Ft 943 Form

What is the FT 943?

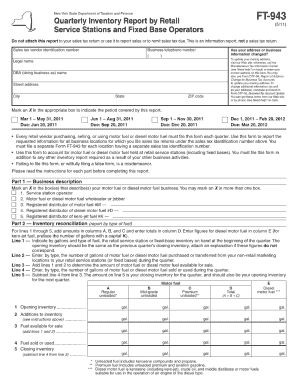

The FT 943 is a New York State tax form used for reporting certain financial information related to franchise taxes. This form is essential for businesses operating in New York, as it helps ensure compliance with state tax regulations. The information provided on the FT 943 is used by the New York State Department of Taxation and Finance to assess the tax obligations of various business entities, including corporations and partnerships.

How to obtain the FT 943

To obtain the FT 943, individuals or businesses can visit the New York State Department of Taxation and Finance website. The form is available for download in a PDF format, allowing users to print it for completion. Additionally, physical copies may be available at local tax offices or through authorized tax professionals. It is important to ensure that you are using the most current version of the form to comply with any recent changes in tax regulations.

Steps to complete the FT 943

Completing the FT 943 involves several key steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Fill out the form with accurate information regarding your business's financial status.

- Double-check all entries for accuracy, ensuring that all calculations are correct.

- Sign and date the form to validate your submission.

Once completed, the FT 943 can be submitted online, by mail, or in person, depending on your preference and the specific requirements of the New York State Department of Taxation and Finance.

Legal use of the FT 943

The FT 943 is legally binding when filled out and submitted according to New York State regulations. It is crucial to ensure that all information is truthful and complete, as any discrepancies can lead to penalties or legal issues. Utilizing a reliable eSignature platform, such as signNow, can enhance the security and legality of your submission, ensuring compliance with eSignature laws and regulations.

Filing Deadlines / Important Dates

Filing deadlines for the FT 943 vary depending on the type of business entity and the tax year. Typically, businesses must submit the form by the due date for their franchise tax return. It is advisable to check the New York State Department of Taxation and Finance website for specific deadlines and any updates that may affect your filing schedule.

Form Submission Methods

The FT 943 can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission through the New York State Department of Taxation and Finance's e-file system.

- Mailing a completed paper form to the designated address provided on the form.

- In-person submission at local tax offices, if preferred.

Choosing the right submission method can help ensure timely processing of your tax information.

Quick guide on how to complete ft 943

Prepare Ft 943 effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to locate the right template and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without holdups. Handle Ft 943 on any device using the airSlate SignNow Android or iOS applications and simplify any document-centric task today.

The simplest method to alter and eSign Ft 943 without hassle

- Locate Ft 943 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form: via email, SMS, or an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign Ft 943 and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ft 943

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is FT 943 in relation to airSlate SignNow?

FT 943 refers to a specific document template that can be utilized within the airSlate SignNow platform. This template streamlines the process of electronic signing, making it easier for businesses to manage their documentation efficiently. By using FT 943, users can save time and improve their document workflows.

-

How does airSlate SignNow enhance the FT 943 signing process?

airSlate SignNow enhances the FT 943 signing process by providing a user-friendly interface and versatile features such as customizable templates and automated reminders. This ensures that all parties involved can sign documents quickly and securely. The FT 943 template specifically allows for seamless integrations with other tools, further simplifying the signing process.

-

What are the pricing options for using the FT 943 template with airSlate SignNow?

Pricing for using the FT 943 template with airSlate SignNow varies based on the plan selected. We offer a range of subscription options designed to accommodate different business needs and budgets. Users can access prototypes of FT 943 and other dynamic templates on our competitive pricing plans, making it a cost-effective solution.

-

Can I integrate other tools with FT 943 in airSlate SignNow?

Yes, you can integrate various tools with FT 943 in airSlate SignNow, enhancing your workflow. This capability allows users to connect their existing software and applications with airSlate SignNow, fostering a more efficient document management experience. Integrating these tools enables smooth data transfer and automates repetitive tasks related to the FT 943 document.

-

What are the main benefits of using the FT 943 document with airSlate SignNow?

The primary benefits of using the FT 943 document with airSlate SignNow include increased efficiency, improved compliance, and better tracking of document statuses. The ease of use of the FT 943 template enables quicker approvals and less manual effort, which ultimately saves time and reduces errors. Moreover, it provides a comprehensive audit trail for all signatures.

-

Is it secure to use airSlate SignNow for FT 943 document signing?

Absolutely, airSlate SignNow ensures that signing FT 943 documents is secure and compliant with industry standards. We utilize advanced encryption methods and authentication processes to protect your data and signatures. Users can confidently sign and manage documents, knowing that their information remains safe and secure throughout the process.

-

How can I customize the FT 943 template in airSlate SignNow?

You can easily customize the FT 943 template in airSlate SignNow to meet your business needs. The platform provides various tools that allow you to modify fields, add branding elements, and tailor the document layout. This flexibility ensures that the FT 943 template aligns perfectly with your company's branding and specific requirements.

Get more for Ft 943

Find out other Ft 943

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament