La Form it 565 Instructions

What is the Louisiana Form IT 565?

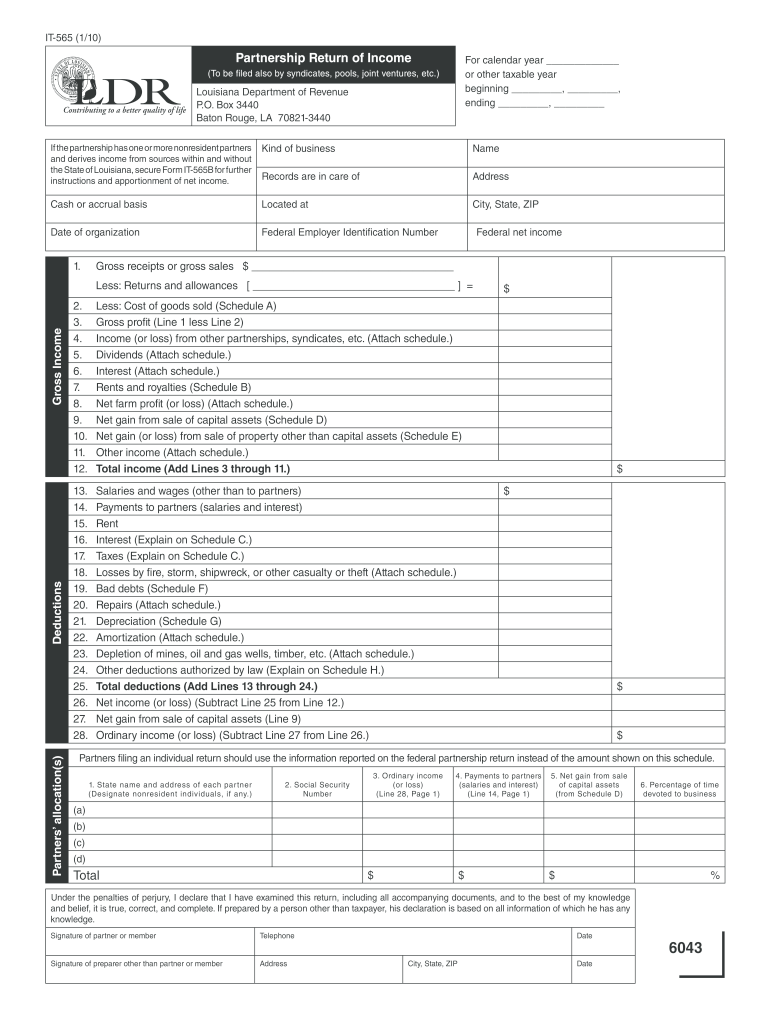

The Louisiana Form IT 565 is a tax return form specifically designed for partnerships operating within the state of Louisiana. This form is essential for reporting the income, deductions, and credits of partnerships, allowing the state to assess the appropriate tax liabilities. The IT 565 is part of the Louisiana Department of Revenue's requirements for partnerships to ensure compliance with state tax laws.

Steps to Complete the Louisiana Form IT 565

Completing the Louisiana Form IT 565 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense reports. Next, accurately fill out the form by providing details such as the partnership's name, address, and federal employer identification number (EIN). Ensure that all income and deductions are reported correctly. After completing the form, review it for any errors or omissions before submission.

Filing Deadlines for the Louisiana Form IT 565

The filing deadline for the Louisiana Form IT 565 typically aligns with the federal tax return deadlines. Partnerships must file their returns by the 15th day of the third month following the end of their tax year. For partnerships operating on a calendar year, this means the form is due by March 15. It is crucial to adhere to these deadlines to avoid penalties and interest on any unpaid taxes.

Required Documents for the Louisiana Form IT 565

When preparing to file the Louisiana Form IT 565, certain documents are essential. These include:

- Partnership financial statements

- Federal tax return (Form 1065)

- Schedule K-1 for each partner

- Records of income and expenses

- Any applicable tax credits or deductions documentation

Having these documents ready will facilitate a smoother filing process and help ensure compliance with state regulations.

Legal Use of the Louisiana Form IT 565

The Louisiana Form IT 565 is legally binding when completed and submitted according to state regulations. Electronic signatures are accepted, provided they meet the requirements set forth by the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). Using a reliable electronic platform for submission can enhance security and compliance, ensuring that the form is recognized as valid by state authorities.

Form Submission Methods for the Louisiana Form IT 565

Partnerships have several options for submitting the Louisiana Form IT 565. The form can be filed electronically through the Louisiana Department of Revenue's online portal, which offers a streamlined process for submission. Alternatively, partnerships may choose to mail a paper copy of the form to the appropriate state address. In-person submissions are also accepted at designated state offices, providing flexibility based on the partnership's preferences.

Penalties for Non-Compliance with the Louisiana Form IT 565

Failure to file the Louisiana Form IT 565 by the deadline can result in significant penalties. Late filing penalties may accrue, typically calculated as a percentage of the unpaid tax amount. Additionally, interest may be charged on any outstanding tax liabilities. It is essential for partnerships to file on time and accurately to avoid these financial repercussions and maintain compliance with state tax laws.

Quick guide on how to complete la form it 565 instructions

Prepare La Form It 565 Instructions effortlessly across any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documentation, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage La Form It 565 Instructions on any device using airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The easiest way to modify and electronically sign La Form It 565 Instructions without hassle

- Obtain La Form It 565 Instructions and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses all your requirements in document management with just a few clicks from any device you choose. Modify and electronically sign La Form It 565 Instructions to ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the la form it 565 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Louisiana Form IT-565?

The Louisiana Form IT-565 is a state tax form used by partners to report partnerships, limited liability companies (LLCs), and other pass-through entities. Properly completing the Louisiana Form IT-565 ensures compliance with state tax regulations and affects each partner's individual tax returns.

-

How can airSlate SignNow help with Louisiana Form IT-565?

airSlate SignNow provides an intuitive platform for securely sending and eSigning the Louisiana Form IT-565. With its user-friendly interface, you can easily gather signatures from multiple partners, ensuring timely submission of tax documents.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including a free trial to get started. By using airSlate SignNow for the Louisiana Form IT-565, you can save time and reduce costs associated with traditional signing methods.

-

What features does airSlate SignNow provide for document signing?

Key features of airSlate SignNow include customizable templates, real-time tracking, and cloud storage. These features make it easier to manage the Louisiana Form IT-565 and enhance collaboration across your team.

-

Is airSlate SignNow compliant with state regulations for the Louisiana Form IT-565?

Yes, airSlate SignNow is compliant with all applicable laws and regulations regarding digital signatures, making it a reliable option for the Louisiana Form IT-565. Your documents are securely stored and legally binding, ensuring peace of mind for all parties involved.

-

Can I integrate airSlate SignNow with other software for filing the Louisiana Form IT-565?

Absolutely! airSlate SignNow seamlessly integrates with various applications, such as accounting software and CRMs, simplifying the process of filing the Louisiana Form IT-565. This integration helps ensure that all your financial data is aligned and accessible.

-

What are the benefits of using airSlate SignNow for the Louisiana Form IT-565?

Using airSlate SignNow for the Louisiana Form IT-565 streamlines the signature collection process and improves accuracy. The platform's automation features reduce human error and enhance efficiency, allowing you to focus on other important business tasks.

Get more for La Form It 565 Instructions

- Spouse andor child of a deceased member spouse andor child of a deceased member form

- Pens con form

- Reconsideration personal retired military member reconsideration personal retired military member form

- Sample submission department of primary industries form

- Youtube scroll saw puzzles for kids projects that sell well form

- Personal accident insurance beneficiary form

- Chronic pain management mr pain assessment questionnaire form

- Wa secretary state llc form

Find out other La Form It 565 Instructions

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now