Puerto Rico Question About Form as 26451 2011

What is the Puerto Rico Question About Form AS 26451

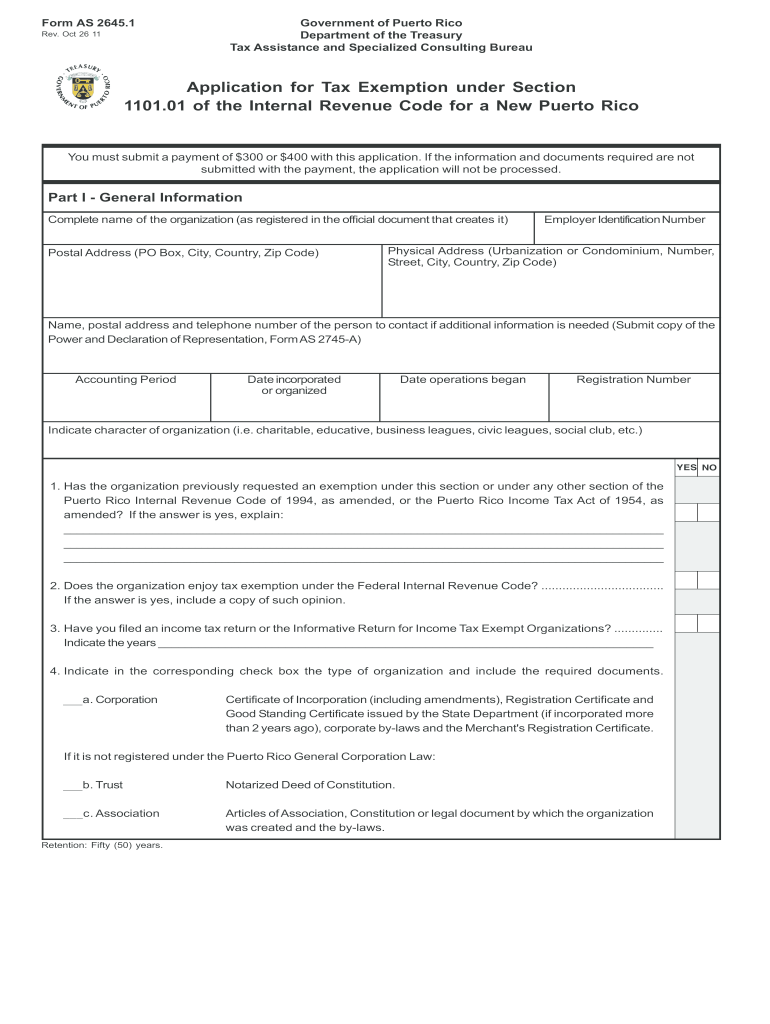

The Puerto Rico Question About Form AS 26451 is a specific tax form used by residents of Puerto Rico to address unique tax circumstances. This form helps taxpayers clarify their residency status and eligibility for certain tax benefits under U.S. tax laws. It is particularly relevant for individuals who may have income sourced from both Puerto Rico and the mainland United States, ensuring proper compliance with federal tax regulations.

How to Use the Puerto Rico Question About Form AS 26451

To use the Puerto Rico Question About Form AS 26451 effectively, individuals must first determine their eligibility based on their residency status and income sources. The form requires detailed information about the taxpayer's financial situation, including income earned in Puerto Rico and any applicable deductions. Completing the form accurately is crucial for ensuring compliance with tax obligations and avoiding potential penalties.

Steps to Complete the Puerto Rico Question About Form AS 26451

Completing the Puerto Rico Question About Form AS 26451 involves several key steps:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill out the form, ensuring that all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the completed form electronically or via mail, following the guidelines provided.

Legal Use of the Puerto Rico Question About Form AS 26451

The Puerto Rico Question About Form AS 26451 is legally recognized by the Internal Revenue Service (IRS) as a valid document for tax reporting purposes. It is essential for taxpayers to understand the legal implications of the information provided on the form. Misrepresentation or inaccuracies can lead to audits or penalties, making it vital to ensure that all details are truthful and complete.

Filing Deadlines / Important Dates

Filing deadlines for the Puerto Rico Question About Form AS 26451 typically align with the standard tax filing dates established by the IRS. Taxpayers should be aware of these deadlines to avoid late fees and penalties. Generally, the deadline for filing is April fifteenth, but extensions may be available under certain circumstances. It is advisable to check the IRS website or consult a tax professional for the most current information.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Puerto Rico Question About Form AS 26451. The form can be completed and submitted online through the IRS e-filing system, which is often the fastest method. Alternatively, individuals may choose to print the form and mail it to the appropriate IRS address. In-person submissions are also possible at designated IRS offices, though this option may vary based on location and current health guidelines.

Quick guide on how to complete puerto rico question about form as 26451 2011

Your assistance manual on how to prepare your Puerto Rico Question About Form As 26451

If you're seeking information on how to finalize and dispatch your Puerto Rico Question About Form As 26451, here are some concise guidelines to facilitate tax declaration.

To begin, all you need is to register your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, create, and finalize your tax forms effortlessly. Utilizing its editor, you can navigate between text, checkboxes, and eSignatures and return to amend answers as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and convenient sharing.

Follow the steps below to finish your Puerto Rico Question About Form As 26451 in a matter of minutes:

- Create your account and start engaging with PDFs within moments.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Press Get form to access your Puerto Rico Question About Form As 26451 in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to incorporate your legally-binding eSignature (if needed).

- Review your document and rectify any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Employ this manual to file your taxes electronically with airSlate SignNow. Keep in mind that filing on paper may increase return errors and postpone refunds. Naturally, prior to e-filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct puerto rico question about form as 26451 2011

FAQs

-

How do US citizens feel about Puerto Rico adding a star to the US flag as propaganda for statehood?

Well, my first response was "They did that? Interesting." In all honestly, most Americans just don't think of Puerto Rican statehood. Statehood for the District of Columbia is more of an issue, because DC is very vocal about it. But even then, I'm biased, having lived near, though not in, DC for twenty five years now. I suppose you could say I support Puerto Rican statehood in that I'd be for it if it came to a Congressional vote and the people of Puerto Rico clearly favored it. It's hardly a big issue for me, though. Others might oppose it, but very few would get really angry about it, with the exception of bigots who don't want a Hispanic state added to the Union. As for the tactic of adding a star, I think it's probably ill-considered. The words "publicity stunt" spring to mind. I'd say it's most likely to tick off people who view the flag as sacred and inviolable.

-

How do I remove an area of "expertise" from my Quora profile? I made one supportive comment about Puerto Rico to one question, and now I get endless questions about Puerto Rico. How do I convince Quora I'm not an expert?

On the right side of your profile, you can edit your “Credentials” as well as your “Knows About” topics. But I don’t see Puerto Rico in either of those categories. And it doesn’t look like you’re following the topic, either.What I do see, which you forgot to mention in your question, is that you have written two answers on Quora - both to questions about Puerto Rico.So when someone writes a question about Puerto Rico, and Quora is looking for people to answer it… well, Quora doesn’t know if you know anything at all about any other topics, but it does know you’ve written two answers to questions about Puerto Rico!Short of flat-out deleting your answers, all I can suggest is answering questions about other topics, and hoping that enough other people will answer enough questions about Puerto Rico that you wind up “far down the list” when people are looking for people to ask.But yeah, a lot of us get asked questions about things we have no knowledge of…

-

How do we have 10 billion for a damn wall but are quick to pull help out of Puerto Rico as we still help New Orleans?

The facts of the US financial situation tell us that there isn’t money for a wall nor is there money for Puerto Rico’s so called recovery or any area’s recovery for that matter (the government isn’t even close to the most effective way to find recovery, so let’s be grateful private businesses get an opportunity to serve potential customers as they desire to be). There isn’t money for much of anything. The US government has been spending stolen funds as if there’s no end to the flow.This video with Professor Antony Davies offers perspective on how the government has no chance to resolve this problem without drastic changes in their spending. Further taxation won’t solve it. Massive cuts in spending is the only way.This video, again with Professor Davies, helps us visualize how horrific the US government budget has been neglected and abused.Personally I don’t feel any responsibility for the abuse, neglect, or any of the debt at all. The bureaucrats who have plundered productive individuals in society are responsible. Instead of feeling responsible, I feel it’s best to find a way to donate time, money, and effort to needs I feel are worthy of that time, money, and effort. As a large group of individual actors we can make a much more signNow difference than the outrageously inefficient government.

-

How do I get updates about the government jobs to fill out the form?

Employment news is the best source to know the notifications published for govt job vacancy. The details are given in the notices. The news available on net also. One can refer the news on net too. It is published regularly on weekly basis. This paper includes some good article also written by experts which benefits the students and youths for improving their skill and knowledge. Some time it gives information regarding carrier / institution/ special advance studies.

-

If we ignore questions of culture, as we did with other states, how practical would it be for the US to admit Puerto Rico and the Virgin Islands as a single state?

If you ignore culture, then I think it’s a question of geopolitics and economics. Based on these factors, the PR and USVI should NOT be a state.The US took possession of the USVI and PR from the Spanish as spoils of war. Taking possession of them made sense at the time because it was clear to the other world powers that Spain was an empire in terminal decline and had been losing control of it’s colonial possessions throughout the 1800’s. At the time it wasn’t clear if it’s remaining Caribbean colonies would gain self governance as the South American colonies had in the early 1800’s or would fall under control of a different European power. Since the US certainly has always wanted European powers to get out / stay out of ‘our’ hemisphere, it made sense at the time to take possession of Spanish colonies. However, today there’s really not a geopolitical benefit to having PR and USVI continue to be US territories. Unlike Guam and the Northern Mariana Islands, which do continue to be important to the US thanks to their location, the PR and USVI no longer really add value to US geopolitically speaking.Economically speaking, PR and USVI are net beneficiaries of being US territories. I know that some people will disagree with me on the numbers since you can expand the scope by looking at the flow of goods; but if you look simply at the taxes paid vs the benefits received, the rest of the US does not benefit from the relationship but rather pays for it. If they were independent nations rather than territories, much of the current trade would still happen, so those numbers shouldn’t be included here.HOWEVER, there’s a big reason why the US won’t free PR as a territory, and why PR wouldn’t want independence. 72 billion reason actually. PR is under a $72B debt burden; which is larger than all but three US states - NY, CA, and MA. Worse yet, PR is loosing people to the US mainland because of their economic woes. The entire US ‘owns’ this issue and so owes assistance to the PR in fixing it, but that problem in itself doesn’t indicate that statehood is a good idea but just the opposite.On a personal note, I’ve been to both USVI and PR and really enjoyed the visits. The islands themselves are beautiful, and the people were great. It’s very sad to see how hard the islands have been hit by this season’s hurricanes. I hope to see them recover as soon as possible.

-

As a teenager, what aspects about survey questions could be changed to make a survey more enjoyable to fill out?

I guess these best practices will help you:Point Out Survey Goals - Decide what you want to obtain. Choose if you should prioritize data, feedback, or generating leads. Look up at your business objectives.Select Appropriate Topics For Your Online Surveys - All the fun here is in finding the golden mean between your business objectives and your customer’s engagement.Create Catchy Forms - When choosing online survey tool, check out if there are a few features available:different themes,preferred fonts,background photo uploading,blur and brightness adjuster,different photos positioning option (fill, fit, tiled, centered),various background, answer, answer background, and question colors to choose.Add Right Number of Questions - number of questions should belong to the 5 – 7 interval (9 when it’s more complicated).Diversify Questions Types - Declining attention span obligate online surveys creators to use various types of questions. When selecting your take into account your target group, topic, and which kind helps with making questions fillable. Your survey maker should have (at least) 4 types of questions:multiple choice,picture choice,ratings,open forms.Make a Use of a Different Kind of Content - Follow this guidebook to learn how to add videos, audio content, and gifs to your online surveys.Distribute Online Surveys In a Smart Way - Focus on your audience and get their insight. Use available channels to signNow out to them:embed survey into your website,share through your social media channels,send a link in email, SMS, a direct message in common messengers,embed into your blog posts and articles.share in your professional groups and chats.Generate Leads - interactive content (surveys, quizzes, polls, assessments) makes generating leads more intuitive. Surveys make a use of taken actions and emails leaving forms implemented in the sequence of motions. It is easier to make third or fourth step than first one. When interesting in gaining leads through interactive content, find out more.Try out Engageform:1. Quick to create and design – intuitive and effortless panel2. Easy sharing and embedding – spread your interactive content across the web3. Feedback, stats & leads – user-friendly analyticsFind out more>>Feel free to contact me. Disclosure: I work at 4screens

-

I am applying for a job as Interaction Designer in New York, the company has an online form to fill out and they ask about my current salary, I am freelancing.. What should I fill in?

As Sarah said, leave it blank or, if it's a free-form text field, put in "Freelancer".If you put in $50k and they were thinking of paying $75k, you just lost $25k/year. If you put in $75k, but their budget only allows $50k, you may have lost the job on that alone.If you don't put in anything, leave it to the interview, and tell thm that you're a freelancer and adjust your fee according to the difficulty of the job, so there's no set income. If they ask for how much you made last year, explain that that would include periods between jobs, where you made zero, so it's not a fair number.In any financial negotiation, an old saying will always hold true - he who comes up with a number first, loses. Jobs, buying houses - they're both the same. Asking "How much?" is the better side to be on. then if they say they were thinking of $50k-$75k, you can tell them that it's just a little less than you were charging, but the job looks to be VERY interesting, the company seems to be a good one to work for and you're sure that when they see what you're capable of, they'll adjust your increases. (IOW, "I'll take the $75k, but I expect to be making about $90k in a year.")They know how to play the game - show them that you do too.

-

There is curfew in my area and Internet service is blocked, how can I fill my exam form as today is the last day to fill it out?

Spend less time using your blocked Internet to ask questions on Quora, andTravel back in time to when there was no curfew and you were playing Super Mario Kart, and instead, fill out your exam form.

Create this form in 5 minutes!

How to create an eSignature for the puerto rico question about form as 26451 2011

How to generate an electronic signature for the Puerto Rico Question About Form As 26451 2011 online

How to create an electronic signature for the Puerto Rico Question About Form As 26451 2011 in Chrome

How to create an electronic signature for signing the Puerto Rico Question About Form As 26451 2011 in Gmail

How to generate an eSignature for the Puerto Rico Question About Form As 26451 2011 right from your smart phone

How to generate an electronic signature for the Puerto Rico Question About Form As 26451 2011 on iOS devices

How to create an eSignature for the Puerto Rico Question About Form As 26451 2011 on Android devices

People also ask

-

What is the airSlate SignNow solution for the 'Puerto Rico Question About Form AS 26451'?

airSlate SignNow provides a comprehensive eSigning solution for managing forms like the Puerto Rico Question About Form AS 26451. With its intuitive interface, users can easily create, send, and sign documents securely, all while ensuring compliance with local regulations. This tool simplifies the paperwork process, making it efficient for businesses operating in Puerto Rico.

-

How can airSlate SignNow assist with compliance related to the Puerto Rico Question About Form AS 26451?

airSlate SignNow is designed to help businesses adhere to compliance requirements for the Puerto Rico Question About Form AS 26451. By utilizing secure electronic signatures and storing documents in a compliant manner, airSlate SignNow ensures that you remain within legal guidelines while expediting document processing times.

-

What are the pricing options for airSlate SignNow when handling forms like Puerto Rico Question About Form AS 26451?

The pricing for airSlate SignNow is competitive and affordable, tailored to the needs of businesses managing documents such as the Puerto Rico Question About Form AS 26451. We offer various subscription plans designed to suit businesses of all sizes. By reviewing our pricing tiers, you can choose the best plan that meets your requirements.

-

Does airSlate SignNow integrate with other tools for managing Puerto Rico Question About Form AS 26451?

Yes, airSlate SignNow offers seamless integrations with numerous applications to help manage the Puerto Rico Question About Form AS 26451. Our platform can connect with popular tools like Salesforce, Google Drive, and Microsoft Office, enabling businesses to streamline their workflow and enhance productivity.

-

What features does airSlate SignNow provide for businesses handling the Puerto Rico Question About Form AS 26451?

airSlate SignNow offers a variety of features tailored for handling the Puerto Rico Question About Form AS 26451, including document templates, team collaboration, and automated workflows. These features simplify document management by allowing users to customize their forms and expedite signature collection. This makes it easier to focus on growing your business.

-

Is airSlate SignNow user-friendly for those managing the Puerto Rico Question About Form AS 26451?

Absolutely! airSlate SignNow is designed with user experience in mind, making it exceptionally user-friendly for managing the Puerto Rico Question About Form AS 26451. Our straightforward interface allows users to navigate effortlessly through the document workflow, facilitating quick adoption and minimizing the learning curve for all team members.

-

What are the benefits of using airSlate SignNow for Puerto Rico Question About Form AS 26451?

Using airSlate SignNow for the Puerto Rico Question About Form AS 26451 brings signNow benefits, such as reduced turnaround time and enhanced security for sensitive documents. It also enables better tracking of document status and ensures timely access, which helps in improving overall operational efficiency for businesses in Puerto Rico.

Get more for Puerto Rico Question About Form As 26451

Find out other Puerto Rico Question About Form As 26451

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple