurance Plan:1. Cover for diseases / illnesses / injuries; as long as within purview of policy.2. Reimbursement of actual expenses or provision of cashless benefit facility.3. Policy continues even after claim is made, until renewal.Critical Illness Plan:1. Cover for specific Critical Illnesses only - such as Heart Attack, Major Organ Transplant, Cancer, Kidney Failure, Stroke, etc. IRDA has made it mandatory for health insurance companies to include 12 critical illnesses under this plan, if provided.2. Unlike health insurance plan, here, lump sum is paid within few days of diagnosis or immediately.3. Policy ceases once benefit has been paid (few offer the choice of remaining insured for other illnesses)Note: Critical illness policy holders have to pay substantially lower as compared to those who have a health insurance cover.

-

How important it is to have a critical illness policy even though I have a health insurance policy, does it really make a difference?

It matters..First of all the Indian insurance business is working on the tariff method like UKs market. Any insurance company can design and sell their products of their choice but IRDAI regulates them.Now comes to your question,Every insurance policy have maximum coverage limit based on the premium paid. The health insurance policy widely covers all the disease of future. It should not be pre-existing.As the cost of medical treatment for certain disease like cancer treatment and kidney transplant and heart therapy etc are very high which can exhaust the normal existing health insurance. If there is any separate insurance for critical illness it might change the situation.But the requirement should be based on the location of working and working style. Lifestyle also affects. So if your lifestyle is seems to be prone to these disease then you must be. If not then save it for vocation. Cheers..

-

A web page I need to fill out states (in their privacy policy) they will track the site I came from and go to afterwards, as well as my location, browser and OS identity, and much more information. How can I safely fill it out but block all this?

There’s a few separate things here:OS and browser: they already have this as soon as you open the form. All web servers get this to ensure they can provide a page you can load. You can send a fake one using something like the Google headers editor for Chrome, but it’s fairly pointless - you are just one of millions running near identical hardware. It’s mostly useful for their site tester to check it works on the common platforms,Location: They will get a rough location from your IP address. You could use a VPN - they will still get a location, but it will not be very accurate. Locations from IP are often not very useful - often they are only accurate to the country level. The site might ask your browser for accurate location information - just click on ‘no’.Source site: Just open the URL manually in a new tab. Then there is no source site information to pass.Forwarded to site: They can only see this if it’s by clicking a link on the page. don’t click the links.Other sites you may have visited. Normally done with a cross-site advertising tracking cookie. Open the site in a Private / Incognito / Porn mode session to block them all. Close it as soon as you have finished.To be honest, they will get far, far more information from the form you complete than anything else.

-

Why don’t medical insurance policies increase the sum assured even if we are ready to pay more premium once they find out that a person has been diagnosed with any critical illness?

Insurance is based in law of large numbers. That helps keep the premium reasonable… imagine if you had to pay a person 10 lac in case he gets a critical illness how much money would you want to charge him… nothing below 8 or 9 lac. At this price no one will buyBut if you knew that only 3 people out of 10000 get critical illness and you had to charge premium, you could maybe divide the 30 lac over 10000 and charge say 3000 bucks and maybe you will be able sell.The problem with customers having critical illness is their chance of claiming is very very high…healthy people will not want to subsidise them knowingly. Thus any insurer offering such product feature will be priced out of market.Having said above I agree that what you state is a customer need. An innovative insurer might crack the problem

-

How can I be more gentle on myself and less critical. My mom is very ill right now and I'm signNowing out to my partner but i feel guilty. What can I do to accept it is perfectly normal to signNowout to my partner?

A2A.If a friend were to come to you in the same situation, and expressed those same feelings, what would you say to that friend? Would you say, "Yes, you should feel guilty for signNowing out to your partner in life, even though you have a relationship in which you both desire to love and support each other through difficult times." Would you say, "What is wrong with you anyway? Its just your mother fighting a terribly illness after all. You should be so much stronger than you are!"Can you imagine being so terribly cold and unkind to that person? Yet, here you are bullying yourself for being in a painful situation. Here you are bullying yourself for signNowing out to your partner, who more than anything, wants to help you through this. You think you are supposed to be some superhero and not feel the same things all humans feel. How did you arrive at that conclusion about yourself? Don't you know there is strength in expressing vulnerability and honesty? Don't you know we are here to love and help one another through this difficult life? Why should you deprive your partner of being able to gift you with love and support so you can be there for your mother? Doesn't your mother deserve that?If you were perfect, you wouldn't be here. Earth is a school. Our experiences are our teachers. To humbly acknowledge your feelings of pain and uncertainty in honesty and non judgment is far stronger than thinking you are supposed to be 'above it all'. This is not about you, but supporting your mother, is it not? Yet here you are making it about you and causing a ruckus within your own mind because of some silly idea you have of what strength and perfection is, and how you should be acting and feeling. Well I guess we could all say we should have graduated Earth school by now, but here we all are. Be real. Love yourself and have compassion for yourself for having to experience the pain of your mother being so ill. Be a friend to yourself and speak to yourself as you would a friend. That is strength. That is self dignity, honesty and compassion. That is what you deserve in this difficult time.Stop feeling guilty for being a human being. Stop bullying yourself and get real so you can get yourself out of the way here. Let go and allow some healing and support for yourself. You will be far more effective in dealing with your mother's difficulties.And remember, your mother is also going through an experience that is a teacher for her. We choose these experiences before we are born. They seem harsh, but they heal both karma and misunderstandings we have about ourselves and life. She is always held in the light and love of her guardian angels. Seek peace and order where there seems none. It is there I assure you. Best wishes to you and your mother on this journey.

-

How do I find a dental plan that allows out of network dentist, low monthly individual payments and will start effective today? I need the policy to allow wisdom tooth extractions, fillings, exam and x-rays too.

You are looking for a unicorn, but there is something close.It depends on whether it is offered in the state you live in. Go to coversme and look at the Clear plan. If you don't see that one listed, you may be in a state that doesn't have it.Typical rates are $40/mon for 1 person who is about 35 years old.Most dentists participate with Delta, which makes them in network. It can be effective at the beginning of the next month. Like most insurances, you have copayments for all procedures. There is no dollar maximum and no deductible.If you're in New Jersey, you can always check in to our office at Lake Family Dentistry

Related searches to Policy Series P19872 CRITICAL ILLNESS INDEMNITY INSURANCE The Premium Paid, The Completed Application, And Our Reliance On The A

Create this form in 5 minutes!

How to create an eSignature for the policy series p19872 critical illness indemnity insurance the premium paid the completed application and our reliance on the

How to make an eSignature for the Policy Series P19872 Critical Illness Indemnity Insurance The Premium Paid The Completed Application And Our Reliance On The online

How to make an eSignature for the Policy Series P19872 Critical Illness Indemnity Insurance The Premium Paid The Completed Application And Our Reliance On The in Chrome

How to make an electronic signature for signing the Policy Series P19872 Critical Illness Indemnity Insurance The Premium Paid The Completed Application And Our Reliance On The in Gmail

How to make an eSignature for the Policy Series P19872 Critical Illness Indemnity Insurance The Premium Paid The Completed Application And Our Reliance On The from your mobile device

How to generate an eSignature for the Policy Series P19872 Critical Illness Indemnity Insurance The Premium Paid The Completed Application And Our Reliance On The on iOS devices

How to generate an electronic signature for the Policy Series P19872 Critical Illness Indemnity Insurance The Premium Paid The Completed Application And Our Reliance On The on Android devices

People also ask

-

What is Policy Series P19872 CRITICAL ILLNESS INDEMNITY INSURANCE?

Policy Series P19872 CRITICAL ILLNESS INDEMNITY INSURANCE is a financial product designed to provide a safety net in the event of specific critical illnesses. It indemnifies the insured based on the premium paid, ensuring that policyholders receive financial assistance when they need it most. Understanding this policy is crucial to making informed decisions regarding your health insurance needs.

-

How do I apply for Policy Series P19872 CRITICAL ILLNESS INDEMNITY INSURANCE?

Applying for Policy Series P19872 CRITICAL ILLNESS INDEMNITY INSURANCE requires completing an application form that details your health history. Once the completed application is submitted, our reliance on the assessment ensures that you are provided with the best coverage based on the premium paid. You can start your application process directly on the airSlate SignNow platform for ease of use.

-

What benefits does Policy Series P19872 CRITICAL ILLNESS INDEMNITY INSURANCE offer?

The benefits of Policy Series P19872 CRITICAL ILLNESS INDEMNITY INSURANCE include financial coverage for various critical illnesses, which can alleviate the financial burden of medical expenses. The policy pays out a sum based on the premium paid, giving you peace of mind during challenging times. Additionally, it can complement existing health insurance by providing extra support.

-

What factors determine the premium for Policy Series P19872 CRITICAL ILLNESS INDEMNITY INSURANCE?

The premium for Policy Series P19872 CRITICAL ILLNESS INDEMNITY INSURANCE is influenced by several factors, including your age, health status, and the coverage limits you select. The premium paid directly correlates with the extent of coverage, so it’s important to assess your needs carefully. For an accurate quote, consider signNowing out through the airSlate SignNow platform.

-

Can I customize my coverage with Policy Series P19872 CRITICAL ILLNESS INDEMNITY INSURANCE?

Yes, Policy Series P19872 CRITICAL ILLNESS INDEMNITY INSURANCE offers customizable options to suit your individual needs. You can adjust the coverage limits and select specific critical illnesses based on your preferences. This flexibility ensures that you have a tailored approach to health safety while considering the premium paid.

-

How long does it take to get approved for Policy Series P19872 CRITICAL ILLNESS INDEMNITY INSURANCE?

Approval times for Policy Series P19872 CRITICAL ILLNESS INDEMNITY INSURANCE can vary based on the complexity of your completed application. Typically, if your application is straightforward, you may receive a decision in a few days. However, more detailed assessments could take longer; we encourage applicants to remain patient during this process.

-

What should I do if I need to make a claim on my Policy Series P19872 CRITICAL ILLNESS INDEMNITY INSURANCE?

If you need to make a claim under Policy Series P19872 CRITICAL ILLNESS INDEMNITY INSURANCE, start by contacting customer support to initiate the claims process. You will need to provide relevant documentation, including your completed application information and proof of diagnosis. Our team will guide you through the necessary steps to ensure your claim is processed efficiently.

Get more for Policy Series P19872 CRITICAL ILLNESS INDEMNITY INSURANCE The Premium Paid, The Completed Application, And Our Reliance On The A

Find out other Policy Series P19872 CRITICAL ILLNESS INDEMNITY INSURANCE The Premium Paid, The Completed Application, And Our Reliance On The A

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later