Fiduciary Adjustment Resident Estates and Trusts Only See Instructions Maine Form

What is the Fiduciary Adjustment Resident Estates And Trusts Only see Instructions Maine

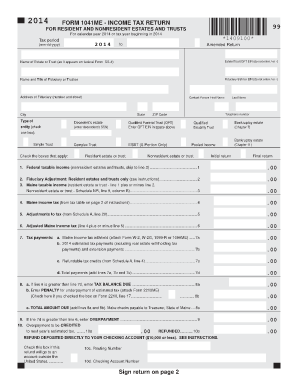

The Fiduciary Adjustment Resident Estates and Trusts Only see Instructions Maine form is a legal document used in the state of Maine for tax purposes related to estates and trusts. This form is essential for fiduciaries managing estates or trusts to report income and adjustments accurately. It ensures compliance with state tax regulations and provides a clear framework for the fiduciary's responsibilities in managing the estate or trust assets. Understanding the nuances of this form is crucial for fiduciaries to fulfill their legal obligations effectively.

Steps to complete the Fiduciary Adjustment Resident Estates And Trusts Only see Instructions Maine

Completing the Fiduciary Adjustment Resident Estates and Trusts Only see Instructions Maine form involves several key steps:

- Gather necessary documentation, including financial statements and tax records related to the estate or trust.

- Review the specific instructions provided for the form to understand the requirements.

- Fill out the form accurately, ensuring that all figures are correct and reflect the current financial status of the estate or trust.

- Sign the form, ensuring that all required signatures are included to validate the document.

- Submit the completed form by the designated deadline, either electronically or via mail, as per state guidelines.

Legal use of the Fiduciary Adjustment Resident Estates And Trusts Only see Instructions Maine

The legal use of the Fiduciary Adjustment Resident Estates and Trusts Only see Instructions Maine form is paramount for fiduciaries. This form must be completed in accordance with Maine state laws to ensure that all tax obligations are met. The form serves as a declaration of the fiduciary's management of the estate or trust, detailing any adjustments that may affect tax liabilities. Proper use of this form helps avoid legal complications and potential penalties for non-compliance.

State-specific rules for the Fiduciary Adjustment Resident Estates And Trusts Only see Instructions Maine

Maine has specific rules governing the use of the Fiduciary Adjustment Resident Estates and Trusts Only see Instructions Maine form. These rules include:

- Fiduciaries must file the form by the state-mandated deadlines to avoid penalties.

- All income and adjustments reported must align with Maine tax laws and regulations.

- Fiduciaries are responsible for maintaining accurate records to support the information provided on the form.

How to obtain the Fiduciary Adjustment Resident Estates And Trusts Only see Instructions Maine

To obtain the Fiduciary Adjustment Resident Estates and Trusts Only see Instructions Maine form, fiduciaries can visit the official Maine state tax website. The form is typically available for download in a PDF format, allowing for easy access and printing. Additionally, fiduciaries may contact the Maine Revenue Services for assistance or clarification regarding the form and its requirements.

Examples of using the Fiduciary Adjustment Resident Estates And Trusts Only see Instructions Maine

Examples of using the Fiduciary Adjustment Resident Estates and Trusts Only see Instructions Maine form include:

- A fiduciary managing a deceased individual's estate must report income generated from estate assets.

- A trustee of a trust must detail any distributions made to beneficiaries and how they affect the trust's tax obligations.

Quick guide on how to complete fiduciary adjustment resident estates and trusts only see instructions maine

Easily prepare Fiduciary Adjustment Resident Estates And Trusts Only see Instructions Maine on any device

Digital document management has gained signNow traction among organizations and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Fiduciary Adjustment Resident Estates And Trusts Only see Instructions Maine on any device using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to edit and eSign Fiduciary Adjustment Resident Estates And Trusts Only see Instructions Maine effortlessly

- Find Fiduciary Adjustment Resident Estates And Trusts Only see Instructions Maine and then click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details carefully and then click on the Done button to save your changes.

- Choose how you prefer to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Leave behind concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Edit and eSign Fiduciary Adjustment Resident Estates And Trusts Only see Instructions Maine and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fiduciary adjustment resident estates and trusts only see instructions maine

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Fiduciary Adjustment for Resident Estates and Trusts only in Maine?

The Fiduciary Adjustment for Resident Estates and Trusts only in Maine refers to specific tax modifications required by the state. This adjustment is essential for ensuring compliance with Maine tax laws when managing estate or trust tax returns. airSlate SignNow can simplify the process of preparing these documents, making it easier to handle the fiduciary responsibilities.

-

How does airSlate SignNow help with fiduciary adjustments in Maine?

airSlate SignNow offers an intuitive platform for electronically signing and managing essential documents related to Fiduciary Adjustment Resident Estates And Trusts Only see Instructions Maine. The software streamlines the eSigning process, ensuring that all necessary adjustments can be executed efficiently and in accordance with Maine regulations.

-

What features does airSlate SignNow offer for managing estate and trust documents?

airSlate SignNow includes features such as template management, document tracking, and secure storage, which are crucial for managing Fiduciary Adjustment Resident Estates And Trusts Only see Instructions Maine. These tools enhance the efficiency of document handling and ensure you have access to all needed adjustments at your fingertips.

-

Is airSlate SignNow cost-effective for fiduciary document management?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing fiduciary documents. With competitive pricing tailored for both individuals and businesses, it provides excellent value while ensuring you meet the requirements for the Fiduciary Adjustment Resident Estates And Trusts Only see Instructions Maine.

-

Can I integrate airSlate SignNow with other software I use?

Absolutely! airSlate SignNow offers integrations with various tools and software, making it easier to manage all aspects of your fiduciary duties. This flexibility is advantageous when dealing with the specifics of the Fiduciary Adjustment Resident Estates And Trusts Only see Instructions Maine, allowing seamless collaboration across platforms.

-

What are the benefits of using airSlate SignNow for trust and estate documents?

Using airSlate SignNow for trust and estate documents allows for quicker processing and enhanced security. The platform's compliance with the requirements of the Fiduciary Adjustment Resident Estates And Trusts Only see Instructions Maine means you can trust that your important documents are handled correctly and securely.

-

Is airSlate SignNow user-friendly for those new to fiduciary adjustments?

Yes, airSlate SignNow offers a user-friendly interface that simplifies the process of managing fiduciary adjustments, even for newcomers. With clear instructions and support tailored for Fiduciary Adjustment Resident Estates And Trusts Only see Instructions Maine, users can quickly get up to speed on the essentials.

Get more for Fiduciary Adjustment Resident Estates And Trusts Only see Instructions Maine

- University of western australia and notre dame university form

- Staff fort wayne allen county department of health form

- Patient questionnaire form

- Family safety guide central coast coalition for form

- Barnard alumnae pdf free download form

- Signature of patient or responsible party date form

- Supplier questionnaire for cosmetic ingredients ikw form

- New patient questionnaire north park acupuncture form

Find out other Fiduciary Adjustment Resident Estates And Trusts Only see Instructions Maine

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors