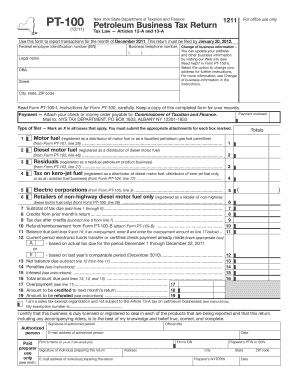

Ny Pt100 Form

What is the NY PT100 Form

The NY PT100 form is a tax document used in New York State for reporting and calculating personal income tax for certain business entities. This form is primarily utilized by partnerships, limited liability companies (LLCs), and corporations to declare their income, deductions, and credits. It is essential for ensuring compliance with state tax regulations and for accurately determining tax liabilities.

How to Use the NY PT100 Form

Using the NY PT100 form involves several steps to ensure that all required information is accurately reported. Taxpayers must gather relevant financial documents, including income statements, expense reports, and any applicable deductions. The form requires detailed entries about the entity's income, expenses, and tax credits. Once completed, it must be submitted to the New York State Department of Taxation and Finance by the designated deadline.

Steps to Complete the NY PT100 Form

Completing the NY PT100 form can be streamlined by following these steps:

- Gather all necessary financial documents, including income and expense statements.

- Fill out the entity's basic information, such as name, address, and identification number.

- Report total income, detailing sources and amounts.

- List all allowable deductions and credits, ensuring accurate calculations.

- Review the form for accuracy and completeness before submission.

Legal Use of the NY PT100 Form

The NY PT100 form is legally binding when filled out correctly and submitted on time. It is crucial for taxpayers to adhere to the guidelines set forth by the New York State Department of Taxation and Finance. Failure to comply with the legal requirements can result in penalties or audits. Utilizing a reliable electronic signature solution can further enhance the legal standing of the submitted form.

Filing Deadlines / Important Dates

Filing deadlines for the NY PT100 form are critical to avoid penalties. Generally, the form must be submitted by the 15th day of the fourth month following the end of the tax year. For entities operating on a calendar year, this typically falls on April 15. Taxpayers should also be aware of any extensions that may apply and ensure timely submission to maintain compliance.

Form Submission Methods

The NY PT100 form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission via the New York State Department of Taxation and Finance website.

- Mailing a paper copy to the appropriate tax office.

- In-person submission at designated tax offices.

Quick guide on how to complete ny pt100 form

Complete Ny Pt100 Form effortlessly across all devices

Digital document management has gained traction among companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to access the necessary forms and securely save them online. airSlate SignNow provides all the tools required to create, adjust, and electronically sign your documents swiftly without any delays. Handle Ny Pt100 Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The simplest way to modify and eSign Ny Pt100 Form without hassle

- Locate Ny Pt100 Form and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Select pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to finalize your changes.

- Decide how you wish to share your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Modify and eSign Ny Pt100 Form to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ny pt100 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a PT100 form and how is it used?

The PT100 form is a specific document used for processing time-sensitive transactions and agreements. It serves as a formal record, ensuring all parties are on the same page regarding the terms. Using airSlate SignNow, you can easily create and eSign PT100 forms, streamlining your workflow.

-

How can airSlate SignNow help me with PT100 forms?

airSlate SignNow simplifies the handling of PT100 forms by allowing you to create, send, and eSign documents quickly. With its user-friendly interface, you can easily manage and track the status of your PT100 forms in real-time, improving efficiency and productivity.

-

What are the pricing options for using airSlate SignNow for PT100 forms?

airSlate SignNow offers various pricing plans designed to fit different business needs, including individual and team options. All plans provide essential features for creating and managing PT100 forms at a competitive rate, ensuring you receive great value for your investment.

-

Are there any integrations available for managing PT100 forms with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with popular platforms like Google Drive, Salesforce, and Microsoft, allowing you to manage your PT100 forms efficiently. These integrations help you streamline your document workflows and enhance collaboration across your teams.

-

What are the benefits of using airSlate SignNow for PT100 forms?

Using airSlate SignNow for your PT100 forms provides numerous benefits, including enhanced security, compliance, and ease of use. The electronic signature feature ensures that your documents are legally binding, while also saving time and resources in the signing process.

-

Can I customize my PT100 forms in airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your PT100 forms according to your specific requirements. You can add branding elements, adjust the layout, and include required fields to ensure that your forms meet your business needs.

-

Is airSlate SignNow secure for handling PT100 forms?

Yes, airSlate SignNow prioritizes security, implementing robust encryption and compliance standards to protect your PT100 forms. You can confidently manage sensitive information knowing that your documents are secure from unauthorized access.

Get more for Ny Pt100 Form

- City of orlando vehicle for hire form

- Easement agreement boca raton form

- City of st petersburg telemedic program form

- Fire penetration affidavit form

- Contractor registration or renewal form pdf city of fort myers

- Fl federal certificate tax form

- Florida driving log form

- Charlotte county notice of commencement form

Find out other Ny Pt100 Form

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample