IDB TAX FORM 7R Ajbid

What is the IDB Tax Form 7R Ajbid

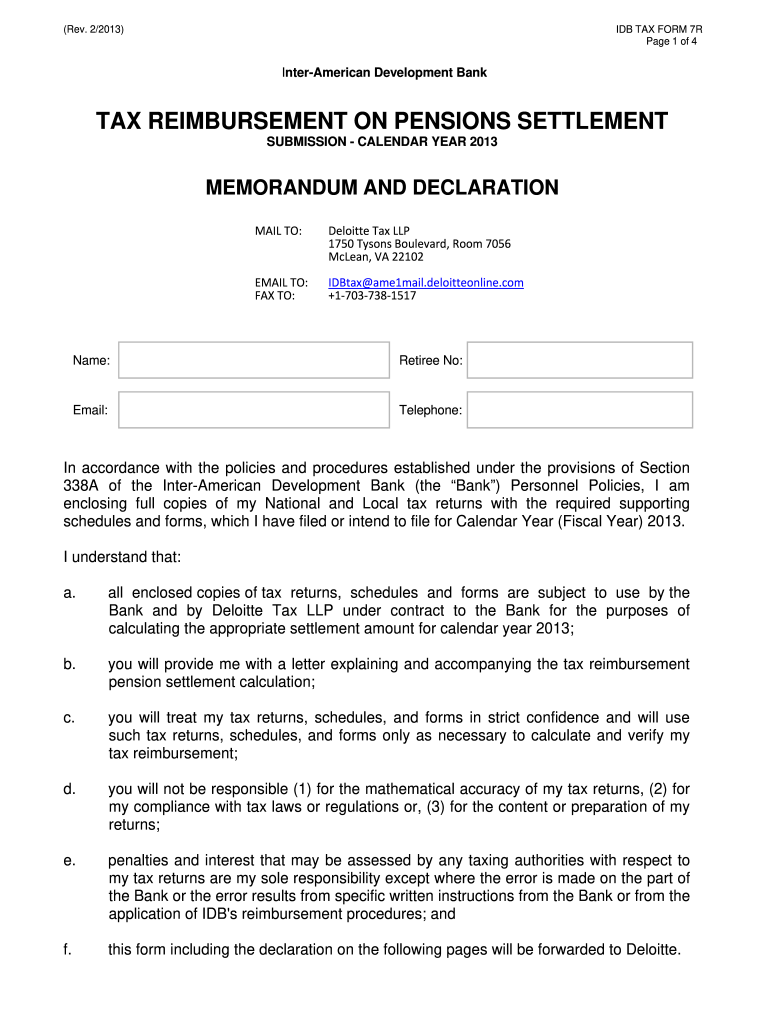

The IDB Tax Form 7R Ajbid is a specific tax form used in the United States for reporting certain financial information to the Internal Revenue Service (IRS). This form is typically required for individuals or businesses that need to disclose specific income, deductions, or credits. Understanding the purpose of the IDB Tax Form 7R Ajbid is essential for compliance with tax regulations and ensuring accurate reporting. It serves as a critical document in the tax filing process, facilitating transparency and accountability in financial dealings.

How to Use the IDB Tax Form 7R Ajbid

Using the IDB Tax Form 7R Ajbid involves several key steps to ensure accurate completion. First, gather all necessary financial documents and information required to fill out the form. This may include income statements, previous tax returns, and other relevant records. Next, carefully follow the instructions provided with the form to enter your information correctly. It is important to double-check all entries for accuracy to avoid potential issues with the IRS. Once completed, the form can be submitted electronically or through traditional mail, depending on your preference and the guidelines set forth by the IRS.

Steps to Complete the IDB Tax Form 7R Ajbid

Completing the IDB Tax Form 7R Ajbid involves a systematic approach. Begin by downloading the form from the IRS website or obtaining a physical copy. Next, fill in your personal information, including your name, address, and Social Security number. Proceed to report your income, deductions, and any applicable credits as instructed. After entering all required information, review the form for any errors or omissions. Finally, sign and date the form before submitting it to the IRS by the designated deadline, ensuring you keep a copy for your records.

Legal Use of the IDB Tax Form 7R Ajbid

The legal use of the IDB Tax Form 7R Ajbid is governed by IRS regulations that dictate how and when the form should be filed. It is essential to understand that submitting this form is not only a matter of compliance but also a legal obligation. Failure to file the form accurately or on time can result in penalties or legal repercussions. Therefore, it is crucial to ensure that all information provided is truthful and complete, as the IRS may audit submissions and require supporting documentation.

Filing Deadlines / Important Dates

Filing deadlines for the IDB Tax Form 7R Ajbid are critical to avoid penalties. Typically, the IRS sets specific dates each tax year by which the form must be submitted. It is essential to stay informed about these deadlines, which can vary based on individual circumstances, such as whether you are self-employed or filing jointly. Marking these dates on your calendar can help ensure timely submission and compliance with tax regulations.

Required Documents

To complete the IDB Tax Form 7R Ajbid accurately, certain documents are required. These may include income statements, such as W-2s or 1099s, previous tax returns, and documentation supporting any deductions or credits claimed. Having all necessary documents on hand will streamline the process and reduce the likelihood of errors. It is advisable to organize these documents before beginning to fill out the form to ensure a smooth completion process.

Quick guide on how to complete idb tax form 7r ajbid

Effortlessly prepare IDB TAX FORM 7R Ajbid on any device

Managing documents online has gained signNow popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the functionalities required to create, modify, and electronically sign your documents quickly and without delays. Handle IDB TAX FORM 7R Ajbid on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to edit and electronically sign IDB TAX FORM 7R Ajbid with ease

- Find IDB TAX FORM 7R Ajbid and click Get Form to begin.

- Utilize our tools to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from your chosen device. Edit and electronically sign IDB TAX FORM 7R Ajbid and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the idb tax form 7r ajbid

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ajbid and how does it relate to airSlate SignNow?

ajbid is a key term associated with airSlate SignNow's cost-effective solutions for electronic signatures and document management. By leveraging ajbid, businesses can streamline their document workflows, improve efficiency, and enhance collaboration with all stakeholders.

-

How much does using ajbid with airSlate SignNow cost?

The pricing for airSlate SignNow, including ajbid functionalities, varies based on the plan chosen. We offer flexible pricing models designed to fit businesses of all sizes, ensuring that you can access essential features without breaking the bank.

-

What features are included with the ajbid aspect of airSlate SignNow?

airSlate SignNow's ajbid options include powerful features such as customizable templates, automated workflow processes, and secure eSignature functionality. These tools help to simplify the signing process, saving time and boosting productivity.

-

How does using ajbid enhance document security in airSlate SignNow?

With ajbid integrated into airSlate SignNow, users benefit from advanced security measures, including encryption and secure access controls. This ensures that all signed documents are protected, providing peace of mind for businesses handling sensitive information.

-

Can ajbid be integrated with other tools and applications?

Yes, airSlate SignNow supports ajbid integrations with a variety of third-party applications. This flexibility allows businesses to connect their existing tools for seamless workflows, making it easier to manage documents and signatures in one place.

-

What are the benefits of using ajbid for remote teams?

Using ajbid with airSlate SignNow offers numerous benefits for remote teams, such as streamlined document signing from any location. Teams can collaborate and complete paperwork quickly, which enhances overall productivity and reduces time spent on administrative tasks.

-

Is there a free trial available for exploring ajbid features in airSlate SignNow?

Absolutely! airSlate SignNow provides a free trial that includes access to all ajbid features. This allows prospective customers to evaluate the platform's capabilities and see how it can meet their specific document management needs.

Get more for IDB TAX FORM 7R Ajbid

- Lg220 2012 form

- Lg286 pull tab dispensing device game receipts minnesotagov mn form

- Fillable form with no auto calculations

- Per berkeley municipal code 9 form

- California hotel tax exempt form pdf

- Ca brand registration form

- Rental of real property fillable form with no auto calculations

- Instructions for completing the certificate of cagov form

Find out other IDB TAX FORM 7R Ajbid

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors