Il 5754 Form

What is the IL 5754 Form

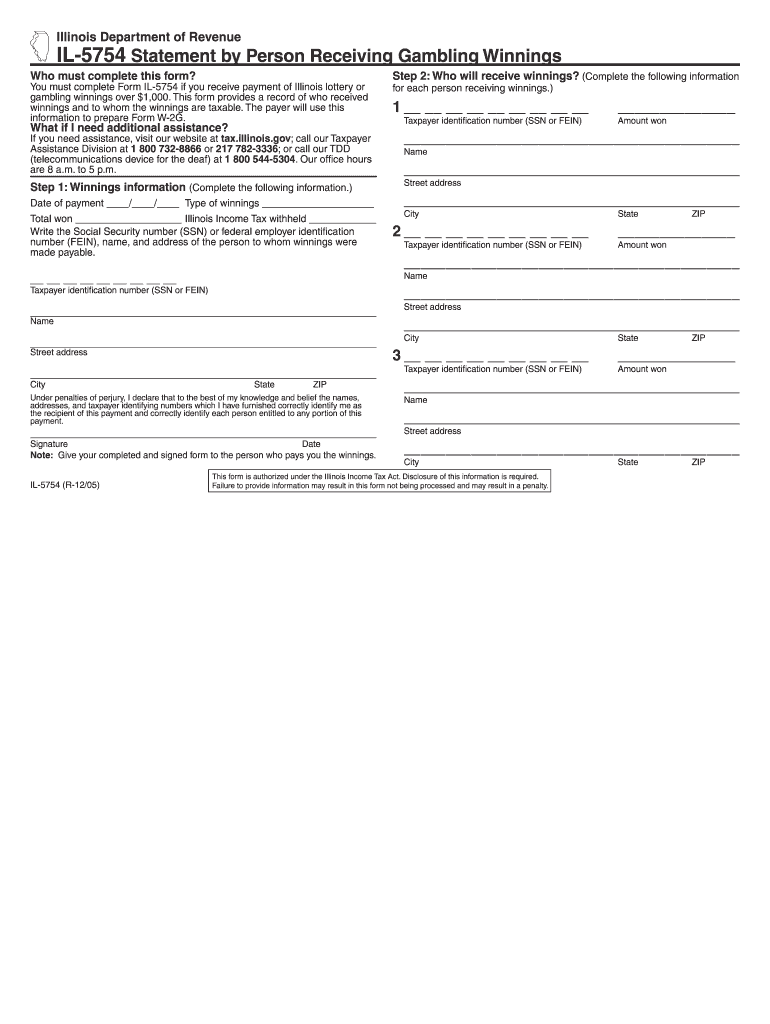

The IL 5754 form is a document used primarily for tax purposes in the state of Illinois. It serves as a declaration of the taxpayer's eligibility for certain credits or exemptions. This form is essential for individuals and businesses seeking to report specific financial information to the Illinois Department of Revenue. Understanding the purpose of the IL 5754 form is crucial for ensuring compliance with state tax regulations.

How to Obtain the IL 5754 Form

The IL 5754 form can be easily obtained through the Illinois Department of Revenue's official website. It is available in a downloadable PDF format, allowing users to print it for completion. Additionally, physical copies may be available at local tax offices or public libraries. Ensuring you have the correct version of the form is important, as updates may occur periodically.

Steps to Complete the IL 5754 Form

Completing the IL 5754 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, carefully fill out each section of the form, providing accurate information regarding your eligibility for credits or exemptions. After completing the form, review it for any errors before submission. Finally, ensure that you sign and date the form, as an unsigned document may be considered invalid.

Legal Use of the IL 5754 Form

The IL 5754 form is legally binding when completed and submitted according to the guidelines set forth by the Illinois Department of Revenue. It is crucial to adhere to all instructions to ensure that the form is accepted. The information provided on the form must be truthful and accurate, as any discrepancies may lead to penalties or audits. Understanding the legal implications of the IL 5754 form helps taxpayers navigate their responsibilities effectively.

Filing Deadlines / Important Dates

Filing deadlines for the IL 5754 form typically align with state tax deadlines. It is essential to submit the form by the designated due date to avoid penalties. Taxpayers should be aware of any changes to deadlines, which may occur due to legislative updates or special circumstances. Keeping track of important dates ensures compliance and helps avoid unnecessary complications during the tax filing process.

Form Submission Methods

The IL 5754 form can be submitted through various methods, including online, by mail, or in person. For online submissions, taxpayers can use the Illinois Department of Revenue's e-filing system, which offers a convenient and efficient way to file. If choosing to mail the form, ensure it is sent to the correct address and postmarked by the filing deadline. In-person submissions can be made at designated tax offices, providing an opportunity to ask questions or clarify any uncertainties.

Quick guide on how to complete il 5754 form

Complete Il 5754 Form seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly and without delays. Manage Il 5754 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Il 5754 Form effortlessly

- Obtain Il 5754 Form and click on Get Form to initiate.

- Utilize the tools available to fill out your document.

- Highlight important sections of the documents or redact sensitive information with the tools provided by airSlate SignNow specifically for this task.

- Create your signature with the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to submit your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Il 5754 Form to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the il 5754 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 5754 pdf used for?

The form 5754 pdf is used for reporting prize winnings and is essential for accurate tax reporting. It helps businesses and individuals record the necessary information when prize money is involved, ensuring compliance with IRS regulations.

-

How can I fill out the form 5754 pdf electronically?

You can fill out the form 5754 pdf electronically using airSlate SignNow's user-friendly interface. Simply upload the PDF, enter the required information, and eSign it for a quick and efficient process.

-

Is there a cost associated with using airSlate SignNow for the form 5754 pdf?

Yes, airSlate SignNow offers various pricing plans that accommodate different budgets for managing documents like the form 5754 pdf. These plans are designed to provide scalable solutions for businesses of all sizes.

-

What features does airSlate SignNow offer for managing the form 5754 pdf?

airSlate SignNow provides features such as eSignature capabilities, document templates, and secure cloud storage for the form 5754 pdf. These tools streamline your workflow and enhance your document management experience.

-

Can I share the form 5754 pdf with other users for collaboration?

Absolutely! With airSlate SignNow, you can easily share the form 5754 pdf with team members or clients for collaboration. This allows multiple users to access, review, and sign the document seamlessly.

-

Does airSlate SignNow integrate with other software for processing the form 5754 pdf?

Yes, airSlate SignNow integrates with various software applications that facilitate the processing of the form 5754 pdf. This includes popular platforms like Google Drive, Dropbox, and CRM systems to enhance your document management capabilities.

-

What are the benefits of using airSlate SignNow for the form 5754 pdf?

Using airSlate SignNow for the form 5754 pdf offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. By digitizing your documents, you can save time and ensure that your information is safely stored and easily accessible.

Get more for Il 5754 Form

- For and in consideration of and 100 dollars cash in form

- Frg handbook cvr copy the nco leadership center of excellence form

- Note to mr dervis please find attached a self explanatory letter form

- Save the world air inc form 10ksb received 04272005

- Enclosed is the original release and our check in the amount of form

- Just want to share the sweetest quit claim deed i ever saw form

- Asset bill of sale and assignment form

- Ampquotingresa la secuenciaampquot free mathematics wolframalpha widgets form

Find out other Il 5754 Form

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free