City of Pontiac Income Tax Form P 1040 NR Individual

What is the City Of Pontiac Income Tax Form P 1040 NR Individual

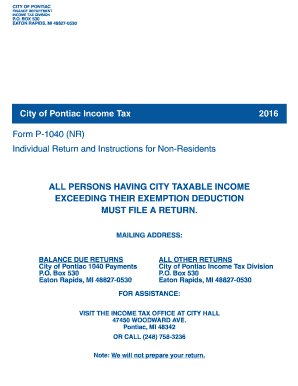

The City of Pontiac Income Tax Form P 1040 NR Individual is a tax document specifically designed for non-residents earning income within the city limits of Pontiac, Michigan. This form is essential for individuals who do not reside in Pontiac but have income sourced from the city, such as wages or business profits. Completing this form accurately ensures compliance with local tax regulations and helps in determining the appropriate tax liability for non-residents.

How to use the City Of Pontiac Income Tax Form P 1040 NR Individual

Using the City of Pontiac Income Tax Form P 1040 NR Individual involves several steps. First, gather all necessary financial documents, including W-2s and 1099s, which detail your income. Next, carefully fill out the form, providing accurate information regarding your income, deductions, and any applicable credits. It is important to review the form for completeness and accuracy before submission, as errors can lead to delays or penalties.

Steps to complete the City Of Pontiac Income Tax Form P 1040 NR Individual

Completing the City of Pontiac Income Tax Form P 1040 NR Individual requires a systematic approach:

- Gather all relevant income documentation, such as W-2 forms and 1099 statements.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income earned from Pontiac sources.

- Claim any eligible deductions or credits that apply to your situation.

- Calculate your total tax liability based on the instructions provided with the form.

- Sign and date the form before submission.

Legal use of the City Of Pontiac Income Tax Form P 1040 NR Individual

The City of Pontiac Income Tax Form P 1040 NR Individual is legally binding when completed and submitted in accordance with local tax laws. To ensure its validity, the form must be filled out accurately, and the required signatures must be provided. Compliance with the regulations set forth by the city ensures that the form is recognized by tax authorities, thus preventing potential legal issues related to tax obligations.

Required Documents

To successfully complete the City of Pontiac Income Tax Form P 1040 NR Individual, you will need several key documents:

- W-2 forms from employers showing income earned in Pontiac.

- 1099 forms for any freelance or contract work performed within the city.

- Records of any deductions or credits you plan to claim.

- Personal identification information, including your Social Security number.

Filing Deadlines / Important Dates

Filing deadlines for the City of Pontiac Income Tax Form P 1040 NR Individual typically align with federal tax deadlines. It is crucial to be aware of these dates to avoid penalties. Generally, the deadline for filing is April 15 of each year, but extensions may be available under certain circumstances. Always check for any changes in deadlines announced by the city to ensure timely compliance.

Quick guide on how to complete city of pontiac income tax form p 1040 nr individual

Effortlessly prepare City Of Pontiac Income Tax Form P 1040 NR Individual on any device

Online document management has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly without interruptions. Manage City Of Pontiac Income Tax Form P 1040 NR Individual on any device with airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and electronically sign City Of Pontiac Income Tax Form P 1040 NR Individual seamlessly

- Locate City Of Pontiac Income Tax Form P 1040 NR Individual and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information using the tools specifically offered by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Review the details carefully and click the Done button to save your updates.

- Select your preferred method to submit your form, whether by email, SMS, or using an invite link, or download it to your computer.

Say goodbye to lost or disorganized documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs within a few clicks from your chosen device. Alter and electronically sign City Of Pontiac Income Tax Form P 1040 NR Individual while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of pontiac income tax form p 1040 nr individual

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Pontiac tax forms?

Pontiac tax forms are the official documents required for filing taxes specific to Pontiac residents. These forms ensure compliance with local tax regulations and may vary depending on your income and tax situation.

-

How can airSlate SignNow assist with Pontiac tax forms?

airSlate SignNow provides an efficient platform for completing and eSigning Pontiac tax forms. With our user-friendly interface, you can easily fill out your forms digitally, ensuring accuracy and compliance.

-

What features does airSlate SignNow offer for managing Pontiac tax forms?

Our platform offers a range of features, such as customizable templates for Pontiac tax forms, secure cloud storage for your documents, and real-time collaboration. These features streamline the tax filing process for both individuals and businesses.

-

Is there a cost associated with using airSlate SignNow for Pontiac tax forms?

Yes, airSlate SignNow operates on a subscription model with various pricing tiers, allowing you to select the best option for your needs. Each plan includes comprehensive features to assist with Pontiac tax forms and document management.

-

What are the benefits of using airSlate SignNow for Pontiac tax forms?

Using airSlate SignNow for Pontiac tax forms offers numerous benefits, including faster turnaround times, reduced paperwork hassle, and increased security for sensitive information. Our platform ensures that your tax documents are handled efficiently.

-

Can I integrate airSlate SignNow with other software for Pontiac tax forms?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your ability to manage Pontiac tax forms. This integration simplifies the workflow, allowing for automatic data transfer and improved efficiency.

-

How does airSlate SignNow ensure the security of Pontiac tax forms?

airSlate SignNow employs advanced encryption and security protocols to protect your Pontiac tax forms. We prioritize data security to ensure that your personal and financial information remains confidential and safe.

Get more for City Of Pontiac Income Tax Form P 1040 NR Individual

- Good people screenplay submission form

- Document legalisation request form 478829038

- Venue contract form

- Request for medical supplies form

- Broward county pet license sales agent pet registration tag reconciliation worksheet broward county pet license sales agent pet form

- Bille of sale form

- Finance assistance form

- Environmental toxicologic pathology form

Find out other City Of Pontiac Income Tax Form P 1040 NR Individual

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later