Form 8822 Turbotax Fill in

What is the Form 8822 Turbotax Fill In

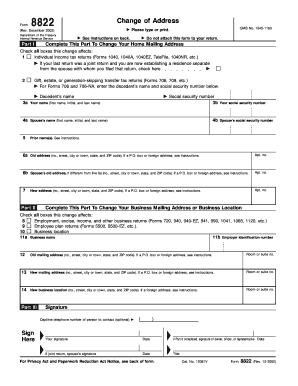

The Form 8822 is a tax form used by individuals to notify the Internal Revenue Service (IRS) of a change in address. This form is essential for ensuring that the IRS has your current address on file, which is crucial for receiving important tax documents and correspondence. The Form 8822 Turbotax fill in allows users to complete this form digitally, streamlining the process and making it more convenient. By utilizing digital tools, taxpayers can fill out the form accurately and efficiently, reducing the risk of errors that may occur with handwritten submissions.

How to use the Form 8822 Turbotax Fill In

Using the Form 8822 Turbotax fill in is straightforward. First, access the form through your TurboTax software or an online platform that supports e-filing. Begin by entering your personal information, including your name, Social Security number, and the old and new addresses. Ensure that all information is accurate to prevent delays in processing. Once you have filled in all required fields, review the form for any errors. After confirming that everything is correct, you can electronically sign and submit the form directly to the IRS.

Steps to complete the Form 8822 Turbotax Fill In

Completing the Form 8822 Turbotax fill in involves several key steps:

- Access the form through TurboTax or a compatible online platform.

- Fill in your personal details, including your full name and Social Security number.

- Provide your previous address and your new address.

- Review all entered information for accuracy.

- Sign the form electronically.

- Submit the form to the IRS electronically.

Following these steps helps ensure that your address change is processed smoothly and efficiently.

Legal use of the Form 8822 Turbotax Fill In

The legal use of the Form 8822 Turbotax fill in is grounded in its compliance with IRS regulations. When filled out correctly, the form serves as a formal notification to the IRS about your address change. It is important to note that failing to notify the IRS of your new address can lead to missed tax documents and potential penalties. By utilizing a reliable digital platform, you can ensure that your submission meets all necessary legal requirements, maintaining compliance with eSignature laws and IRS guidelines.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8822 are generally aligned with tax season. It is recommended to submit the form as soon as you change your address to avoid any disruptions in receiving tax-related correspondence. While there is no specific deadline for submitting Form 8822, timely notification is crucial, especially if you are expecting a tax refund or other important documents. Keeping track of important dates related to tax filings can help ensure that you stay compliant with IRS requirements.

Form Submission Methods (Online / Mail / In-Person)

The Form 8822 can be submitted in several ways, providing flexibility for taxpayers. The most efficient method is to submit the form electronically through TurboTax or other compatible software. This method ensures faster processing and confirmation of receipt. Alternatively, you can print the completed form and mail it to the appropriate IRS address based on your state. In-person submission is generally not available for this form, as it is primarily processed through electronic or mail channels. Choosing the right submission method can help expedite the address change process.

Quick guide on how to complete form 8822 turbotax fill in

Effortlessly prepare Form 8822 Turbotax Fill In on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 8822 Turbotax Fill In on any device using airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

How to alter and eSign Form 8822 Turbotax Fill In with ease

- Locate Form 8822 Turbotax Fill In and select Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Form 8822 Turbotax Fill In and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8822 turbotax fill in

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of form 8822 in TurboTax?

Form 8822 is used to notify the IRS of a change of address. Completing the form 8822 TurboTax fill in ensures that your tax records are updated, allowing the IRS to send future correspondence to your new address effectively.

-

How do I fill in form 8822 using TurboTax?

To fill in form 8822 using TurboTax, simply log into your account and navigate to the section for change of address. Follow the prompts to input your new information, and TurboTax will assist you in completing the form 8822 TurboTax fill in accurately.

-

Is there a cost associated with using TurboTax to fill in form 8822?

TurboTax offers different pricing plans, which may include the ability to fill in form 8822 as part of their services. While some plans come at a cost, the ease of completing the form 8822 TurboTax fill in can save you time and potential mistakes, making it a worthy investment.

-

Can I use airSlate SignNow to eSign my completed form 8822?

Yes, once you have completed form 8822 TurboTax fill in, you can upload it to airSlate SignNow for electronic signature. This not only streamlines the signing process but also provides secure handling and storage of your important documents.

-

What are the key benefits of using TurboTax for form 8822?

Using TurboTax for form 8822 offers several benefits including user-friendly navigation, error-checking capabilities, and guided instructions tailored for taxpayers. The form 8822 TurboTax fill in feature simplifies the process, ensuring you comply with IRS requirements quickly and accurately.

-

Does TurboTax provide support for filling out form 8822?

Yes, TurboTax provides support for filling out form 8822. Their customer service representatives, as well as comprehensive online resources, can assist you with the form 8822 TurboTax fill in process, ensuring that you have the help you need for a successful submission.

-

What features does TurboTax offer for filling out tax forms like form 8822?

TurboTax offers features such as automatic updates for tax laws, step-by-step guidance, and the ability to import prior year data, which can signNowly ease the form 8822 TurboTax fill in process. Additionally, it saves your information securely for future reference.

Get more for Form 8822 Turbotax Fill In

- Texas advertising annual certification of compliance form

- Form 1073 for tanf

- Specialized medical vehicle driver information chart f 01301

- Houston form

- Plan of correction template form

- Undue hardship forms wv

- Application for undue hardship waiver wv income maintenance manual wvdhhr form

- Illinois link form

Find out other Form 8822 Turbotax Fill In

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF