Form 706

What is the Form 706

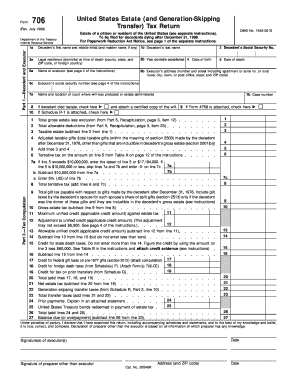

The Form 706, officially known as the United States Estate (and Generation-Skipping Transfer) Tax Return, is a crucial document used to report the value of an estate upon the death of an individual. This form is primarily utilized for federal estate tax purposes and is required when the gross estate exceeds a specific threshold, which can vary annually. The form captures essential details about the decedent's assets, liabilities, and any deductions that may apply, ensuring compliance with federal tax laws.

How to obtain the Form 706

The Form 706 can be obtained directly from the Internal Revenue Service (IRS) website, where it is available for download in PDF format. Additionally, individuals may request a physical copy by contacting the IRS or visiting a local IRS office. It is advisable to ensure that you are using the correct version of the form, as there may be updates or changes that affect filing requirements.

Steps to complete the Form 706

Completing the Form 706 involves several key steps:

- Gather all necessary documentation regarding the decedent's assets, including property deeds, bank statements, and investment records.

- Determine the total value of the gross estate, including real estate, personal property, and financial accounts.

- Identify any debts or liabilities that may offset the estate's value, such as mortgages or loans.

- Complete each section of the form accurately, ensuring all information is consistent with supporting documents.

- Review the form for accuracy before submission, as errors can lead to delays or penalties.

Legal use of the Form 706

The legal use of the Form 706 is critical for ensuring compliance with federal estate tax regulations. This form must be filed within nine months of the decedent's date of death, although an extension may be requested. Proper filing not only helps in determining tax liabilities but also protects the estate from potential legal issues arising from non-compliance. It is essential that the form is completed correctly to avoid disputes with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 706 are crucial for compliance. The form must be submitted within nine months following the date of death of the decedent. If additional time is needed, an extension can be requested using Form 4768, which provides an automatic six-month extension. However, it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Required Documents

To complete the Form 706, several documents are required to substantiate the information provided. These may include:

- Death certificate of the decedent.

- Appraisals of real estate and personal property.

- Bank statements and investment account statements.

- Documentation of debts and liabilities.

- Previous tax returns, if applicable.

Quick guide on how to complete form 706

Easily Prepare Form 706 on Any Device

Digital document management has gained immense popularity among businesses and individuals alike. It serves as a superb eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Manage Form 706 on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The Easiest Way to Edit and eSign Form 706 Effortlessly

- Locate Form 706 and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Select important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Generate your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to finalize your changes.

- Decide how you want to send your form: via email, SMS, or an invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Edit and eSign Form 706 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 706

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 706 1999?

Form 706 1999 is a federal estate tax return specifically used for reporting the estate of a decedent who passed away in 1999. This form is essential for calculating the estate tax owed and ensuring compliance with IRS regulations. Understanding the requirements of Form 706 1999 can help executors manage estates effectively.

-

How can airSlate SignNow help with Form 706 1999?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending Form 706 1999 documents. With its robust features, users can streamline the e-signing process, ensuring timely submission and compliance with statutory requirements. This typically enhances the efficiency of handling important tax-related documents.

-

What features does airSlate SignNow offer for Form 706 1999 processing?

AirSlate SignNow offers features such as customizable templates, secure document storage, and real-time tracking that can signNowly optimize the processing of Form 706 1999. Users can easily create and manage necessary documents while ensuring secure e-signatures and compliance. These features make it ideal for estate planners and tax professionals.

-

Is there a cost associated with using airSlate SignNow for Form 706 1999?

Yes, airSlate SignNow operates on a subscription-based pricing model, offering various plans to suit different needs. These plans typically include features like unlimited e-signatures and document storage, which streamline the management of key documents like Form 706 1999. Comparing plans can help you choose the best value for your requirements.

-

Can airSlate SignNow integrate with other software for managing Form 706 1999?

Absolutely! airSlate SignNow integrates seamlessly with various applications and software, such as CRMs and document management systems, to enhance the process of handling Form 706 1999. These integrations enable users to automate workflows, improving efficiency when dealing with estate documents. This connectivity is crucial for comprehensive estate management.

-

What are the benefits of eSigning Form 706 1999 with airSlate SignNow?

eSigning Form 706 1999 with airSlate SignNow provides numerous advantages, including enhanced security, faster turnaround time, and improved compliance tracking. Digital signatures are legally binding, ensuring that all parties involved have signed the document accurately. This process mitigates the risks linked with traditional signing methods.

-

How secure is the information shared with airSlate SignNow for Form 706 1999?

The safety of your documents is a top priority for airSlate SignNow. The platform employs advanced encryption protocols and complies with relevant regulations to ensure that information related to Form 706 1999 remains confidential. Users can trust that their sensitive data is protected throughout the e-signing process.

Get more for Form 706

- Wwwyellowpagescomharrisburg pamippennsylvania state archives 350 north st harrisburg pa form

- Pdf winter hip amp knee course international congress for joint form

- Stamp duty transfer securities form

- Wwwpdffillercom518284420 fax 4903025 926650 fillable online fax 49 030 25 92 66 50 fax email print form

- Homebound ampamp hospital student services policy form

- Wwwuslegalformscomform library257726authorization of administration for udca form us legal forms

- F 1 01 formulir

- Wwwmassgovorgsmassachusetts department ofmassachusetts department of children ampamp families dcf form

Find out other Form 706

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure