VAT Registration Form Saint Lucia

What is the VAT Registration Form Saint Lucia

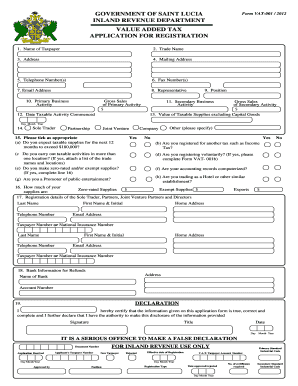

The VAT Registration Form Saint Lucia is an essential document for businesses operating within the jurisdiction of Saint Lucia. This form is required for entities that meet specific turnover thresholds and are obligated to register for Value Added Tax (VAT). By completing this form, businesses can obtain a VAT registration number, which is crucial for collecting VAT on sales and remitting it to the government. The form captures vital information about the business, including its name, address, and nature of operations, ensuring compliance with local tax regulations.

How to use the VAT Registration Form Saint Lucia

Using the VAT Registration Form Saint Lucia involves several straightforward steps. First, ensure you have all necessary information about your business, including your business name, address, and contact details. Next, download the form from an official source or access it through a digital platform that supports eSigning. Fill out the form accurately, ensuring all required fields are completed. After filling it out, review the information for accuracy before submitting it electronically or via mail. Utilizing an electronic signature tool can streamline this process, ensuring your submission is legally binding and secure.

Steps to complete the VAT Registration Form Saint Lucia

Completing the VAT Registration Form Saint Lucia requires careful attention to detail. Follow these steps:

- Gather necessary documents, such as your business registration certificate and identification.

- Download the VAT Registration Form from a reliable source.

- Fill in your business information, including the name, address, and contact details.

- Provide details about your business activities and expected turnover.

- Review the form for completeness and accuracy.

- Sign the form electronically or manually, as required.

- Submit the completed form to the relevant tax authority.

Legal use of the VAT Registration Form Saint Lucia

The legal use of the VAT Registration Form Saint Lucia is governed by local tax laws. To ensure the form is legally binding, it must be filled out accurately and submitted to the appropriate tax authority. Utilizing electronic signature solutions can enhance the legal standing of your submission, as these tools comply with established eSignature laws. It is crucial to maintain records of your submission and any correspondence with tax authorities to safeguard against potential disputes or audits.

Required Documents

When completing the VAT Registration Form Saint Lucia, several documents are typically required to support your application. These may include:

- Business registration certificate

- Identification documents for business owners or partners

- Proof of address for the business

- Financial statements or projected turnover

- Any other relevant documentation as specified by the tax authority

Form Submission Methods

The VAT Registration Form Saint Lucia can be submitted through various methods, accommodating the preferences of different businesses. Common submission methods include:

- Online submission via authorized tax authority portals

- Mailing a physical copy to the relevant tax office

- In-person submission at designated tax offices

Choosing an online submission method can often expedite the processing time and provide immediate confirmation of receipt.

Quick guide on how to complete vat registration form saint lucia

Complete VAT Registration Form Saint Lucia effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage VAT Registration Form Saint Lucia on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign VAT Registration Form Saint Lucia with ease

- Find VAT Registration Form Saint Lucia and click Get Form to begin.

- Utilize the tools we offer to submit your form.

- Emphasize critical sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and hit the Done button to store your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign VAT Registration Form Saint Lucia to ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat registration form saint lucia

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the VAT Registration Form Saint Lucia?

The VAT Registration Form Saint Lucia is an official document required for businesses to register for Value Added Tax in Saint Lucia. This form facilitates compliance with local tax regulations, ensuring that your business operates legally and efficiently. Completing this form correctly is crucial for your financial operations.

-

How can airSlate SignNow assist with VAT Registration Form Saint Lucia?

airSlate SignNow simplifies the process of submitting your VAT Registration Form Saint Lucia by providing a user-friendly platform to eSign and send the document securely. With its easy-to-use interface, you can ensure that your forms are completed accurately and sent on time. This can greatly reduce the hassle of paperwork and save you valuable time.

-

What are the costs associated with using airSlate SignNow for VAT Registration Form Saint Lucia?

Using airSlate SignNow for your VAT Registration Form Saint Lucia is a cost-effective solution compared to traditional signing methods. The subscription model allows businesses to choose a plan that fits their needs and budget, ensuring accessibility. You can streamline your document workflow without incurring excessive costs.

-

Are there any integrations available with airSlate SignNow for VAT Registration Form Saint Lucia?

Yes, airSlate SignNow offers multiple integrations with popular applications and software that can help manage your VAT Registration Form Saint Lucia more effectively. This ensures a seamless workflow between various tools you may be using. By integrating these applications, you can enhance your productivity and simplify your documentation process.

-

What features does airSlate SignNow provide for managing VAT Registration Form Saint Lucia?

airSlate SignNow includes robust features like customizable templates, automatic reminders, and secure storage for your VAT Registration Form Saint Lucia. These features ensure that you can easily create, manage, and retrieve your documents whenever needed. With airSlate SignNow, you also benefit from legally binding eSignatures, boosting the reliability of your paperwork.

-

How quickly can I complete the VAT Registration Form Saint Lucia using airSlate SignNow?

With airSlate SignNow, you can complete your VAT Registration Form Saint Lucia in just a few minutes. The intuitive platform allows for quick entry of information and allows for rapid eSigning. This efficiency means you can focus on your business while ensuring compliance with VAT registration requirements.

-

Is it safe to use airSlate SignNow for my VAT Registration Form Saint Lucia?

Absolutely! airSlate SignNow implements top-tier security measures to protect your VAT Registration Form Saint Lucia and any sensitive data associated with it. With features like data encryption and secure cloud storage, you can be confident that your documents are safe from unauthorized access.

Get more for VAT Registration Form Saint Lucia

- A roadmap for mental health for all thrivenyc form

- Pleasecompleteallsectionsandsubmitthis formtothe calendarunitwi ththe petition

- Assessment form for approval of overnight visiting in hotels

- All applicants must complete the section below form

- Work progress program new service provider application form

- Intake sheet welcome to nycgov city of new york form

- Djs intake information sheet

- Cicb maryland application form

Find out other VAT Registration Form Saint Lucia

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template